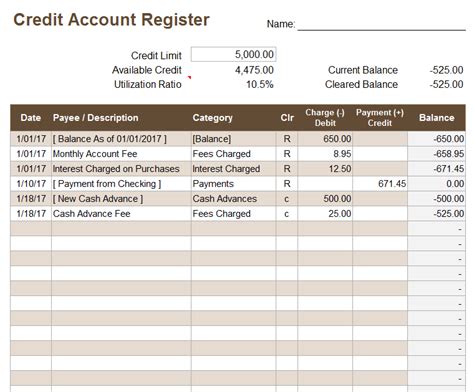

Managing personal finances efficiently requires keeping track of expenses, income, and credit card statements. Converting credit card statements to Excel can help you analyze your spending habits, create budgets, and make informed financial decisions. In this article, we'll explore five ways to convert credit card statements to Excel, along with their benefits and step-by-step instructions.

Why Convert Credit Card Statements to Excel?

Converting credit card statements to Excel offers several benefits, including:

- Easy tracking and analysis of expenses

- Creation of budgets and financial plans

- Identification of areas for cost reduction

- Simplified tax preparation and expense reporting

- Improved financial decision-making

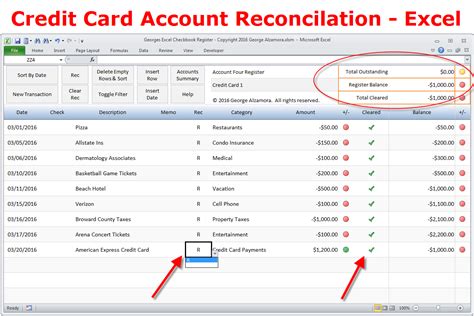

Method 1: Manual Entry

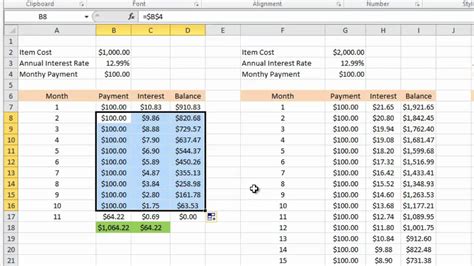

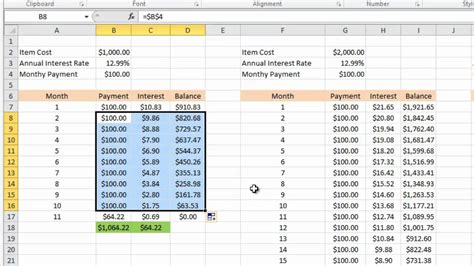

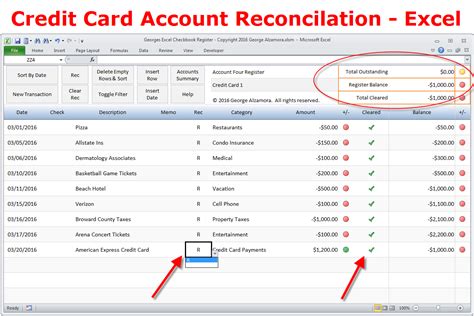

One way to convert credit card statements to Excel is by manual entry. This method involves typing the statement data into an Excel spreadsheet.

Step-by-Step Instructions:

- Open a new Excel spreadsheet or create a new sheet in an existing workbook.

- Set up columns for date, description, amount, and category.

- Enter the data from your credit card statement into the corresponding columns.

- Use formulas to calculate totals and summarize expenses.

- Use conditional formatting to highlight important information, such as high-value transactions.

Method 2: OCR Software

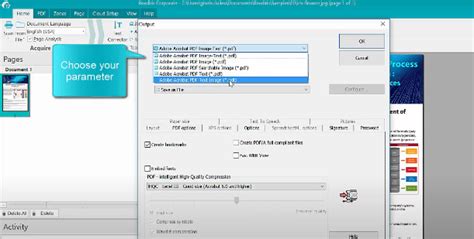

Optical Character Recognition (OCR) software can help you convert credit card statements to Excel by recognizing and extracting text from scanned or digital statements.

Step-by-Step Instructions:

- Scan or save your credit card statement as a digital file.

- Download and install OCR software, such as Adobe Acrobat or Readiris.

- Open the OCR software and select the statement file.

- Choose the Excel output option and select the desired columns and formatting.

- Save the extracted data as an Excel file.

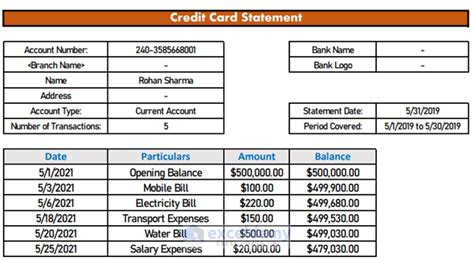

Method 3: Bank Statement Import

Many banks offer the option to download credit card statements in Excel format or import them directly into Excel using specialized software.

Step-by-Step Instructions:

- Log in to your online banking account and navigate to the credit card statement section.

- Look for the option to download statements in Excel format or import them into Excel.

- Follow the prompts to download or import the statement data.

- Open the downloaded file in Excel or verify the imported data.

Method 4: Automated Parsing Tools

Automated parsing tools can help you extract data from credit card statements and convert it to Excel format.

Step-by-Step Instructions:

- Search for automated parsing tools that support credit card statement conversion.

- Select a tool and follow the setup instructions.

- Upload or import your credit card statement into the tool.

- Configure the output options to match your desired Excel format.

- Download the extracted data as an Excel file.

Method 5: Third-Party Services

Third-party services, such as credit card statement conversion services or personal finance apps, can also help you convert credit card statements to Excel.

Step-by-Step Instructions:

- Research and select a reputable third-party service that offers credit card statement conversion.

- Create an account or sign in to the service.

- Upload or import your credit card statement into the service.

- Follow the prompts to configure the output options and select the desired Excel format.

- Download the extracted data as an Excel file.

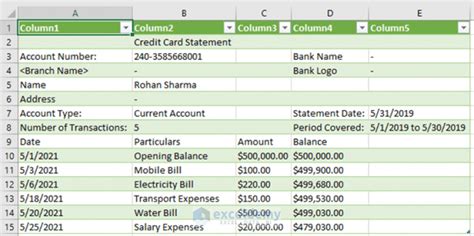

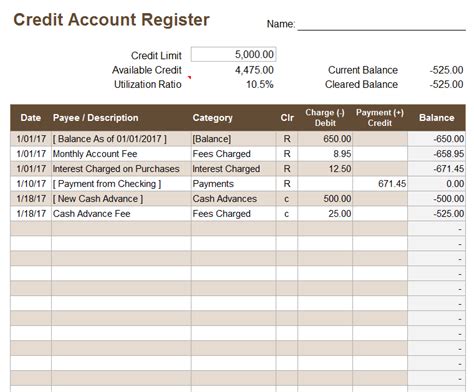

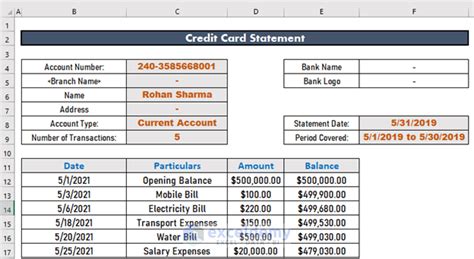

Gallery of Credit Card Statement to Excel

Credit Card Statement to Excel Image Gallery

Conclusion

Converting credit card statements to Excel can help you gain a deeper understanding of your financial habits and make informed decisions about your money. Whether you choose to use manual entry, OCR software, bank statement import, automated parsing tools, or third-party services, the benefits of converting credit card statements to Excel are undeniable. By following the methods outlined in this article, you can unlock the full potential of your credit card statements and take control of your finances.

We hope this article has been helpful in guiding you through the process of converting credit card statements to Excel. If you have any further questions or would like to share your own experiences, please feel free to comment below.