Discover 5 ways a CT paycheck calculator simplifies payroll, offering tax withholding, gross pay, and net income insights, with benefits for employees, employers, and accountants, using payroll software and salary calculators for accurate Connecticut state tax calculations.

The state of Connecticut is known for its beautiful coastline, rich history, and high standard of living. However, with a high cost of living comes the need for careful financial planning, especially when it comes to managing one's paycheck. A CT paycheck calculator can be a valuable tool for residents of Connecticut, helping them understand their take-home pay and make informed decisions about their finances. In this article, we will explore five ways a CT paycheck calculator can benefit individuals and families in the state.

A CT paycheck calculator is an online tool that allows users to input their salary, deductions, and other relevant information to estimate their net pay. This can be especially useful for individuals who are new to the state or who have recently changed jobs. By using a CT paycheck calculator, individuals can get a clear picture of their financial situation and make adjustments as needed. Whether you're a resident of Hartford, New Haven, or another part of the state, a CT paycheck calculator can be a valuable resource for managing your finances.

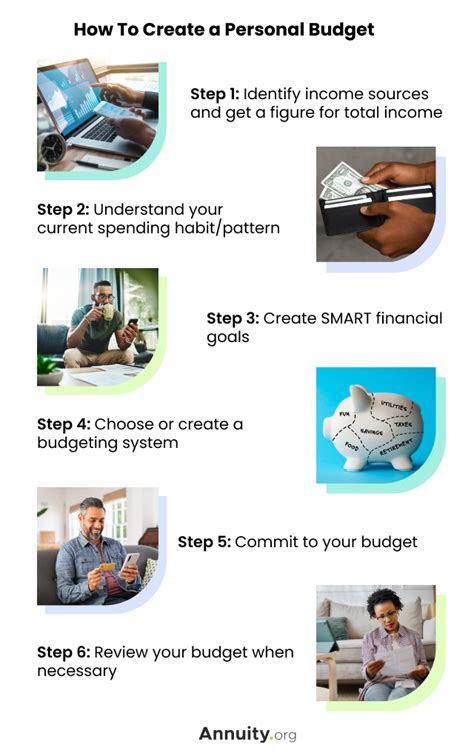

The importance of understanding one's paycheck cannot be overstated. With the rising cost of living in Connecticut, it's essential to make the most of one's income. A CT paycheck calculator can help individuals do just that, by providing a detailed breakdown of their pay and deductions. This information can be used to create a budget, prioritize expenses, and make smart financial decisions. Whether you're trying to save for a down payment on a house, pay off debt, or simply build up your emergency fund, a CT paycheck calculator can be a powerful tool in your financial toolkit.

Understanding Gross Income vs. Net Income

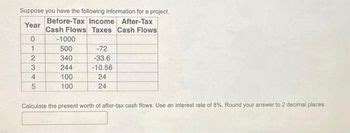

Calculating Taxes and Deductions

Creating a Budget

Managing Benefits and Deductions

Planning for the Future

In addition to these benefits, a CT paycheck calculator can also provide users with a detailed breakdown of their pay and deductions, including:

- Gross income

- Federal income tax

- State income tax

- Social Security tax

- Medicare tax

- Health insurance premiums

- 401(k) contributions

- Other deductions and benefits

By using a CT paycheck calculator, individuals can get a clear picture of their financial situation and make informed decisions about their finances. Whether you're a resident of Connecticut or just visiting, a CT paycheck calculator can be a valuable resource for managing your finances and achieving your long-term goals.

Benefits of Using a CT Paycheck Calculator

Some of the benefits of using a CT paycheck calculator include: * Accurate estimates of net income and deductions * Detailed breakdown of pay and deductions * Ability to adjust tax withholding and optimize benefits * Ability to create a realistic budget and prioritize expenses * Ability to plan for long-term goals, such as saving for a down payment on a house or building up retirement savingsBy using a CT paycheck calculator, individuals can take control of their finances and make informed decisions about their money. Whether you're just starting out in your career or nearing retirement, a CT paycheck calculator can be a valuable tool in your financial toolkit.

CT Paycheck Calculator Image Gallery

In conclusion, a CT paycheck calculator can be a valuable tool for individuals and families in Connecticut. By providing accurate estimates of net income and deductions, a CT paycheck calculator can help users create a realistic budget, prioritize expenses, and plan for long-term goals. Whether you're a resident of Hartford, New Haven, or another part of the state, a CT paycheck calculator can be a powerful resource for managing your finances and achieving your financial goals. We invite you to try out a CT paycheck calculator today and see the difference it can make in your financial life. Share your experiences and tips with us in the comments below, and don't forget to share this article with your friends and family who may benefit from using a CT paycheck calculator.