Intro

Create a stress-free financial life with the Dave Ramsey budget template. Easily track income, expenses, and savings with our simplified template. Say goodbye to debt and hello to financial peace. Learn how to allocate 70% for necessities, 10% for savings, and 20% for debt repayment and discretionary spending.

Managing your finances effectively is crucial for achieving financial stability and security. One of the most popular and effective budgeting methods is the Dave Ramsey budget template. This template is designed to help you create a realistic and achievable budget that can help you get out of debt, build wealth, and secure your financial future.

The Dave Ramsey budget template is based on the 7 Baby Steps, a proven plan for getting out of debt and building wealth. These steps include:

- Save $1,000 as an emergency fund

- Pay off all debt using the Debt Snowball method

- Save 3-6 months of expenses in a savings account

- Invest 15% of your income in retirement accounts

- Save for college expenses

- Pay off your mortgage

- Build wealth and give generously

The Dave Ramsey budget template is designed to help you allocate your income according to these steps. Here's how to use it:

Understanding the Dave Ramsey Budget Template

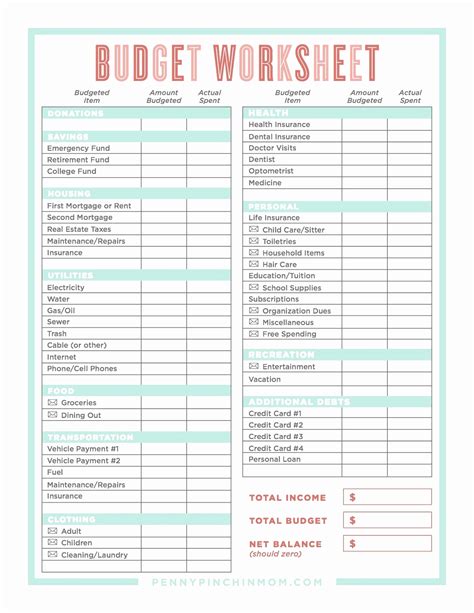

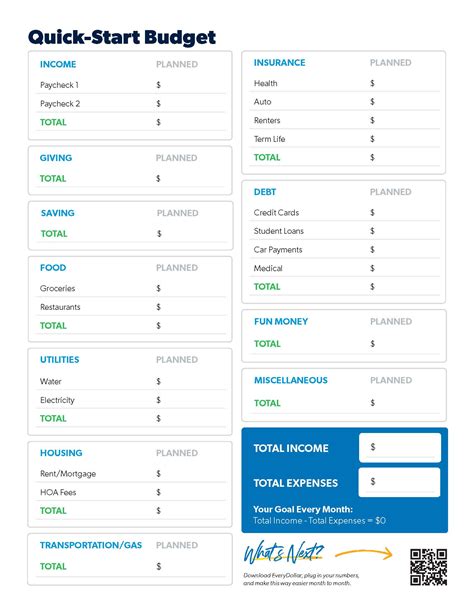

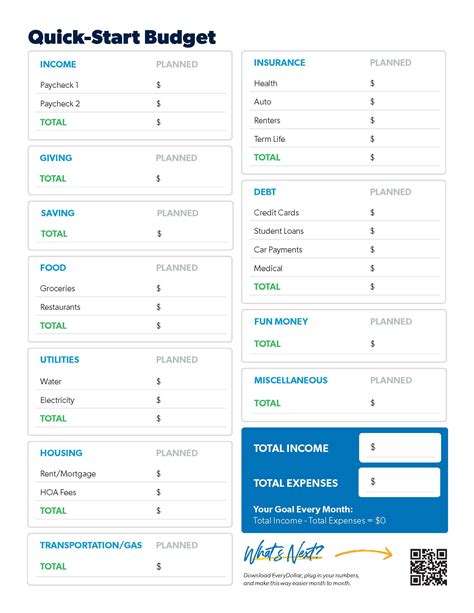

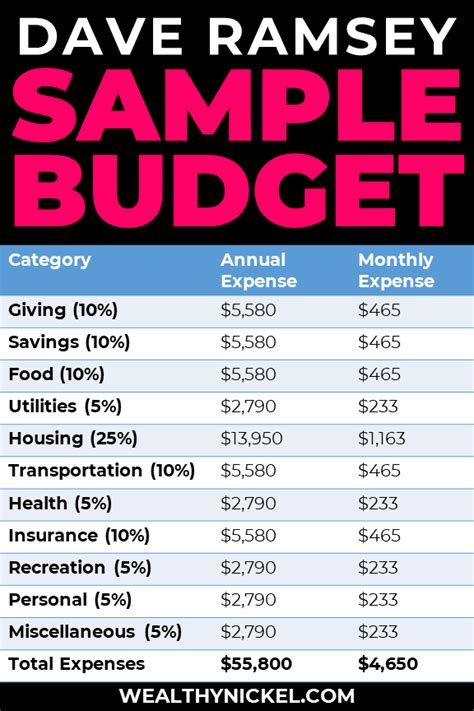

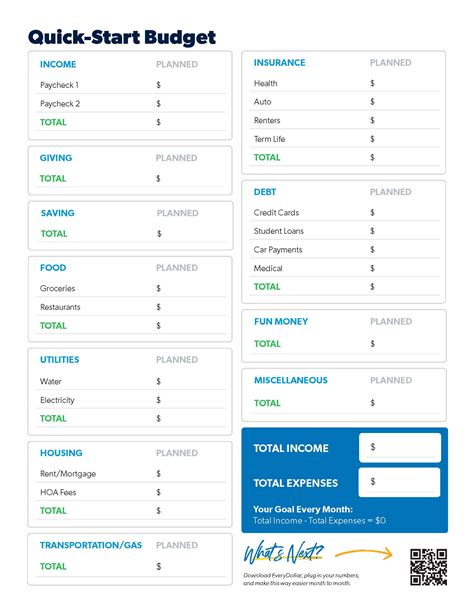

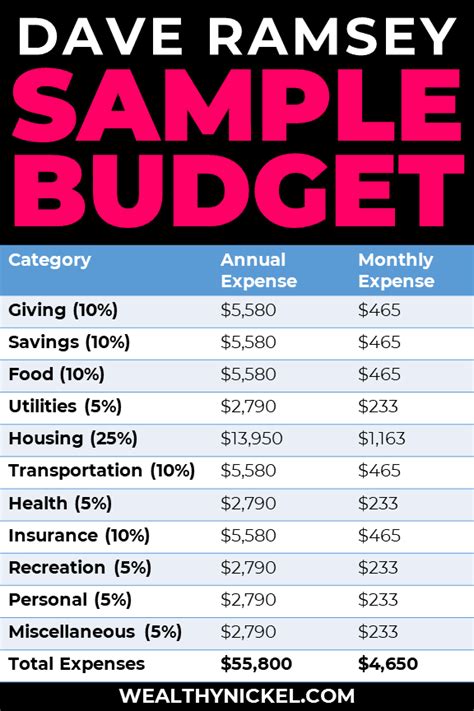

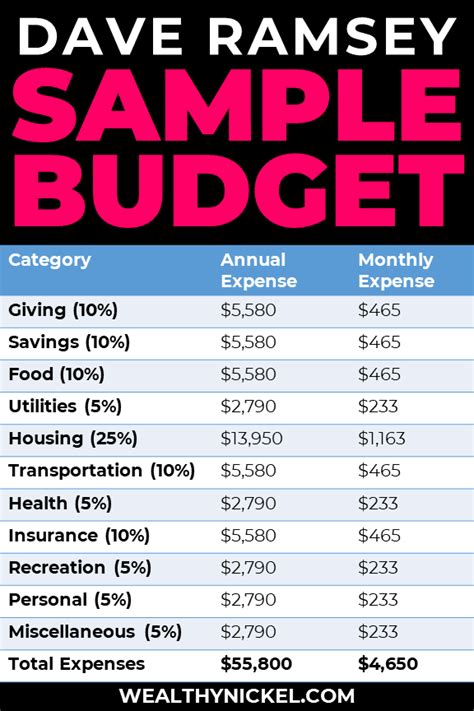

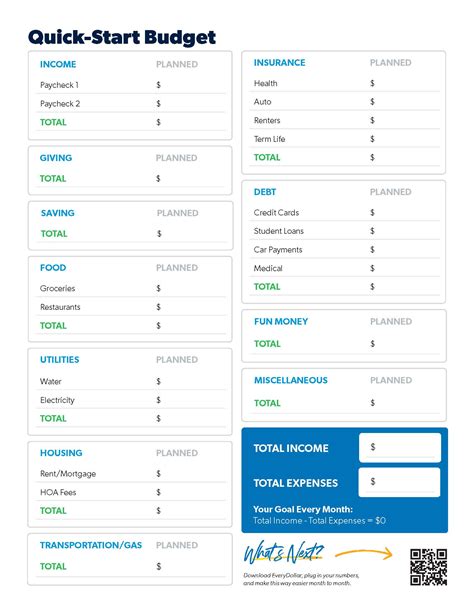

The Dave Ramsey budget template is a simple and straightforward tool that helps you allocate your income into different categories. The template includes the following categories:

- Income

- Savings

- Debt repayment

- Housing

- Transportation

- Food

- Insurance

- Entertainment

- Miscellaneous

How to Use the Dave Ramsey Budget Template

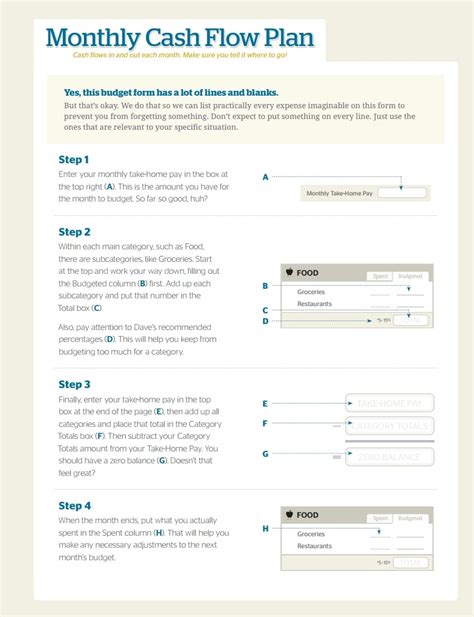

Using the Dave Ramsey budget template is easy. Here's a step-by-step guide:

- Start by listing your income from all sources.

- Allocate 10% of your income towards savings.

- Allocate 10% of your income towards debt repayment.

- Allocate 30% of your income towards housing.

- Allocate 10% of your income towards transportation.

- Allocate 10% of your income towards food.

- Allocate 5% of your income towards insurance.

- Allocate 5% of your income towards entertainment.

- Allocate 5% of your income towards miscellaneous expenses.

Benefits of Using the Dave Ramsey Budget Template

Using the Dave Ramsey budget template has numerous benefits, including:

- Helps you create a realistic and achievable budget

- Helps you prioritize your expenses

- Helps you get out of debt faster

- Helps you build wealth over time

- Helps you achieve financial stability and security

Common Mistakes to Avoid When Using the Dave Ramsey Budget Template

While using the Dave Ramsey budget template is a great way to manage your finances, there are some common mistakes to avoid:

- Not tracking your expenses

- Not adjusting your budget regularly

- Not prioritizing your expenses

- Not building an emergency fund

- Not investing for the future

Alternatives to the Dave Ramsey Budget Template

While the Dave Ramsey budget template is a popular and effective tool for managing your finances, there are other alternatives to consider:

- The 50/30/20 rule

- The Envelope System

- The Zero-Based Budget

- The Cash Flow Budget

Conclusion

The Dave Ramsey budget template is a simple and effective tool for managing your finances and achieving financial stability and security. By following the 7 Baby Steps and using the template to allocate your income, you can get out of debt, build wealth, and secure your financial future. Remember to track your expenses, adjust your budget regularly, and prioritize your expenses to get the most out of the template.

Take Action

Don't wait any longer to take control of your finances. Download the Dave Ramsey budget template today and start working towards a more secure financial future.

Gallery of Dave Ramsey Budget Template

Dave Ramsey Budget Template Gallery

Note: You can share your own experience with the Dave Ramsey budget template in the comments section below.