Intro

Boost your financial calculations with Excel! Discover 5 easy methods to calculate daily compound interest in Excel, including formulas and functions. Learn how to harness the power of compounding, accurately calculate interest rates, and create automated spreadsheets for precise financial projections and investment tracking.

Calculating daily compound interest is a crucial aspect of personal finance, business, and investing. Whether you're managing your savings, investments, or loans, understanding how to calculate daily compound interest can help you make informed decisions. In this article, we'll explore five ways to calculate daily compound interest in Excel, including formulas, examples, and practical applications.

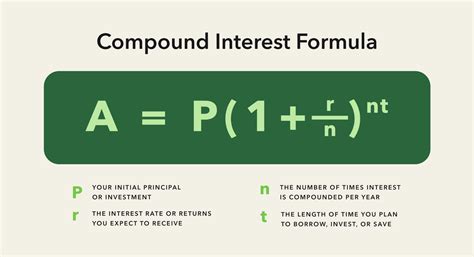

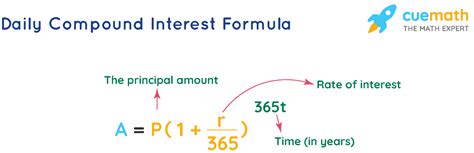

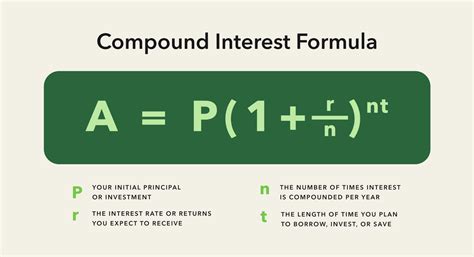

Daily compound interest is the interest calculated on both the principal amount and any accrued interest over a daily period. This type of interest is commonly used in savings accounts, certificates of deposit (CDs), and loans. To calculate daily compound interest, you need to know the principal amount, interest rate, and time period.

Let's dive into the five ways to calculate daily compound interest in Excel:

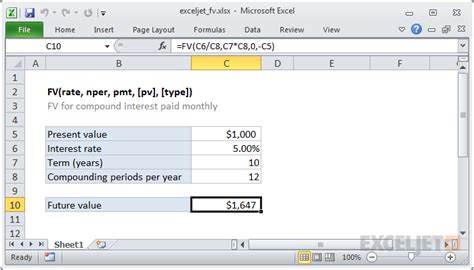

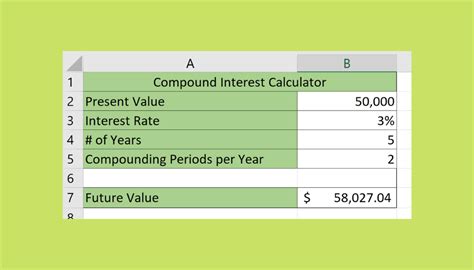

Method 1: Using the FV Function

The FV function in Excel calculates the future value of an investment based on a constant interest rate. You can use this function to calculate daily compound interest by specifying the interest rate as a daily rate.

Formula: =FV(rate, nper, pmt, [pv], [type])

rate: Daily interest rate (e.g., 0.05/365 for 5% annual rate)nper: Number of dayspmt: 0 (since we're calculating interest only)[pv]: Principal amount (optional)[type]: 0 (optional, for regular payments)

Example: =FV(0.05/365, 365, 0, 1000) calculates the future value of a $1,000 investment with a 5% annual interest rate compounded daily for 1 year.

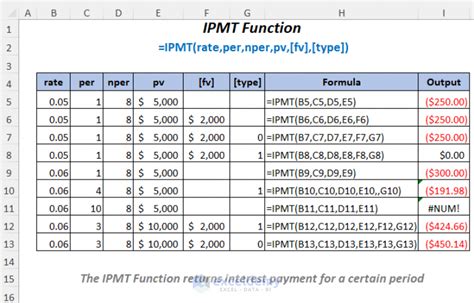

Method 2: Using the IPMT Function

The IPMT function calculates the interest portion of a loan or investment payment. You can use this function to calculate daily compound interest by specifying the interest rate as a daily rate.

Formula: =IPMT(rate, per, nper, [pv], [fv], [type])

rate: Daily interest rate (e.g., 0.05/365 for 5% annual rate)per: Period number (e.g., 1 for the first day)nper: Number of days[pv]: Principal amount (optional)[fv]: Future value (optional)[type]: 0 (optional, for regular payments)

Example: =IPMT(0.05/365, 1, 365, 1000) calculates the interest portion of the first day's payment for a $1,000 investment with a 5% annual interest rate compounded daily for 1 year.

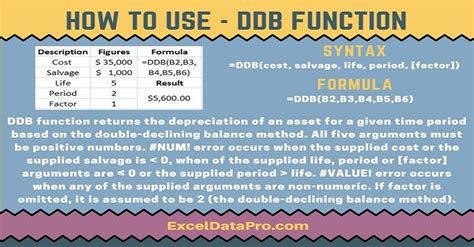

Method 3: Using the DDB Function

The DDB function calculates the depreciation of an asset using the double-declining balance method. You can use this function to calculate daily compound interest by specifying the interest rate as a daily rate.

Formula: =DDB(cost, salvage, life, period, [factor])

cost: Principal amountsalvage: Future valuelife: Number of daysperiod: Period number (e.g., 1 for the first day)[factor]: Daily interest rate (e.g., 0.05/365 for 5% annual rate)

Example: =DDB(1000, 0, 365, 1, 0.05/365) calculates the depreciation of a $1,000 asset with a 5% annual interest rate compounded daily for 1 year.

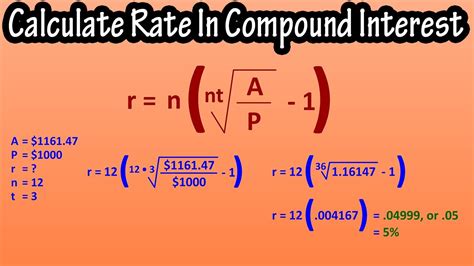

Method 4: Using the Power Function

You can use the POWER function to calculate daily compound interest by raising the daily interest rate to the power of the number of days.

Formula: =POWER(1 + rate, nper) * [pv]

rate: Daily interest rate (e.g., 0.05/365 for 5% annual rate)nper: Number of days[pv]: Principal amount (optional)

Example: =POWER(1 + 0.05/365, 365) * 1000 calculates the future value of a $1,000 investment with a 5% annual interest rate compounded daily for 1 year.

Method 5: Using a Custom Formula

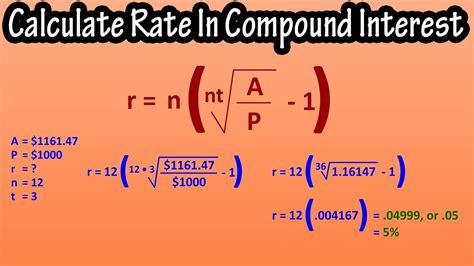

You can create a custom formula to calculate daily compound interest using the formula:

Formula: =(1 + rate)^nper * [pv]

rate: Daily interest rate (e.g., 0.05/365 for 5% annual rate)nper: Number of days[pv]: Principal amount (optional)

Example: =(1 + 0.05/365)^365 * 1000 calculates the future value of a $1,000 investment with a 5% annual interest rate compounded daily for 1 year.

In conclusion, calculating daily compound interest in Excel can be accomplished using various methods, including the FV function, IPMT function, DDB function, POWER function, and a custom formula. Each method has its advantages and disadvantages, and the choice of method depends on your specific needs and preferences. By understanding how to calculate daily compound interest, you can make informed decisions about your finances and investments.

Gallery of Compound Interest

Compound Interest Image Gallery

Now that you've learned about the different methods for calculating daily compound interest in Excel, try applying these methods to your own financial calculations. Share your experiences and questions in the comments below!