Intro

Take control of your finances with Dave Ramsey printables. Discover 7 practical ways to budget and achieve financial stability. Get debt snowball templates, expense trackers, and income planners to simplify your money management. Start your journey to financial freedom with these free printable resources, perfect for budgeting beginners and experts alike.

Creating a budget can be a daunting task, especially for those who are new to managing their finances. However, with the right tools and guidance, it can be a straightforward process that sets you on the path to financial freedom. One popular approach to budgeting is the Dave Ramsey method, which emphasizes living below your means, getting out of debt, and building wealth. To help you implement this method, we'll explore 7 ways to budget with Dave Ramsey printables.

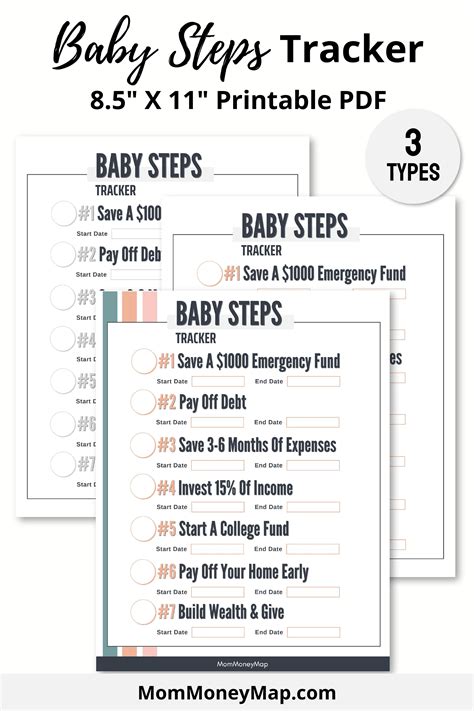

The Dave Ramsey method is a proven approach to taking control of your finances and achieving financial stability. By following his baby steps, you can create a budget that works for you and helps you achieve your long-term financial goals. In this article, we'll discuss the benefits of using printables to budget with the Dave Ramsey method and provide you with 7 effective ways to do so.

What are Dave Ramsey Printables?

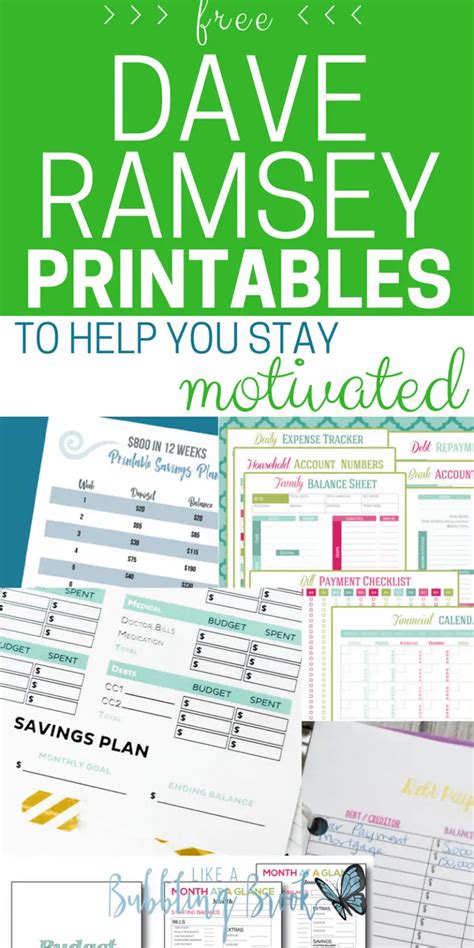

Dave Ramsey printables are free budgeting worksheets and templates that you can download and print to help you manage your finances. These printables are designed to make it easy to track your income and expenses, create a budget, and achieve your financial goals. They're a great tool for anyone who wants to take control of their finances and start building wealth.

Benefits of Using Dave Ramsey Printables

There are several benefits to using Dave Ramsey printables to budget. Here are a few:

- They're easy to use: Dave Ramsey printables are designed to be user-friendly, making it easy to track your income and expenses.

- They're customizable: You can tailor the printables to fit your specific financial needs and goals.

- They're free: You can download and print the budgeting worksheets and templates for free.

- They're a great teaching tool: If you're new to budgeting, the printables can help you learn how to manage your finances effectively.

7 Ways to Budget with Dave Ramsey Printables

Here are 7 effective ways to budget with Dave Ramsey printables:

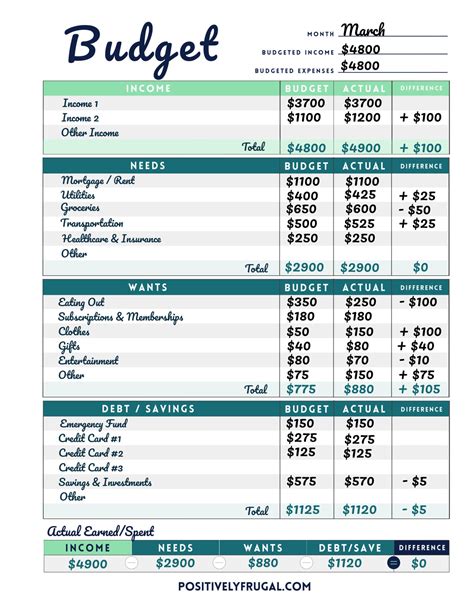

1. Create a Budget Form

One of the first steps to budgeting with Dave Ramsey printables is to create a budget form. This form will help you track your income and expenses and make sure you're staying within your means. To create a budget form, you'll need to download the budgeting worksheet from the Dave Ramsey website. Then, fill in the form with your income and expenses, and use the calculations to determine how much you have available to spend each month.

2. Track Your Expenses

Tracking your expenses is an essential part of budgeting with Dave Ramsey printables. By keeping track of where your money is going, you can identify areas where you can cut back and make adjustments to your budget. To track your expenses, use the expense tracker printable from the Dave Ramsey website. Write down every purchase you make, no matter how small, and categorize your expenses into different areas, such as housing, transportation, and food.

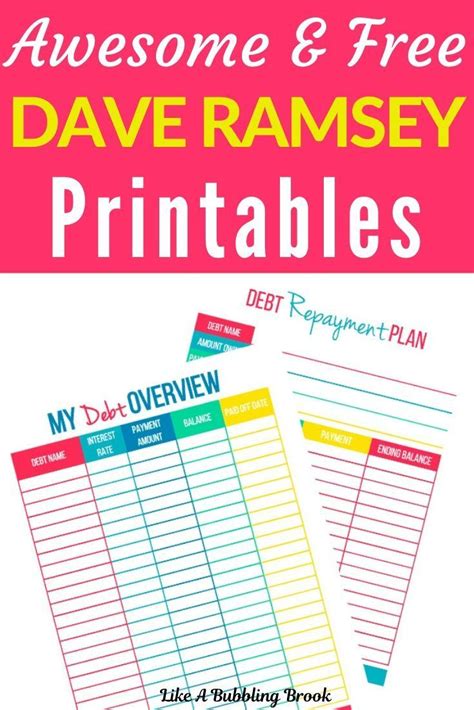

3. Create a Debt Snowball

If you have debt, creating a debt snowball is a great way to pay it off quickly. To create a debt snowball, use the debt snowball printable from the Dave Ramsey website. List all of your debts, starting with the smallest balance first, and then prioritize them based on the balance. Then, make minimum payments on all of your debts except the smallest one, which you'll pay off as aggressively as possible.

4. Build an Emergency Fund

Having an emergency fund in place is essential for financial stability. To build an emergency fund, use the emergency fund printable from the Dave Ramsey website. Determine how much you need to save based on your income and expenses, and then set up automatic transfers from your checking account to your savings account.

5. Invest for the Future

Once you've built an emergency fund and paid off your debt, it's time to start investing for the future. To invest, use the investment printable from the Dave Ramsey website. Determine how much you can afford to invest each month, and then set up automatic transfers from your checking account to your investment account.

6. Create a Savings Plan

Creating a savings plan is an essential part of budgeting with Dave Ramsey printables. To create a savings plan, use the savings plan printable from the Dave Ramsey website. Determine how much you need to save based on your income and expenses, and then set up automatic transfers from your checking account to your savings account.

7. Review and Adjust Your Budget

Finally, it's essential to review and adjust your budget regularly. To do this, use the budget review printable from the Dave Ramsey website. Review your income and expenses, and make adjustments as needed. This will help you stay on track and ensure that you're achieving your financial goals.

Dave Ramsey Printables Image Gallery

By following these 7 ways to budget with Dave Ramsey printables, you can take control of your finances and achieve financial stability. Remember to review and adjust your budget regularly to ensure you're on track to achieving your financial goals.

Now that you've learned how to budget with Dave Ramsey printables, it's time to take action. Download the budgeting worksheets and templates from the Dave Ramsey website, and start creating a budget that works for you. Don't forget to review and adjust your budget regularly to ensure you're on track to achieving your financial goals.