Intro

Boost your financial management skills with the Dave Ramsey Excel template. Master budgeting in 7 simple ways using this powerful tool. Say goodbye to debt and hello to financial freedom. Learn how to track expenses, create a budget plan, and achieve long-term financial goals with ease. Get started with budgeting mastery today!

The world of budgeting can be a daunting one, especially for those who are new to managing their finances. However, with the right tools and strategies, anyone can master budgeting and achieve financial stability. One such tool is the Dave Ramsey Excel template, a powerful resource for creating a personalized budget that works for you. In this article, we'll explore seven ways to master budgeting with the Dave Ramsey Excel template.

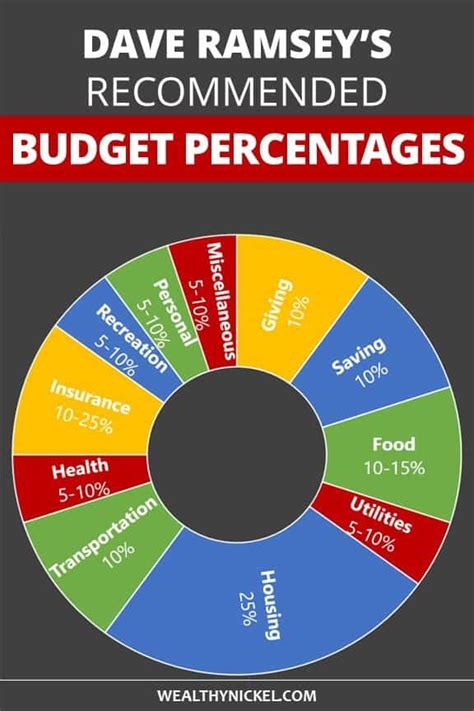

Understanding the Dave Ramsey Budgeting Method

Before we dive into the Excel template, it's essential to understand the Dave Ramsey budgeting method. This approach focuses on prioritizing needs over wants, creating a budget that allocates 70% of your income towards necessary expenses, 10% towards savings, and 20% towards debt repayment and entertainment.

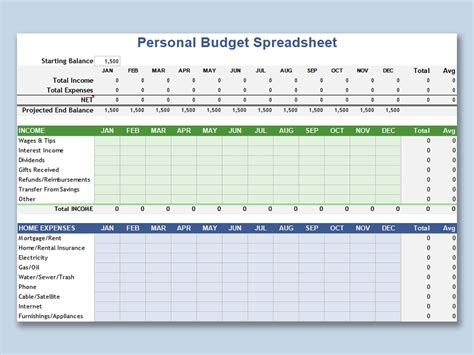

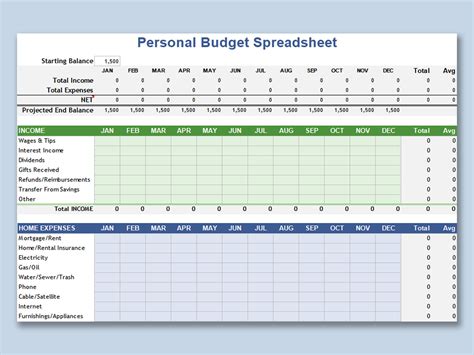

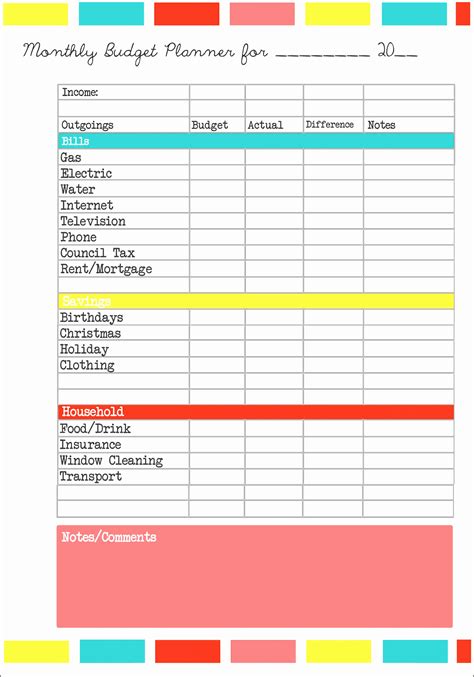

Step 1: Identify Your Income and Expenses

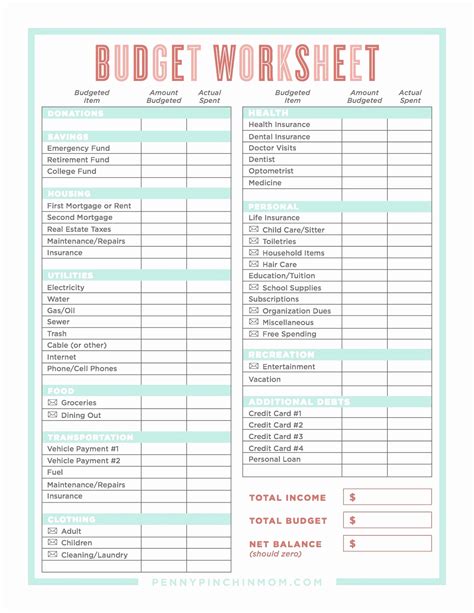

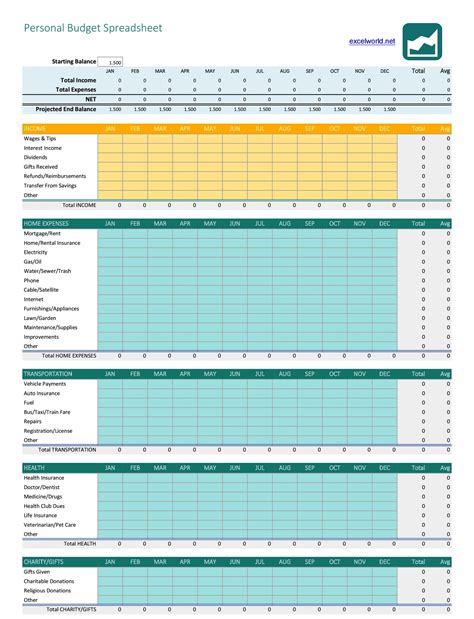

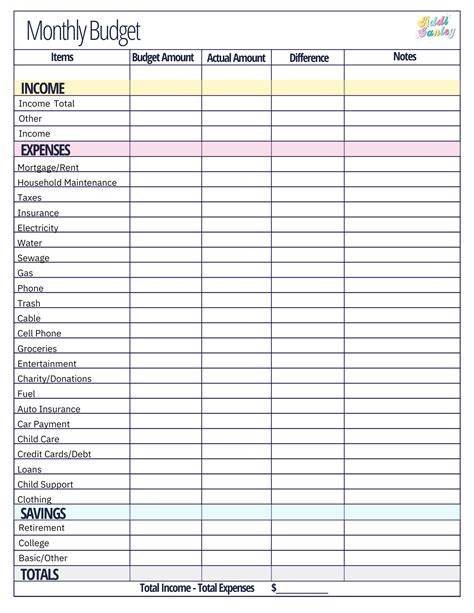

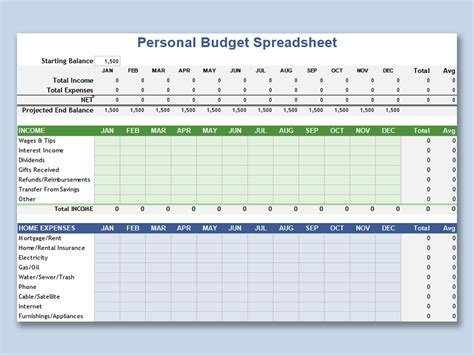

To create an effective budget, you need to understand where your money is coming from and where it's going. The Dave Ramsey Excel template provides a comprehensive framework for tracking your income and expenses. Start by listing all your income sources, including your salary, investments, and any side hustles. Next, categorize your expenses into needs (housing, food, utilities), wants (entertainment, hobbies), and debt repayment.

Allocating Your Income

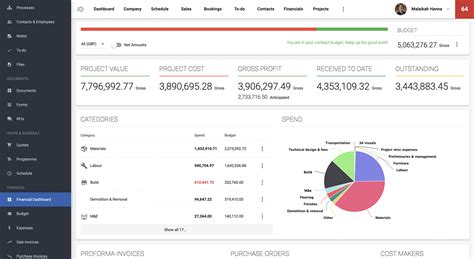

Once you have a clear picture of your income and expenses, it's time to allocate your funds. The Dave Ramsey Excel template provides a simple and intuitive way to assign percentages to each category based on your individual needs.

Step 2: Prioritize Your Needs

Using the 70/10/20 rule, allocate 70% of your income towards necessary expenses, such as:

- Housing (rent/mortgage, utilities, maintenance)

- Food and groceries

- Transportation (car loan/lease, insurance, gas)

- Minimum debt payments (credit cards, loans)

- Insurance (health, life, disability)

Step 3: Save for the Future

Allocate 10% of your income towards savings, including:

- Emergency fund

- Retirement savings

- Other savings goals (college fund, down payment on a house)

Managing Debt

Debt can be a significant obstacle to achieving financial stability. The Dave Ramsey Excel template provides a debt snowball calculator to help you prioritize your debt repayment.

Step 4: Create a Debt Repayment Plan

List all your debts, including credit cards, loans, and mortgages. Then, prioritize your debts by focusing on the smallest balance first, while making minimum payments on the rest.

Step 5: Automate Your Payments

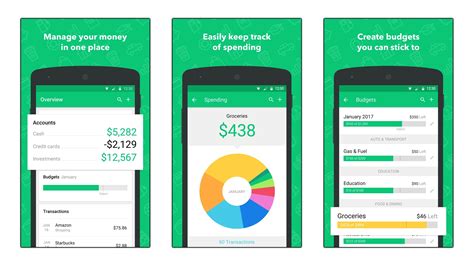

Set up automatic payments for your debts, savings, and investments to ensure you never miss a payment.

Monitoring and Adjusting Your Budget

Budgeting is not a one-time task; it's an ongoing process. Regularly review your budget to ensure you're on track to meet your financial goals.

Step 6: Track Your Expenses

Use the Dave Ramsey Excel template to track your expenses throughout the month. This will help you identify areas where you can cut back and make adjustments.

Step 7: Adjust Your Budget as Needed

Life is unpredictable, and your budget may need to change to accommodate unexpected expenses or changes in income. Don't be afraid to make adjustments as needed to stay on track.

Conclusion

Mastering budgeting with the Dave Ramsey Excel template requires discipline, patience, and persistence. By following these seven steps, you can create a personalized budget that helps you achieve financial stability and reach your long-term goals. Remember to regularly review and adjust your budget to ensure you're on track to achieving financial freedom.

Dave Ramsey Budgeting Template Gallery

We hope this article has provided you with a comprehensive guide to mastering budgeting with the Dave Ramsey Excel template. Take the first step towards achieving financial stability today!