Intro

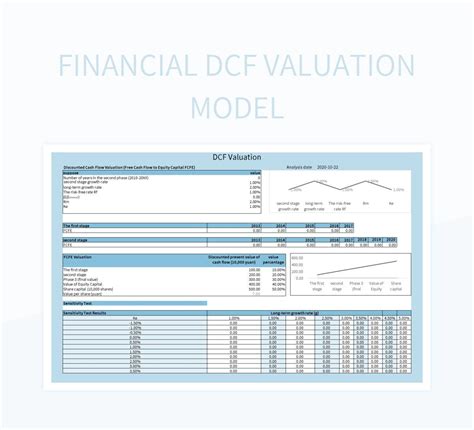

Master financial analysis with our DCF Valuation Excel Template. Easily estimate a companys intrinsic value using discounted cash flow models. Ideal for investors, analysts, and students, this template simplifies complex calculations, providing a clear picture of future cash flows, growth rates, and present value. Boost your valuation skills with this intuitive tool.

Creating a comprehensive financial analysis is crucial for investors, analysts, and business owners to make informed decisions about their investments or companies. One of the most widely used methods for evaluating a company's financial performance is the Discounted Cash Flow (DCF) model. A DCF valuation Excel template can simplify the process, making it more accessible and efficient. In this article, we will explore the world of DCF valuation, its importance, and how to create a straightforward Excel template for easy financial analysis.

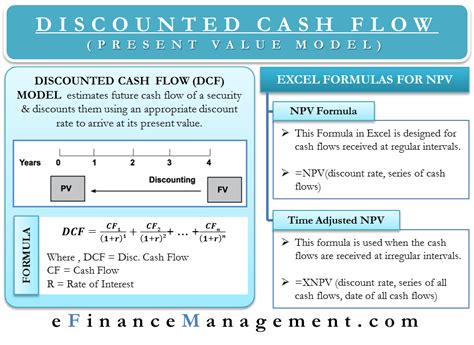

Understanding DCF Valuation

Discounted Cash Flow (DCF) valuation is a method used to estimate the value of an investment based on its future cash flows. The model assumes that the value of an investment is equal to the present value of its expected future cash flows. This approach is widely used in finance and accounting to evaluate the financial performance of companies, projects, and investments.

Why Use DCF Valuation?

DCF valuation provides a comprehensive framework for evaluating the financial performance of a company. It takes into account the company's expected future cash flows, the time value of money, and the risk associated with the investment. This approach helps investors and analysts to:

- Estimate the intrinsic value of a company

- Compare the company's current market price with its intrinsic value

- Evaluate the company's financial performance and make informed investment decisions

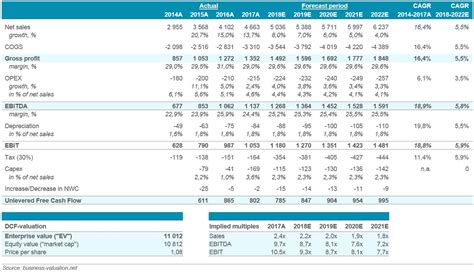

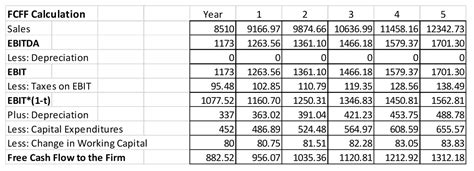

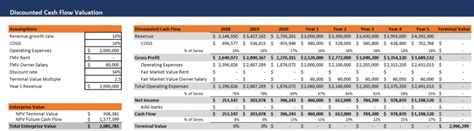

Creating a DCF Valuation Excel Template

Creating a DCF valuation Excel template can simplify the process of financial analysis. Here's a step-by-step guide to creating a basic DCF valuation template:

- Input Assumptions: Create a section for input assumptions, including the company's expected future cash flows, discount rate, and terminal growth rate.

- Calculate Present Value: Use the XNPV function to calculate the present value of the company's expected future cash flows.

- Calculate Terminal Value: Use the perpetuity growth model to calculate the terminal value of the company.

- Calculate Equity Value: Calculate the equity value of the company by adding the present value of the expected future cash flows and the terminal value.

- Calculate Per-Share Value: Calculate the per-share value of the company by dividing the equity value by the total number of shares outstanding.

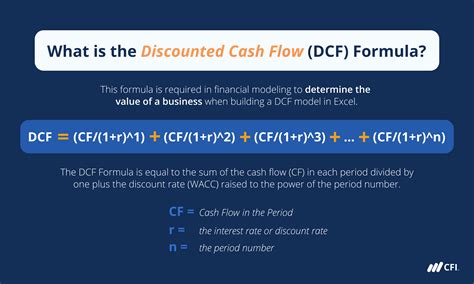

DCF Valuation Formula

The DCF valuation formula is as follows:

PV = Σ (CFt / (1 + r)^t) + TV / (1 + r)^n

Where:

- PV = present value

- CFt = expected future cash flow at time t

- r = discount rate

- TV = terminal value

- n = number of periods

Example of DCF Valuation

Let's assume we want to estimate the value of a company with the following expected future cash flows:

| Year | Cash Flow |

|---|---|

| 1 | $100 |

| 2 | $120 |

| 3 | $150 |

| 4 | $180 |

| 5 | $200 |

The discount rate is 10%, and the terminal growth rate is 5%. The terminal value is estimated to be $1,000.

Using the DCF valuation formula, we can calculate the present value of the expected future cash flows and the terminal value.

PV = $100 / (1 + 0.10)^1 + $120 / (1 + 0.10)^2 +... + $200 / (1 + 0.10)^5 + $1,000 / (1 + 0.10)^5 PV = $647.14

The equity value of the company is estimated to be $647.14.

Benefits of Using a DCF Valuation Excel Template

Using a DCF valuation Excel template provides several benefits, including:

- Simplifies the financial analysis process

- Reduces errors and inconsistencies

- Increases efficiency and productivity

- Enhances transparency and accountability

Conclusion

A DCF valuation Excel template is a powerful tool for financial analysis. It simplifies the process of estimating a company's intrinsic value and provides a comprehensive framework for evaluating financial performance. By following the steps outlined in this article, you can create a basic DCF valuation template and start analyzing companies like a pro.

Share Your Thoughts

We hope this article has provided you with a better understanding of DCF valuation and how to create a simple Excel template. Share your thoughts and experiences with DCF valuation in the comments section below. Don't forget to share this article with your friends and colleagues who may benefit from this information.

DCF Valuation Image Gallery