Intro

Get out of debt fast with Dave Ramseys debt snowball template. Learn how to prioritize debts, create a customized plan, and pay off debt quickly using this proven method. Includes free templates and expert advice on debt consolidation, budgeting, and financial freedom. Start your debt-free journey today!

Debt can be a significant burden, causing stress and anxiety for millions of people around the world. However, with the right strategy and tools, it is possible to pay off debt quickly and efficiently. One popular method for paying off debt is the debt snowball template, popularized by financial expert Dave Ramsey.

The debt snowball template is a simple yet effective way to prioritize and pay off debt. It involves listing all of your debts, from smallest to largest, and then focusing on paying off the smallest debt first. Once the smallest debt is paid off, you use the money you were paying on that debt to attack the next smallest debt, and so on.

Using the debt snowball template can be a powerful way to pay off debt quickly. By focusing on one debt at a time, you can create momentum and build confidence as you work towards becoming debt-free.

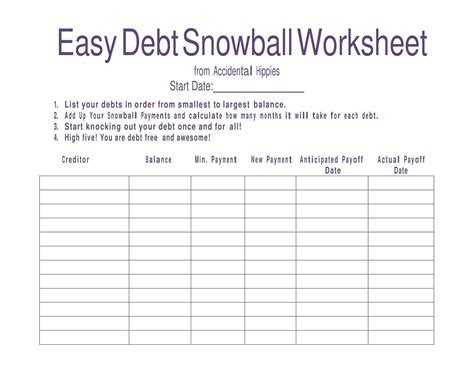

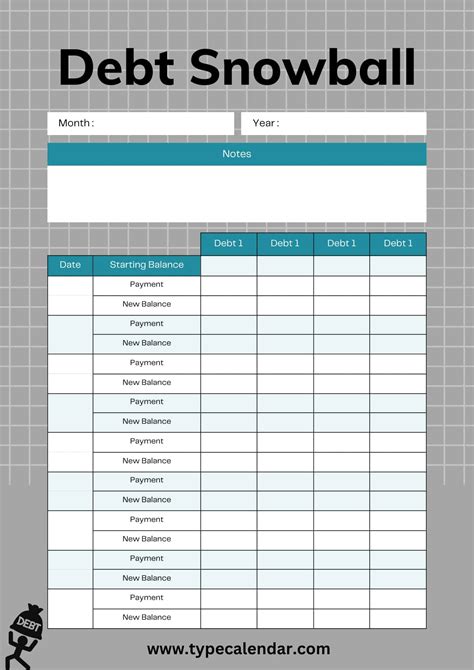

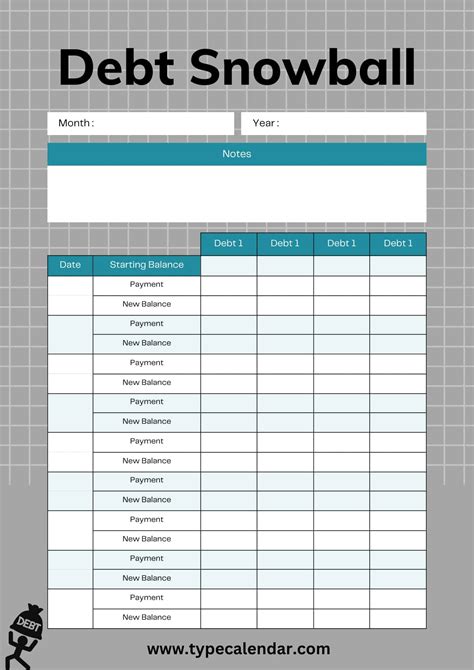

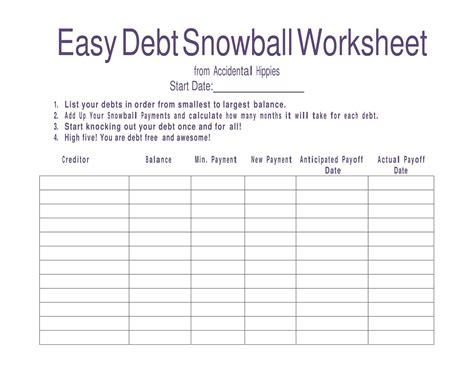

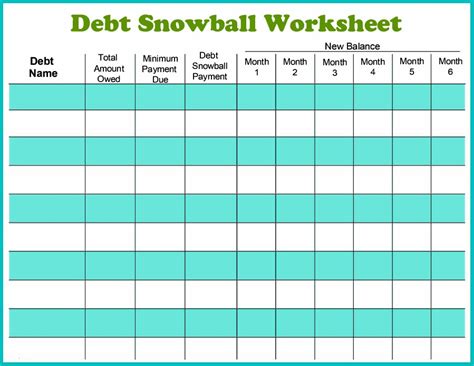

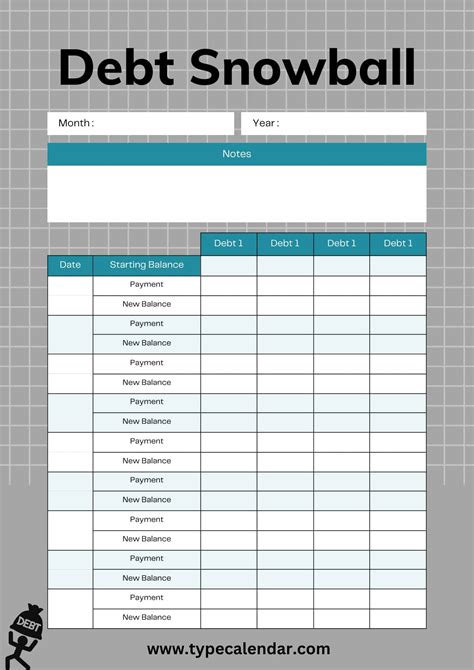

How the Debt Snowball Template Works

The debt snowball template is a straightforward process that involves the following steps:

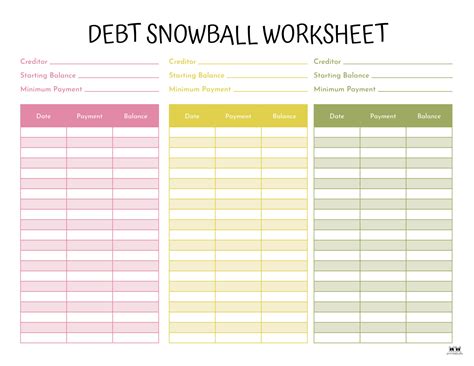

- List all of your debts: Start by making a list of all of your debts, including credit cards, loans, and other financial obligations.

- Prioritize your debts: Next, prioritize your debts by listing them from smallest to largest. This means that the debt with the smallest balance will be at the top of the list.

- Create a budget: Create a budget that allocates as much money as possible towards paying off your debt.

- Focus on the smallest debt: Begin by focusing on the smallest debt on your list. Make minimum payments on all other debts, but put as much money as possible towards the smallest debt.

- Pay off the smallest debt: Continue to focus on the smallest debt until it is paid off.

- Move on to the next debt: Once the smallest debt is paid off, move on to the next debt on the list and repeat the process.

Example of the Debt Snowball Template in Action

Let's say you have the following debts:

- Credit card with a balance of $500

- Car loan with a balance of $10,000

- Student loan with a balance of $30,000

Using the debt snowball template, you would prioritize these debts as follows:

- Credit card with a balance of $500

- Car loan with a balance of $10,000

- Student loan with a balance of $30,000

You would then create a budget that allocates as much money as possible towards paying off the credit card debt. Once the credit card debt is paid off, you would move on to the car loan and repeat the process.

Benefits of the Debt Snowball Template

The debt snowball template has several benefits, including:

- Quick wins: By focusing on the smallest debt first, you can achieve quick wins and build momentum as you work towards becoming debt-free.

- Simplified budgeting: The debt snowball template simplifies the budgeting process by allowing you to focus on one debt at a time.

- Increased motivation: Paying off debt can be a long and difficult process, but the debt snowball template provides a clear plan and achievable goals, which can increase motivation and help you stay on track.

Common Objections to the Debt Snowball Template

Some people may object to the debt snowball template, citing the following reasons:

- It doesn't always make mathematical sense: Some critics argue that the debt snowball template doesn't always make mathematical sense, as it prioritizes debts based on balance rather than interest rate.

- It may not save the most money in interest: Paying off debts with the highest interest rates first may save the most money in interest over time.

- It's too simplistic: The debt snowball template is a simple process, but some people may find it too simplistic and prefer a more complex approach to paying off debt.

However, these objections can be addressed by considering the following:

- The debt snowball template is not just about math: While math is an important consideration when paying off debt, the debt snowball template also takes into account the psychological and emotional aspects of debt repayment.

- Quick wins can be powerful motivators: Achieving quick wins can be a powerful motivator, and the debt snowball template provides a clear plan and achievable goals.

- Simplistic doesn't mean ineffective: The debt snowball template may be simple, but it has been proven to be effective for millions of people around the world.

Alternatives to the Debt Snowball Template

While the debt snowball template is a popular and effective method for paying off debt, there are alternative approaches that may be more suitable for some people. Some alternatives include:

- The debt avalanche template: This approach prioritizes debts based on interest rate, with the debt with the highest interest rate being paid off first.

- The snowflaking method: This approach involves making small, extra payments towards debt whenever possible, such as by selling items or using unexpected windfalls.

- The debt consolidation method: This approach involves consolidating multiple debts into one loan with a lower interest rate and a single monthly payment.

Ultimately, the best approach to paying off debt will depend on individual circumstances and preferences. It's essential to find a method that works for you and stick to it.

Conclusion

Paying off debt can be a challenging and overwhelming process, but with the right strategy and tools, it is possible to achieve financial freedom. The debt snowball template is a popular and effective method for paying off debt, providing a clear plan and achievable goals. While there are alternative approaches to paying off debt, the debt snowball template remains a powerful tool for anyone looking to become debt-free.

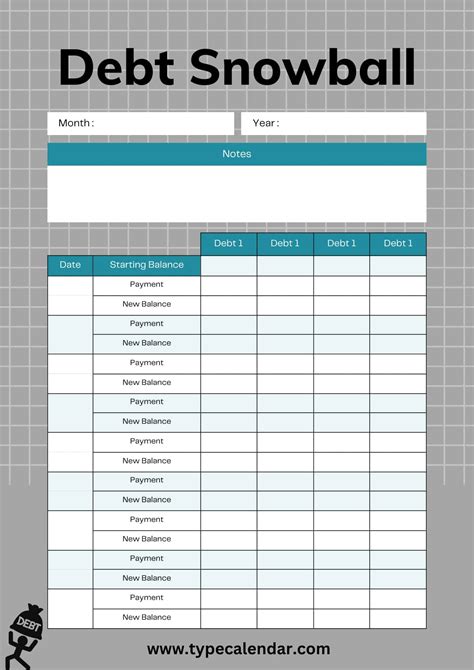

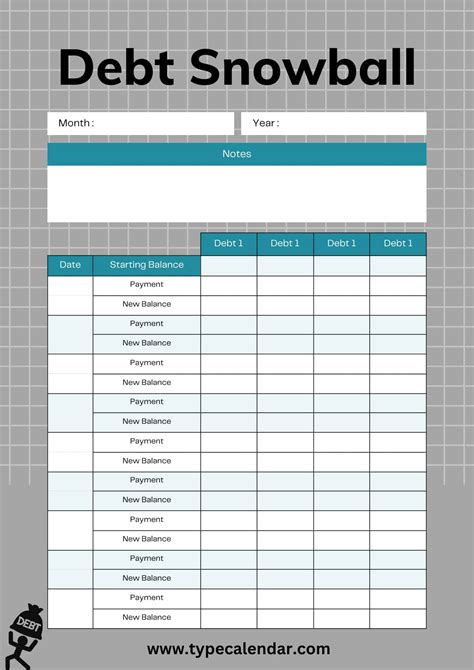

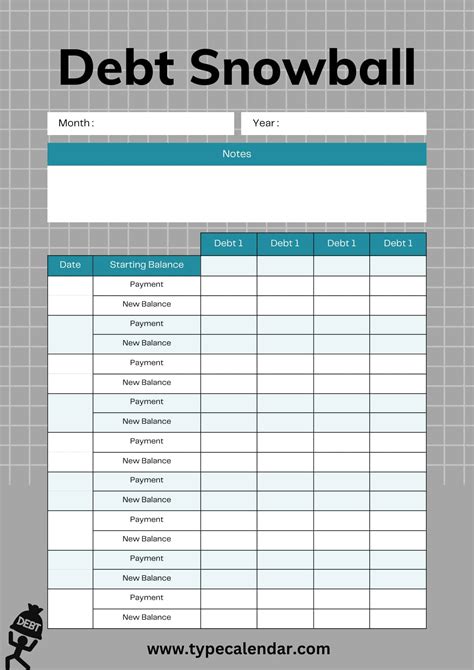

Debt Snowball Template Image Gallery

FAQs

Q: What is the debt snowball template? A: The debt snowball template is a method for paying off debt that involves prioritizing debts based on balance, with the smallest debt being paid off first.

Q: How does the debt snowball template work? A: The debt snowball template works by creating a list of all debts, prioritizing them based on balance, and then focusing on paying off the smallest debt first.

Q: What are the benefits of the debt snowball template? A: The benefits of the debt snowball template include quick wins, simplified budgeting, and increased motivation.

Q: What are some alternatives to the debt snowball template? A: Alternatives to the debt snowball template include the debt avalanche template, the snowflaking method, and the debt consolidation method.

Q: Is the debt snowball template effective? A: Yes, the debt snowball template has been proven to be effective for millions of people around the world.