Intro

Get back on track with Dave Ramseys proven financial plan. Discover a comprehensive resume template designed to help you achieve financial success. Learn how to create a budget, pay off debt, and build wealth with our expert guide, featuring key LSI keywords: budgeting, debt reduction, financial planning, and wealth creation.

Creating a budget and getting out of debt can be a daunting task, but with the right tools and guidance, it can be achievable. Dave Ramsey, a well-known personal finance expert, has helped millions of people get out of debt and achieve financial success. One of the key tools he recommends is using a budgeting template to track income and expenses. In this article, we will discuss the Dave Ramsey resume template for financial success and provide a comprehensive guide on how to use it.

The Importance of Budgeting

Before we dive into the Dave Ramsey resume template, let's talk about why budgeting is important. Budgeting is the process of creating a plan for how you want to spend your money. It helps you track your income and expenses, identify areas where you can cut back, and make smart financial decisions. Without a budget, it's easy to overspend and get into debt. In fact, according to a survey by the Federal Reserve, 40% of Americans don't have enough savings to cover a $400 emergency.

Benefits of Using a Budgeting Template

Using a budgeting template can help you create a budget that works for you. A budgeting template is a pre-designed spreadsheet that helps you track your income and expenses. It can help you:

- Identify areas where you can cut back

- Make smart financial decisions

- Achieve your financial goals

- Reduce stress and anxiety related to money

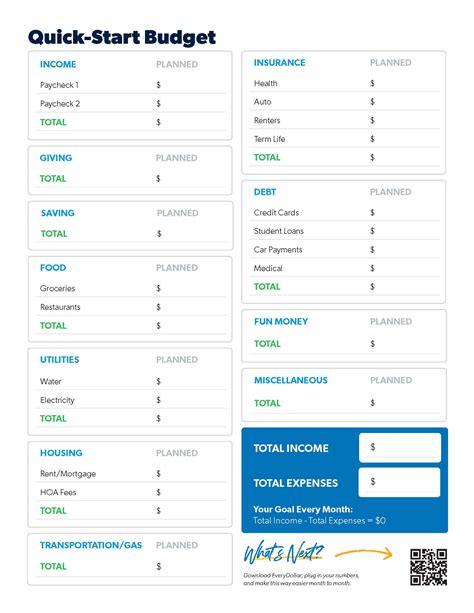

Dave Ramsey Resume Template

The Dave Ramsey resume template is a budgeting template that is specifically designed to help you get out of debt and achieve financial success. It's a simple and easy-to-use template that helps you track your income and expenses. The template includes sections for:

- Income

- Fixed expenses (such as rent/mortgage, utilities, and groceries)

- Debt repayment

- Savings

- Entertainment expenses

How to Use the Dave Ramsey Resume Template

Using the Dave Ramsey resume template is easy. Here's a step-by-step guide:

- Download the template from the Dave Ramsey website or create your own using a spreadsheet software like Microsoft Excel or Google Sheets.

- Fill in your income and fixed expenses.

- List all your debts, including credit cards, student loans, and mortgages.

- Determine how much you can afford to pay each month towards your debt.

- Allocate money towards savings and entertainment expenses.

- Track your expenses throughout the month and make adjustments as needed.

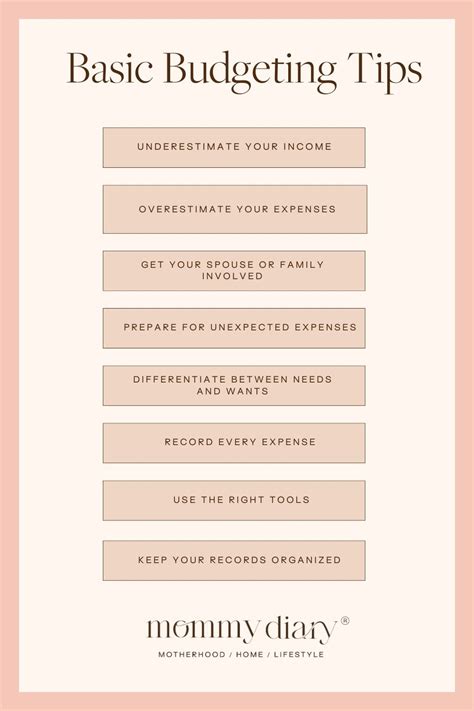

Tips for Using the Dave Ramsey Resume Template

Here are some tips for using the Dave Ramsey resume template:

- Be honest about your spending habits

- Include all sources of income

- Prioritize debt repayment

- Use the 50/30/20 rule (50% for fixed expenses, 30% for discretionary spending, and 20% for saving and debt repayment)

- Review and adjust your budget regularly

Common Mistakes to Avoid

Here are some common mistakes to avoid when using the Dave Ramsey resume template:

- Not including all sources of income

- Underestimating expenses

- Not prioritizing debt repayment

- Not reviewing and adjusting the budget regularly

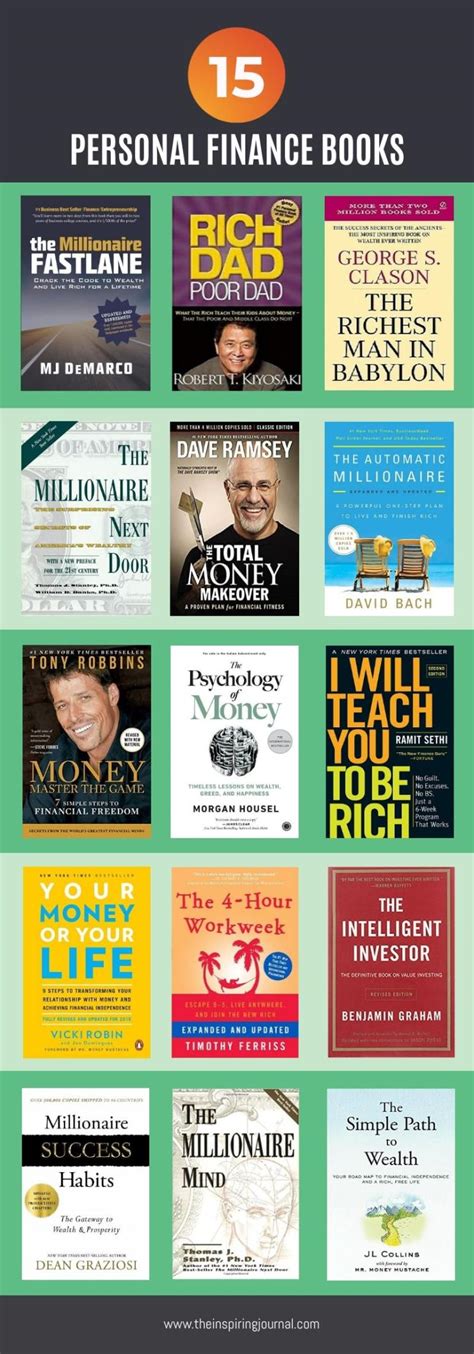

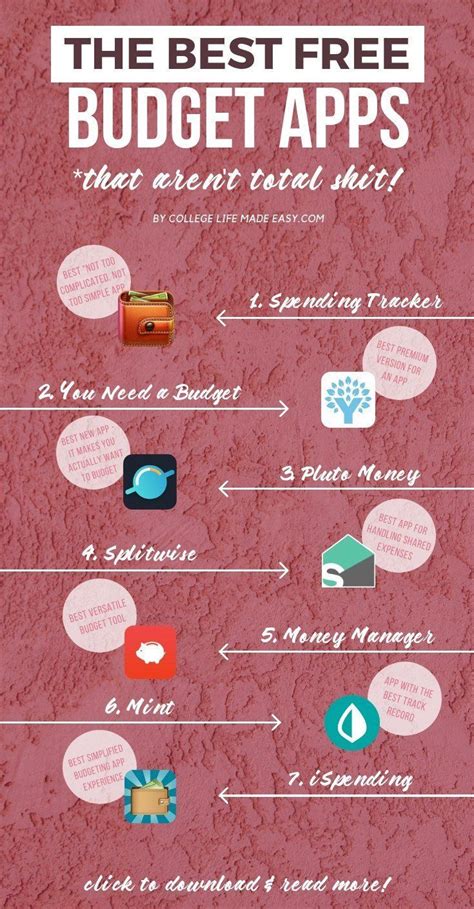

Gallery of Budgeting and Financial Success

Budgeting and Financial Success Image Gallery

Conclusion

Creating a budget and getting out of debt can be a challenging task, but with the right tools and guidance, it can be achievable. The Dave Ramsey resume template is a simple and easy-to-use budgeting template that can help you track your income and expenses and achieve financial success. By following the tips and avoiding common mistakes, you can create a budget that works for you and achieve financial freedom.

We hope this article has provided you with a comprehensive guide on how to use the Dave Ramsey resume template for financial success. If you have any questions or comments, please leave them below.