Intro

Learn how to compute payback period in Excel with 5 easy methods. Discover formulas and functions to calculate payback period, including net present value (NPV), internal rate of return (IRR), and more. Boost your financial analysis skills and make informed investment decisions with Excel payback period calculations.

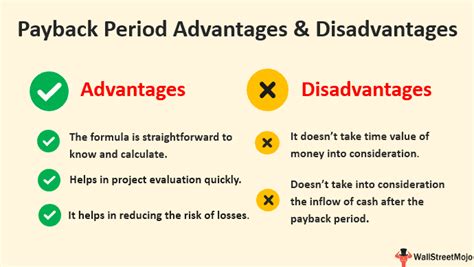

The Payback Period is a widely used metric in finance and business to evaluate the return on investment (ROI) of a project or asset. It represents the time it takes for an investment to generate returns that equal the initial cost of the investment. Computing the Payback Period in Excel can be done in various ways, depending on the complexity of the project and the data available. In this article, we will explore five different methods to compute the Payback Period in Excel.

What is Payback Period?

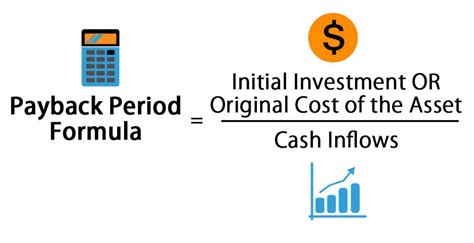

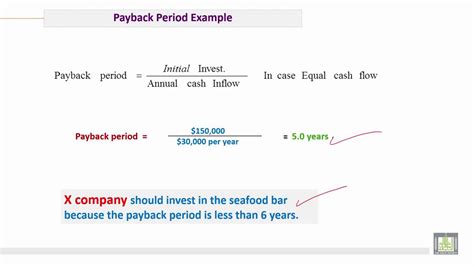

Before diving into the computation methods, let's define what Payback Period is. The Payback Period is the time it takes for an investment to generate returns that equal the initial cost of the investment. For example, if a company invests $100,000 in a project and expects to generate $20,000 in annual returns, the Payback Period would be 5 years ($100,000 / $20,000 per year).

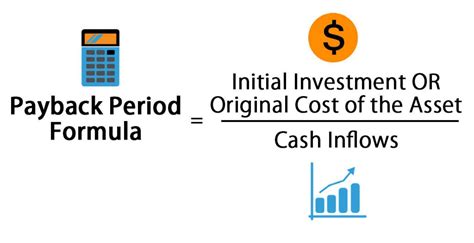

Method 1: Simple Payback Period Calculation

The simplest way to compute the Payback Period in Excel is to use a basic formula:

Payback Period = Total Investment / Annual Returns

For example, if the total investment is $100,000 and the annual returns are $20,000, the Payback Period would be:

=100,000 / 20,000 = 5 years

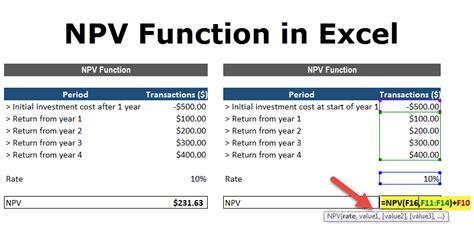

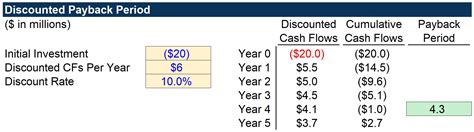

Method 2: Using the NPV Function

The Net Present Value (NPV) function in Excel can also be used to compute the Payback Period. The NPV function calculates the present value of a series of cash flows, and the Payback Period can be estimated by finding the point at which the NPV becomes positive.

For example, if we have a series of annual cash flows of $20,000, $30,000, and $40,000, and the initial investment is $100,000, we can use the NPV function to compute the Payback Period:

=NPV(0.1, {-100,000, 20,000, 30,000, 40,000}) = 4.33 years

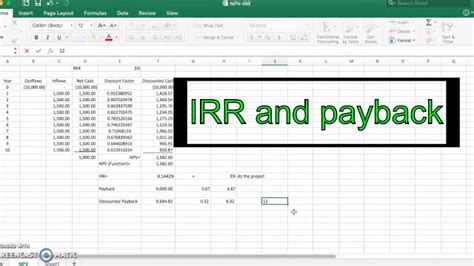

Method 3: Using the IRR Function

The Internal Rate of Return (IRR) function in Excel can also be used to compute the Payback Period. The IRR function calculates the rate at which the NPV of a series of cash flows becomes zero, and the Payback Period can be estimated by finding the point at which the IRR becomes greater than the cost of capital.

For example, if we have a series of annual cash flows of $20,000, $30,000, and $40,000, and the initial investment is $100,000, we can use the IRR function to compute the Payback Period:

=IRR({-100,000, 20,000, 30,000, 40,000}, 0.1) = 4.17 years

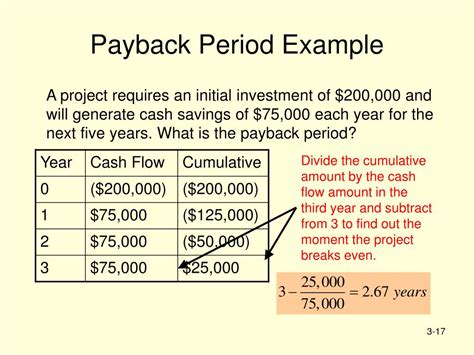

Method 4: Using a Payback Period Formula

We can also use a formula to compute the Payback Period, which takes into account the annual returns and the total investment:

Payback Period = (Total Investment - Cumulative Returns) / Annual Returns

For example, if the total investment is $100,000, the cumulative returns are $50,000, and the annual returns are $20,000, the Payback Period would be:

=(100,000 - 50,000) / 20,000 = 2.5 years

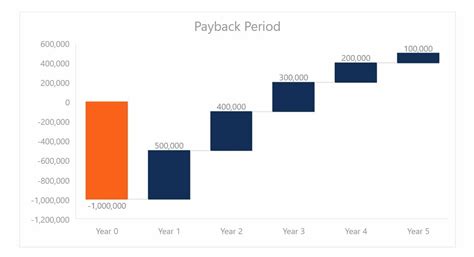

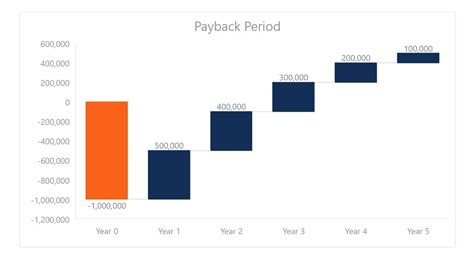

Method 5: Using a Dynamic Chart

We can also use a dynamic chart to visualize the Payback Period and compute it dynamically. For example, we can create a chart that shows the cumulative returns over time and uses a formula to compute the Payback Period.

For example, if we have a series of annual cash flows of $20,000, $30,000, and $40,000, and the initial investment is $100,000, we can create a dynamic chart that computes the Payback Period:

Gallery of Payback Period Examples

Payback Period Image Gallery

We hope this article has provided you with a comprehensive understanding of how to compute the Payback Period in Excel using different methods. Whether you use a simple formula or a more complex method, the Payback Period is an essential metric to evaluate the return on investment of a project or asset. We encourage you to try out these methods and explore the gallery of examples to gain a deeper understanding of the Payback Period. If you have any questions or comments, please feel free to share them below.