Intro

Simplify your daily cash handling routine with our expert guide. Discover 5 efficient ways to streamline your cash count sheet process, reducing errors and increasing productivity. Learn how to implement effective cash management strategies, automate tasks, and optimize your workflow using tools like cash counting machines and accounting software.

Effective cash management is crucial for businesses to maintain their financial health and make informed decisions. One of the essential tools for achieving this is a daily cash count sheet. However, manually tracking and recording cash transactions can be a tedious and error-prone task, especially for businesses with high volumes of cash transactions. In this article, we will explore five ways to simplify your daily cash count sheet, making it easier to manage your cash flow and reduce the risk of errors.

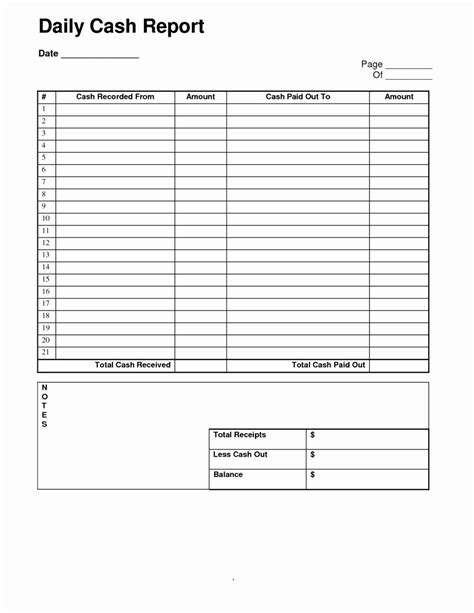

Understanding the Importance of a Daily Cash Count Sheet

A daily cash count sheet is a record of all cash transactions, including receipts and payments, that a business makes over a 24-hour period. It helps businesses keep track of their cash inflows and outflows, identify any discrepancies, and make adjustments to their cash management strategies. By simplifying your daily cash count sheet, you can streamline your cash management process, reduce errors, and make more informed decisions about your business.

1. Automate Your Cash Counting Process

One of the most effective ways to simplify your daily cash count sheet is to automate your cash counting process. Cash counting machines can quickly and accurately count your cash, reducing the risk of human error and saving you time. These machines can also help you detect counterfeit bills and provide a detailed report of your cash transactions.

Benefits of Automating Your Cash Counting Process

- Reduces the risk of human error

- Saves time and increases efficiency

- Helps detect counterfeit bills

- Provides a detailed report of cash transactions

2. Implement a Cash Management Software

Another way to simplify your daily cash count sheet is to implement a cash management software. This software can help you track and manage your cash transactions, including receipts and payments, and provide you with real-time updates on your cash position. Cash management software can also help you identify any discrepancies and make adjustments to your cash management strategies.

Benefits of Implementing a Cash Management Software

- Tracks and manages cash transactions

- Provides real-time updates on cash position

- Helps identify discrepancies and make adjustments

- Increases efficiency and reduces errors

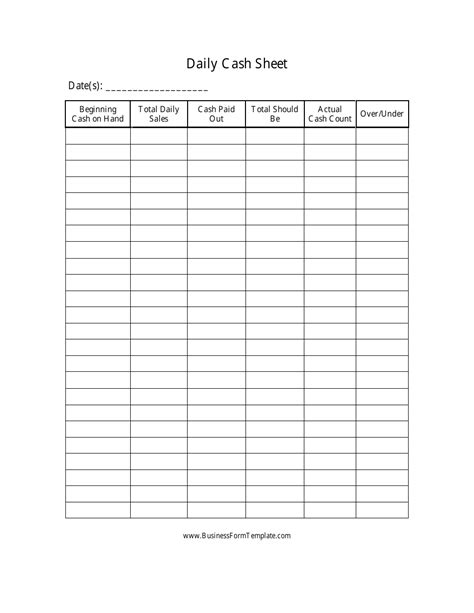

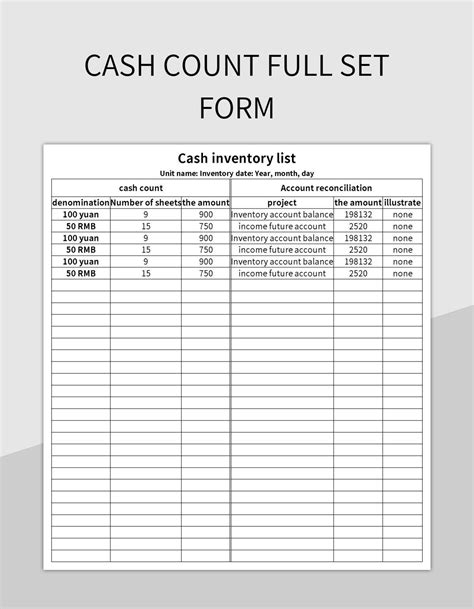

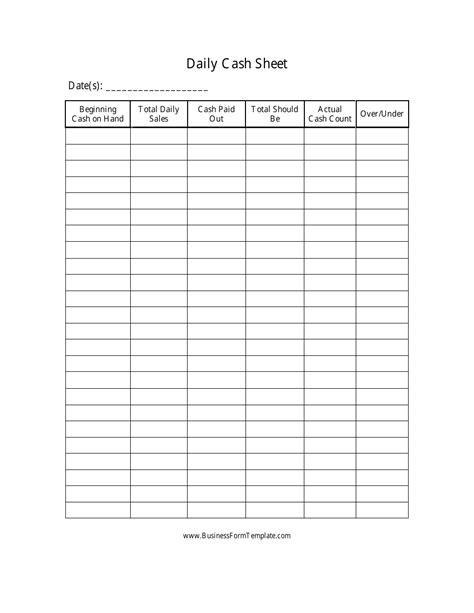

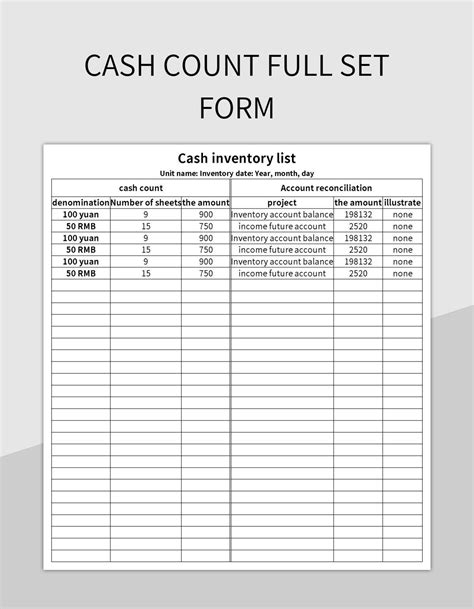

3. Use a Cash Counting Template

A cash counting template can help you standardize your cash counting process and reduce errors. This template can include columns for date, time, cash in, cash out, and net cash, making it easy to track and record your cash transactions. You can also customize the template to fit your business needs and use it to track other types of transactions, such as credit card sales or checks.

Benefits of Using a Cash Counting Template

- Standardizes cash counting process

- Reduces errors and increases accuracy

- Easy to customize and use

- Helps track other types of transactions

4. Train Your Staff on Cash Handling Procedures

Training your staff on cash handling procedures is essential to simplify your daily cash count sheet. By teaching your staff how to properly handle cash, including counting and recording cash transactions, you can reduce errors and increase efficiency. You can also train your staff on how to use cash counting machines and cash management software, making it easier for them to perform their cash handling duties.

Benefits of Training Your Staff on Cash Handling Procedures

- Reduces errors and increases accuracy

- Increases efficiency and productivity

- Helps staff understand cash handling procedures

- Improves customer service

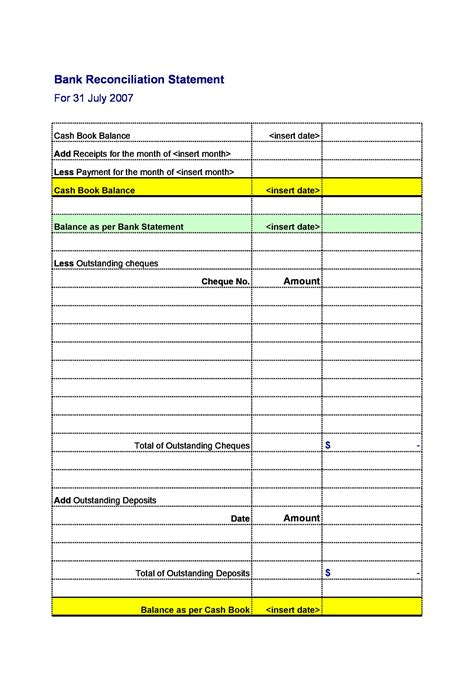

5. Regularly Review and Reconcile Your Cash Transactions

Finally, regularly reviewing and reconciling your cash transactions is essential to simplify your daily cash count sheet. By regularly reviewing your cash transactions, you can identify any discrepancies and make adjustments to your cash management strategies. You can also reconcile your cash transactions with your bank statements to ensure that your records are accurate and up-to-date.

Benefits of Regularly Reviewing and Reconciling Your Cash Transactions

- Identifies discrepancies and errors

- Helps make adjustments to cash management strategies

- Ensures accuracy and up-to-date records

- Increases efficiency and productivity

Daily Cash Count Sheet Image Gallery

By implementing these five ways to simplify your daily cash count sheet, you can streamline your cash management process, reduce errors, and make more informed decisions about your business. Remember to automate your cash counting process, implement a cash management software, use a cash counting template, train your staff on cash handling procedures, and regularly review and reconcile your cash transactions.