Intro

Unlock the power of Excels CUMPRINC function to calculate principal payments on loans and investments. Mastering this function can help you make informed financial decisions. Learn 5 ways to use CUMPRINC in Excel, including calculating cumulative principal, scheduling loan payments, and analyzing investment returns with formulas and examples.

Microsoft Excel is an incredibly powerful tool that has revolutionized the way we work with data. With its vast array of functions and formulas, Excel makes it possible to perform complex calculations and data analysis with ease. One such function that is often overlooked but is incredibly useful is the CUMPRINC function. In this article, we will explore five ways to use the CUMPRINC function in Excel to enhance your data analysis skills.

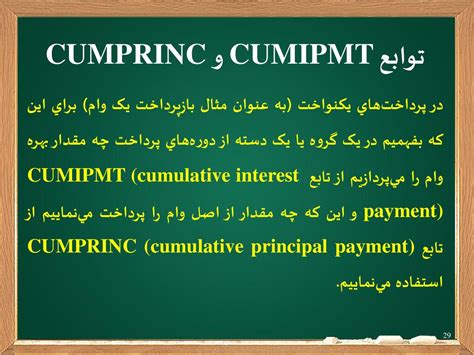

The CUMPRINC function in Excel calculates the cumulative principal paid on a loan or investment. It takes into account the interest rate, number of periods, and the amount of each payment. This function is particularly useful for financial analysts, accountants, and anyone who needs to calculate the cumulative principal paid on a loan or investment.

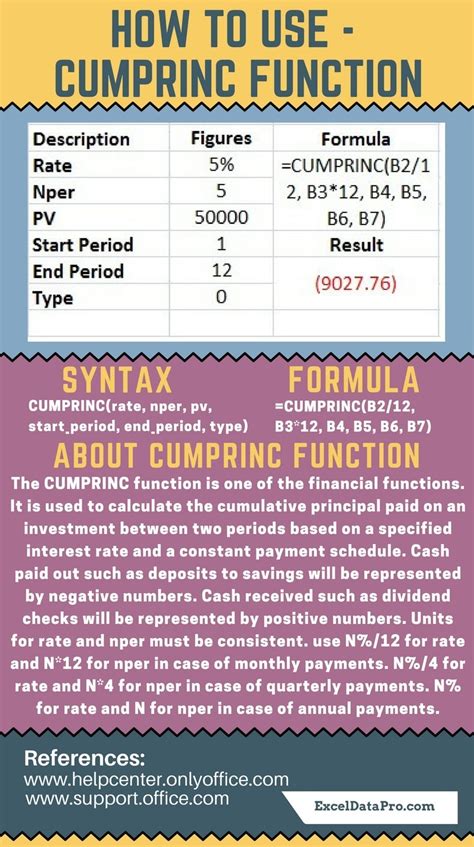

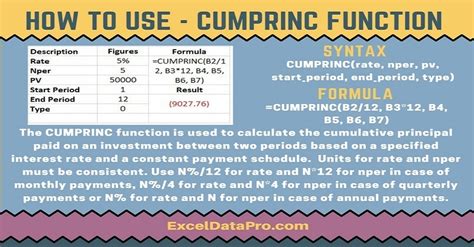

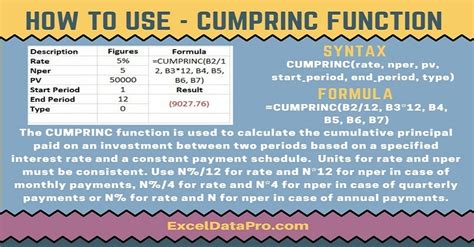

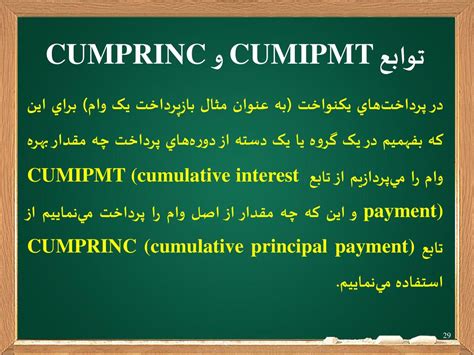

What is the CUMPRINC Function?

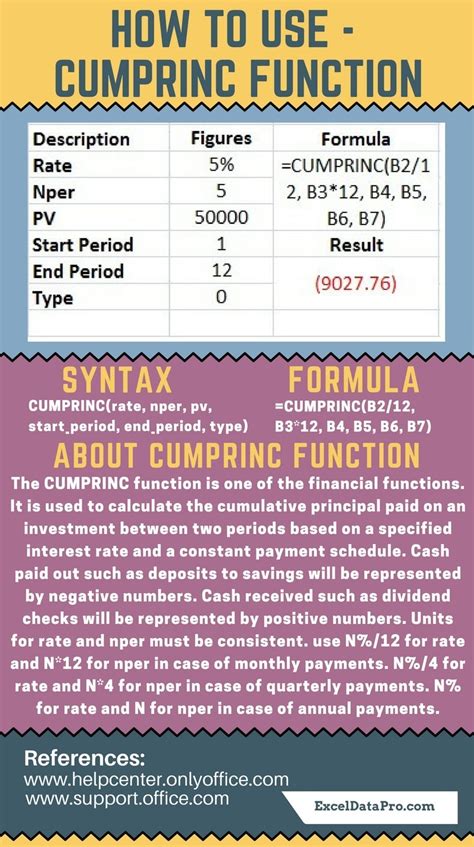

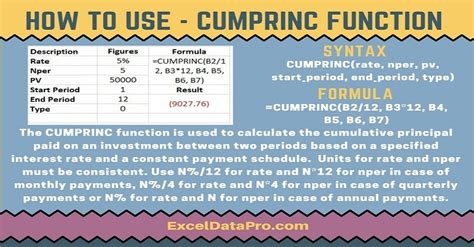

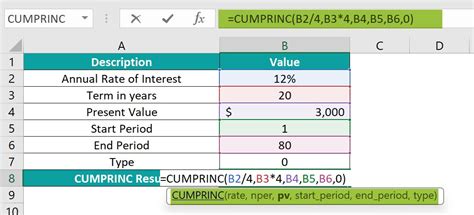

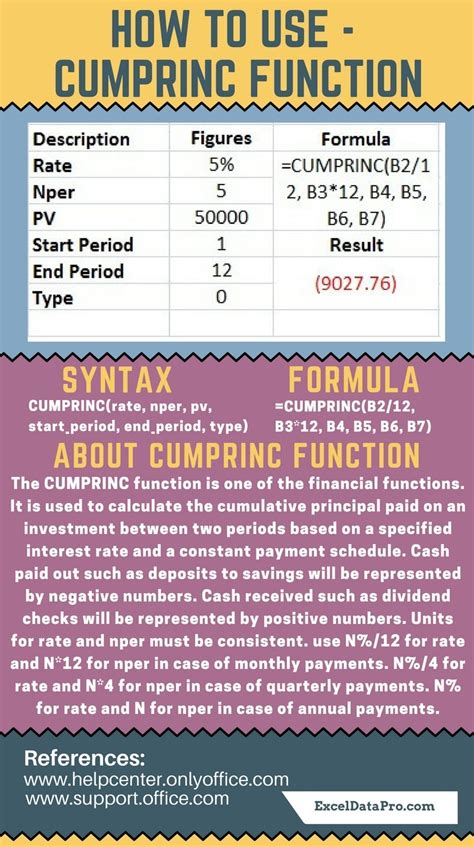

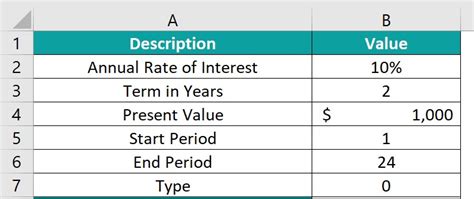

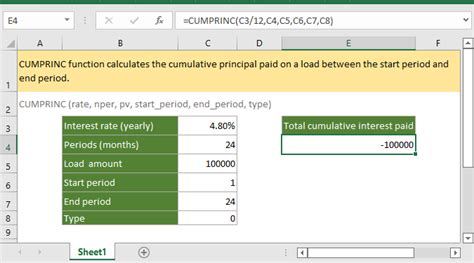

The CUMPRINC function is a built-in Excel function that calculates the cumulative principal paid on a loan or investment. The syntax for the CUMPRINC function is:

CUMPRINC(rate, nper, pv, [start_period], [end_period], [type])

- rate: The interest rate per period

- nper: The total number of payment periods

- pv: The present value (the initial amount of the loan or investment)

- start_period: The first period to calculate the cumulative principal (optional)

- end_period: The last period to calculate the cumulative principal (optional)

- type: The type of payment (0 for end-of-period payment, 1 for beginning-of-period payment) (optional)

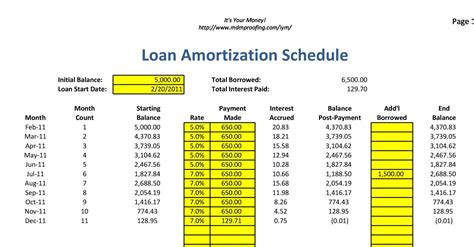

1. Calculating Cumulative Principal on a Loan

One of the most common uses of the CUMPRINC function is to calculate the cumulative principal paid on a loan. For example, suppose you borrowed $10,000 at an interest rate of 6% per annum, and you need to make 5 annual payments of $2,500 each. To calculate the cumulative principal paid after 3 years, you can use the CUMPRINC function as follows:

=CUMPRINC(0.06, 5, 10000, 1, 3, 0)

This formula calculates the cumulative principal paid after 3 years, assuming that the payments are made at the end of each period.

Using the CUMPRINC Function with Multiple Payments

If you need to calculate the cumulative principal paid on a loan with multiple payments, you can use the CUMPRINC function in conjunction with the SUM function. For example, suppose you borrowed $10,000 at an interest rate of 6% per annum, and you need to make 5 annual payments of $2,500 each, with an additional payment of $1,000 at the end of the 3rd year. To calculate the cumulative principal paid after 3 years, you can use the following formula:

=CUMPRINC(0.06, 5, 10000, 1, 3, 0) + SUM(CUMPRINC(0.06, 3, 1000, 1, 1, 0))

This formula calculates the cumulative principal paid after 3 years, taking into account the additional payment of $1,000 at the end of the 3rd year.

2. Calculating Cumulative Principal on an Investment

The CUMPRINC function can also be used to calculate the cumulative principal paid on an investment. For example, suppose you invested $10,000 in a savings account that earns an interest rate of 4% per annum, compounded annually. To calculate the cumulative principal after 5 years, you can use the CUMPRINC function as follows:

=CUMPRINC(0.04, 5, 10000, 1, 5, 0)

This formula calculates the cumulative principal after 5 years, assuming that the interest is compounded annually.

Using the CUMPRINC Function with Compound Interest

If you need to calculate the cumulative principal paid on an investment with compound interest, you can use the CUMPRINC function in conjunction with the FV function. For example, suppose you invested $10,000 in a savings account that earns an interest rate of 4% per annum, compounded annually. To calculate the cumulative principal after 5 years, you can use the following formula:

=CUMPRINC(0.04, 5, 10000, 1, 5, 0) + FV(0.04, 5, 0, 10000, 0)

This formula calculates the cumulative principal after 5 years, taking into account the compound interest.

3. Creating a Cumulative Principal Chart

To visualize the cumulative principal paid on a loan or investment, you can create a chart using the CUMPRINC function. For example, suppose you borrowed $10,000 at an interest rate of 6% per annum, and you need to make 5 annual payments of $2,500 each. To create a chart that shows the cumulative principal paid after each payment, you can use the following formula:

=CUMPRINC(0.06, 5, 10000, 1, ROW(A1), 0)

This formula calculates the cumulative principal paid after each payment, where ROW(A1) represents the row number of the cell.

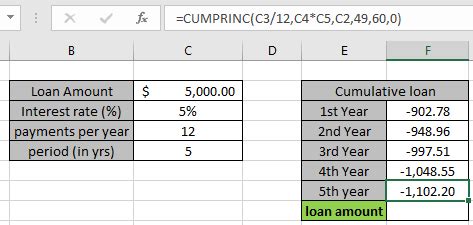

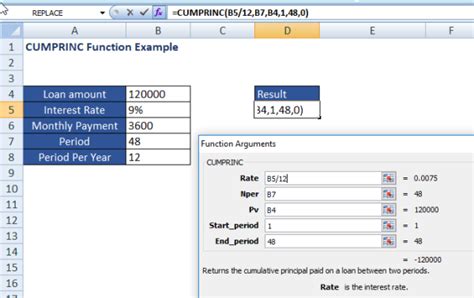

4. Calculating Cumulative Principal with Different Payment Frequencies

The CUMPRINC function can also be used to calculate the cumulative principal paid on a loan or investment with different payment frequencies. For example, suppose you borrowed $10,000 at an interest rate of 6% per annum, and you need to make monthly payments of $500 each for 5 years. To calculate the cumulative principal paid after 3 years, you can use the CUMPRINC function as follows:

=CUMPRINC(0.06/12, 512, 10000, 1, 312, 0)

This formula calculates the cumulative principal paid after 3 years, assuming that the payments are made monthly.

5. Using the CUMPRINC Function with Other Excel Functions

The CUMPRINC function can be used in conjunction with other Excel functions to perform more complex calculations. For example, suppose you borrowed $10,000 at an interest rate of 6% per annum, and you need to make 5 annual payments of $2,500 each. To calculate the cumulative principal paid after 3 years, and also calculate the interest paid during that period, you can use the following formula:

=CUMPRINC(0.06, 5, 10000, 1, 3, 0) + IPMT(0.06, 5, 10000, 1, 3, 0)

This formula calculates the cumulative principal paid after 3 years, and also calculates the interest paid during that period using the IPMT function.

Gallery of Cumprinc Function:

Cumprinc Function Image Gallery

We hope this article has helped you to understand the CUMPRINC function in Excel and how to use it to calculate the cumulative principal paid on a loan or investment. With its flexibility and versatility, the CUMPRINC function is a powerful tool that can help you to perform complex financial calculations with ease. Do you have any questions or comments about the CUMPRINC function? Share them with us in the comments section below!