Intro

Taking control of your finances is a crucial step towards achieving financial stability and securing a prosperous future. One effective way to manage your money is by using a budget form, and Dave Ramsey's budget forms are a popular choice among individuals seeking to get their finances in order. In this article, we'll explore the importance of budgeting, the benefits of using Dave Ramsey's budget forms, and provide you with a printable template to help you get started.

Creating a budget is a straightforward process that helps you track your income and expenses, identify areas where you can cut back, and make informed decisions about how to allocate your resources. By using a budget form, you can:

- Gain a clear understanding of your financial situation

- Set financial goals and develop a plan to achieve them

- Reduce stress and anxiety related to money management

- Improve your credit score and overall financial health

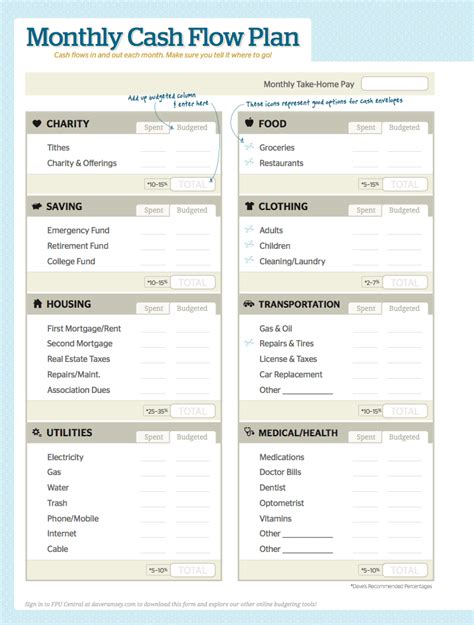

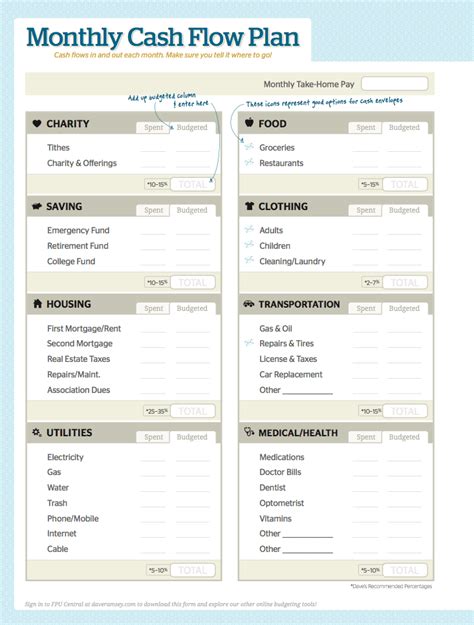

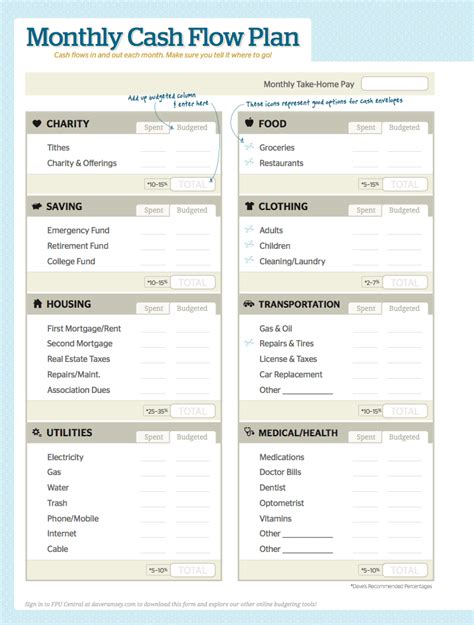

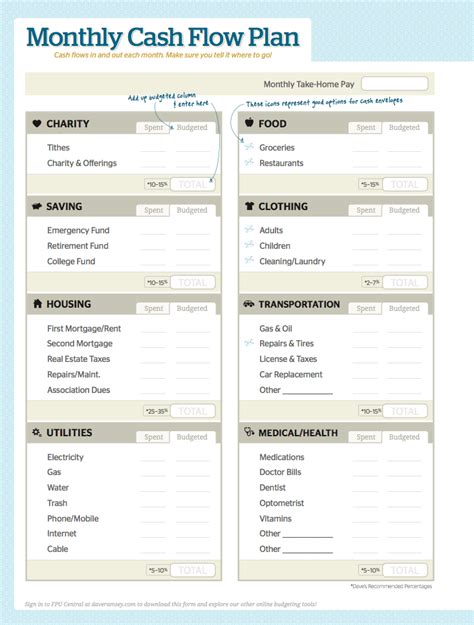

What is a Dave Ramsey Budget Form?

A Dave Ramsey budget form is a simple, easy-to-use template that helps you categorize your income and expenses into different areas, such as housing, transportation, food, and entertainment. The form is designed to help you prioritize your spending, make conscious financial decisions, and achieve financial stability.

Benefits of Using a Dave Ramsey Budget Form

Using a Dave Ramsey budget form can have a significant impact on your financial well-being. Here are some benefits of using this template:

- Simplifies budgeting: The form provides a clear and concise way to track your income and expenses, making it easier to manage your finances.

- Helps you prioritize: By categorizing your expenses, you can identify areas where you can cut back and prioritize your spending.

- Promotes financial discipline: Using a budget form helps you stay on track and make conscious financial decisions.

- Reduces financial stress: By taking control of your finances, you can reduce stress and anxiety related to money management.

How to Use a Dave Ramsey Budget Form

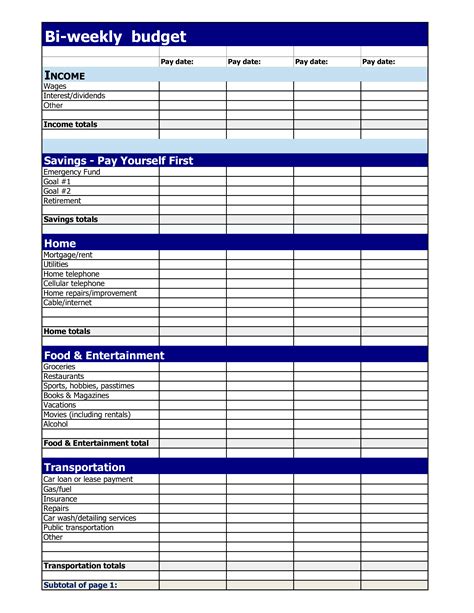

Using a Dave Ramsey budget form is a straightforward process. Here's a step-by-step guide to help you get started:

- Download and print the template: You can download a printable Dave Ramsey budget form template online or create your own using a spreadsheet software.

- Identify your income: Start by listing all your sources of income, including your salary, investments, and any side hustles.

- Categorize your expenses: Divide your expenses into different categories, such as housing, transportation, food, and entertainment.

- Track your expenses: Throughout the month, track your expenses and update your budget form accordingly.

- Review and adjust: At the end of the month, review your budget form and adjust your spending habits as needed.

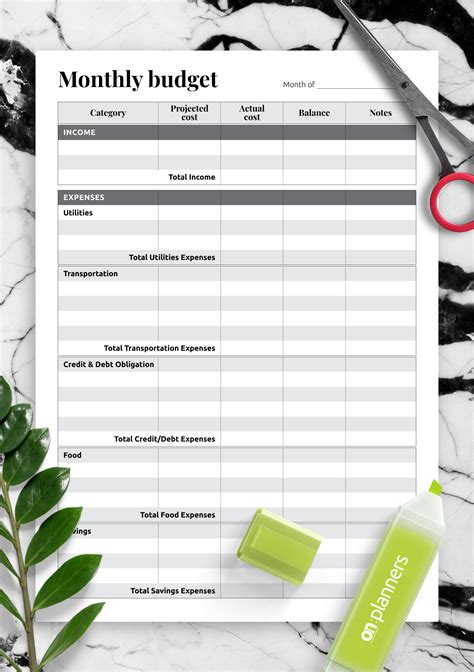

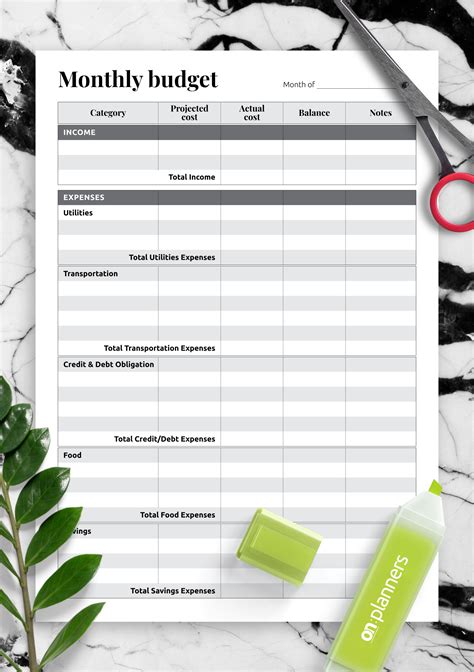

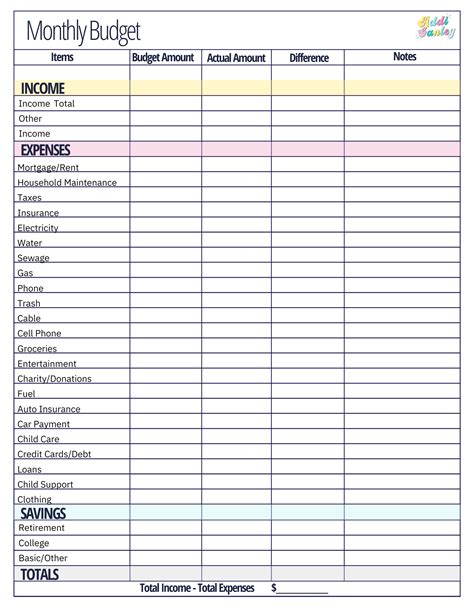

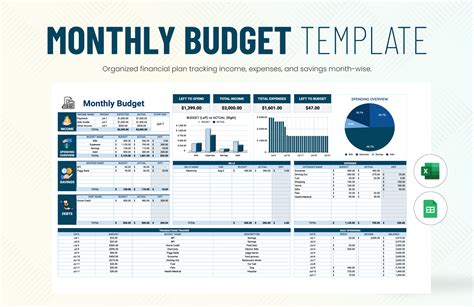

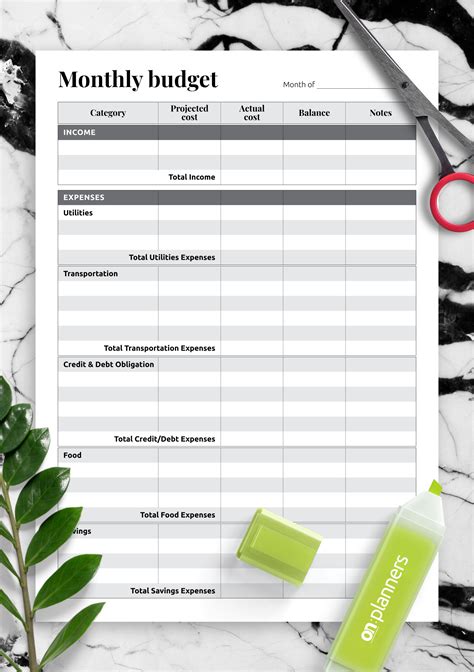

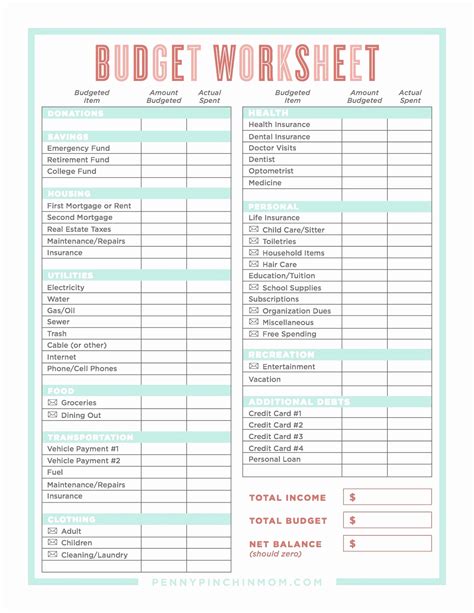

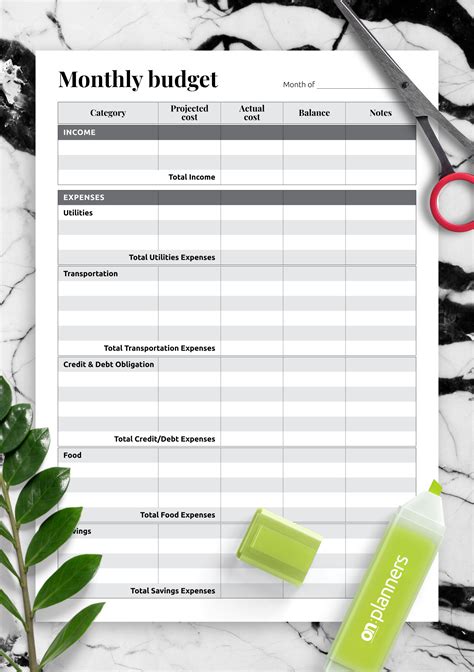

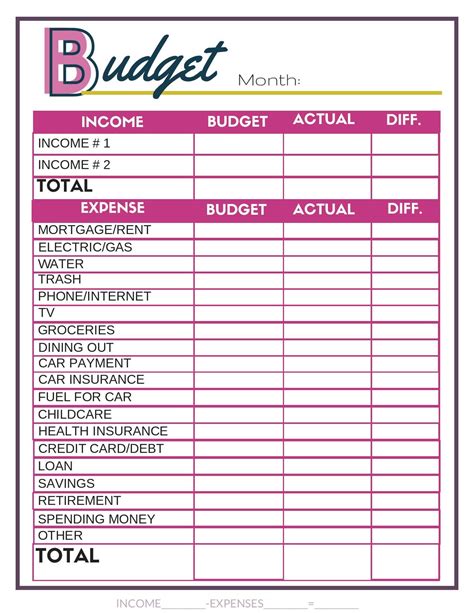

Printable Dave Ramsey Budget Form Template

Here is a printable Dave Ramsey budget form template that you can use to get started:

Income

- Salary: $_____________

- Investments: $_____________

- Side hustles: $_____________

- Total income: $_____________

Fixed Expenses

- Housing: $_____________

- Transportation: $_____________

- Utilities: $_____________

- Insurance: $_____________

- Total fixed expenses: $_____________

Variable Expenses

- Food: $_____________

- Entertainment: $_____________

- Hobbies: $_____________

- Travel: $_____________

- Total variable expenses: $_____________

Debt Repayment

- Credit cards: $_____________

- Loans: $_____________

- Total debt repayment: $_____________

Savings

- Emergency fund: $_____________

- Retirement savings: $_____________

- Other savings goals: $_____________

- Total savings: $_____________

You can download and print this template or create your own using a spreadsheet software.

Dave Ramsey Budget Forms Image Gallery

We hope this article has provided you with a comprehensive understanding of Dave Ramsey's budget forms and how to use them to achieve financial stability. By following the steps outlined in this article and using the printable template provided, you can take control of your finances and start building a brighter financial future. Share your thoughts and experiences with budgeting in the comments section below, and don't forget to share this article with friends and family who may benefit from it.