Intro

Boost your tax savings with a comprehensive Cost Segregation Study Template. Learn how to maximize depreciation deductions, accelerate tax benefits, and increase cash flow. Discover the benefits of cost segregation, including reduced tax liabilities, increased property values, and improved financial reporting. Download your free template today!

As a business owner or real estate investor, understanding the intricacies of tax law can be overwhelming. However, staying informed about tax-saving strategies can significantly impact your bottom line. One powerful tool for maximizing tax savings is a cost segregation study. In this article, we will explore the benefits, mechanisms, and steps involved in conducting a cost segregation study, providing you with a comprehensive template to get started.

Benefits of a Cost Segregation Study

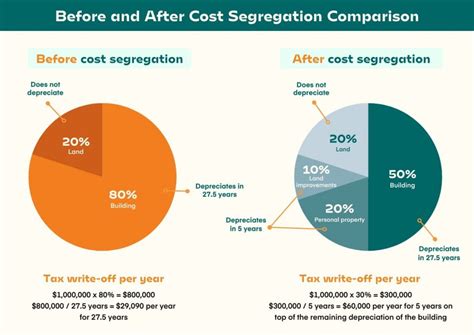

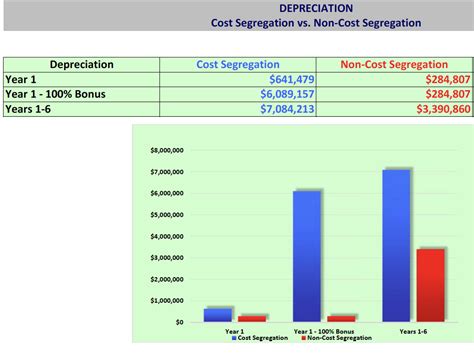

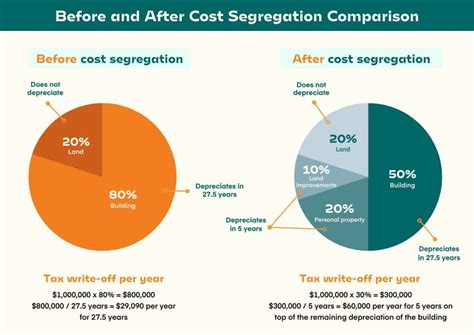

A cost segregation study is a detailed analysis of a commercial property's components, aiming to identify and separate personal property from real property. This separation allows for accelerated depreciation, resulting in significant tax savings. The benefits of a cost segregation study include:

- Increased cash flow through reduced tax liability

- Enhanced financial reporting and compliance

- Improved property valuation and assessment

How Does a Cost Segregation Study Work?

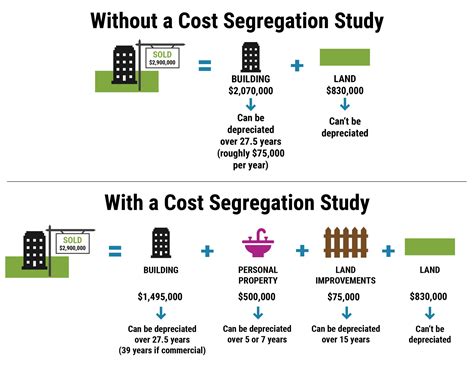

A cost segregation study involves a comprehensive review of a property's components, including:

- Land improvements

- Building components (e.g., walls, roof, electrical systems)

- Personal property (e.g., furniture, fixtures, equipment)

The study aims to assign a useful life to each component, allowing for accelerated depreciation. This accelerated depreciation can be claimed on the property's tax return, resulting in significant tax savings.

Steps Involved in a Cost Segregation Study

Conducting a cost segregation study involves the following steps:

- Property Inspection: A thorough inspection of the property to identify and document its components.

- Component Identification: Identification of each component's useful life, based on IRS guidelines and industry standards.

- Cost Allocation: Allocation of the property's total cost to each component, based on its useful life.

- Depreciation Calculation: Calculation of the accelerated depreciation for each component.

Cost Segregation Study Template

The following template provides a basic outline for conducting a cost segregation study:

| Component | Useful Life | Cost | Depreciation |

|---|---|---|---|

| Land Improvements | 15 years | $100,000 | $6,667 |

| Building Components | 39 years | $500,000 | $12,821 |

| Personal Property | 5 years | $50,000 | $10,000 |

Example:

Assume a commercial property with a total cost of $650,000. After conducting a cost segregation study, the following components are identified:

- Land improvements: $100,000 (15-year useful life)

- Building components: $500,000 (39-year useful life)

- Personal property: $50,000 (5-year useful life)

Using the template above, the accelerated depreciation for each component can be calculated, resulting in significant tax savings.

Frequently Asked Questions

Q: What is the purpose of a cost segregation study?

A: The purpose of a cost segregation study is to identify and separate personal property from real property, allowing for accelerated depreciation and resulting in significant tax savings.

Q: How long does a cost segregation study typically take?

A: The duration of a cost segregation study varies depending on the property's complexity and size. On average, a study can take several weeks to several months to complete.

Q: Can I conduct a cost segregation study myself?

A: While it is possible to conduct a cost segregation study yourself, it is highly recommended to hire a professional with expertise in cost segregation and tax law to ensure accuracy and compliance.

Gallery of Cost Segregation Study Images

Cost Segregation Study Images

Conclusion

A cost segregation study is a powerful tool for maximizing tax savings. By understanding the benefits, mechanisms, and steps involved in conducting a study, you can make informed decisions about your commercial property. Remember to consult with a professional to ensure accuracy and compliance. Share your thoughts and experiences with cost segregation studies in the comments below.