Calculating daily interest is a crucial task for individuals and businesses alike, helping to keep track of the growth of investments or the accumulation of debt. Fortunately, with Excel, this process becomes straightforward and can be accomplished in just a few easy steps. Below, we outline how to calculate daily interest using Excel.

Step 1: Understand the Components

Before diving into the Excel steps, it's essential to understand the components of calculating daily interest. The formula for daily interest typically involves:

- Principal amount (the initial amount of money)

- Interest rate (the percentage at which interest is accrued, usually annual but needs to be adjusted for daily calculations)

- Time (the number of days)

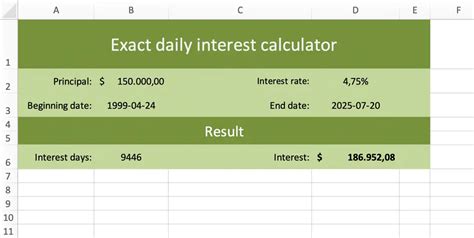

Breaking Down the Interest Rate

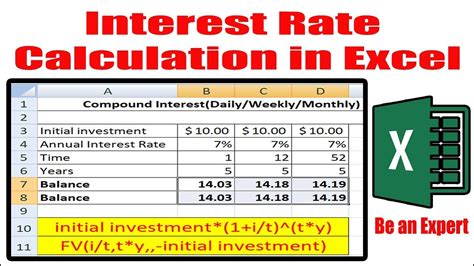

Since interest rates are usually annual, you'll need to convert them into a daily rate. This can be done by dividing the annual rate by 365 (days in a year).

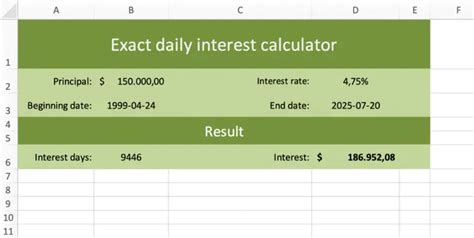

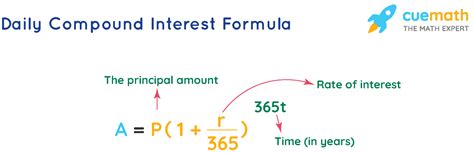

Step 2: Set Up Your Excel Sheet

Open your Excel workbook and set up a new sheet or use an existing one. Label the first row with the following headers:

- A1: Principal Amount

- B1: Annual Interest Rate

- C1: Number of Days

- D1: Daily Interest Rate

- E1: Daily Interest

Step 3: Calculate the Daily Interest Rate

In cell D2, enter the formula to calculate the daily interest rate:

=(B2/100)/365

This formula takes the annual interest rate in B2, converts it into a decimal, and then divides by 365 to find the daily rate.

Step 4: Calculate the Daily Interest

Now, calculate the daily interest in cell E2 using the formula:

=A2*D2

This formula multiplies the principal amount by the daily interest rate to find the daily interest.

Step 5: Apply the Formula to Your Data

If you have multiple sets of data (different principal amounts, interest rates, or durations), you can simply copy the formulas down to apply them to your data.

Additional Tips

- Ensure your interest rate is correctly formatted as a percentage in Excel.

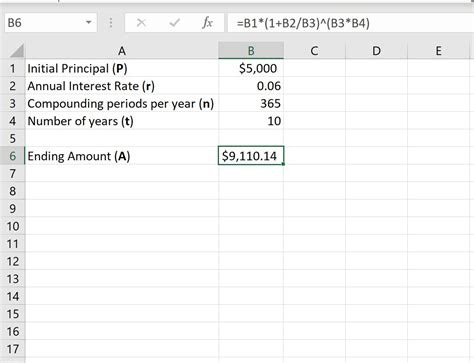

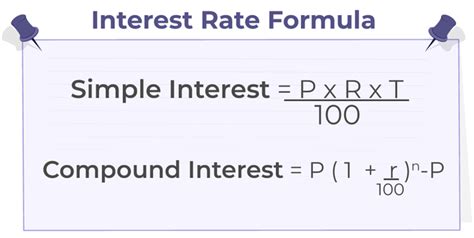

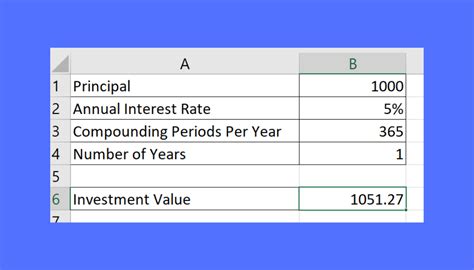

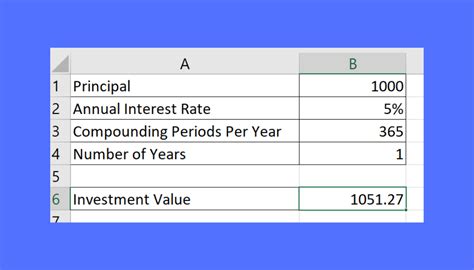

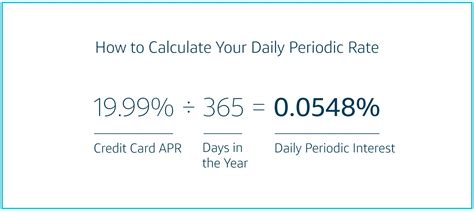

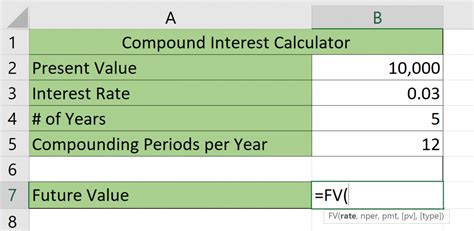

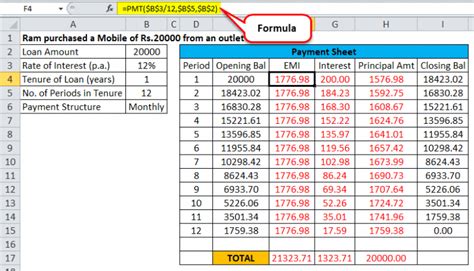

- If your interest compounds daily, you'll need a slightly different approach, using the formula for compound interest: A = P(1 + r/n)^(nt), where A is the amount of money accumulated after n years, including interest, P is the principal amount, r is the annual interest rate (decimal), n is the number of times that interest is compounded per year, and t is the time the money is invested for in years.

By following these steps, you can easily calculate daily interest in Excel, making it a valuable tool for financial planning and analysis.

Daily Interest Calculation in Excel Gallery

Whether you're managing personal finances or making financial decisions for a business, calculating daily interest in Excel provides valuable insights into the growth or debt accumulation over time. By understanding and applying these steps, you can make more informed decisions.