Intro

Get back in control of your finances with our free debt validation letter template. Learn how to dispute and negotiate debt with creditors using this expert-approved template. Streamline your debt relief process, avoid debt collector harassment, and focus on paying off valid debts with our comprehensive guide and customizable template.

Are you tired of receiving harassing phone calls and letters from debt collectors? Do you want to take control of your finances and dispute any errors or inaccuracies on your debt reports? A debt validation letter can be a powerful tool in your debt relief journey. In this article, we will provide you with a free debt validation letter template and guide you through the process of using it to dispute your debts.

What is a Debt Validation Letter?

A debt validation letter is a formal request to a debt collector or creditor to verify the accuracy of a debt. It is a written request that asks the debt collector to provide proof that the debt is valid and belongs to you. This letter is an essential step in the debt collection process, as it allows you to challenge any errors or inaccuracies on your debt reports.

Why Do You Need a Debt Validation Letter?

A debt validation letter is necessary for several reasons:

- It helps you to verify the accuracy of the debt: By requesting proof of the debt, you can ensure that the debt collector has accurate information about your debt.

- It helps you to dispute errors: If you find any errors or inaccuracies on your debt reports, a debt validation letter can help you to dispute them.

- It helps you to stop harassment: If a debt collector is harassing you, a debt validation letter can help you to stop the harassment.

What Should You Include in a Debt Validation Letter?

A debt validation letter should include the following information:

- Your name and address

- The debt collector's name and address

- A clear statement of the debt you are disputing

- A request for proof of the debt

- A request for the debt collector to stop contacting you

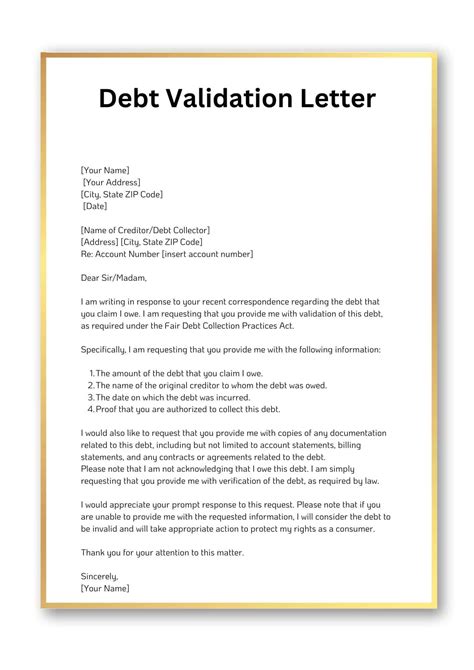

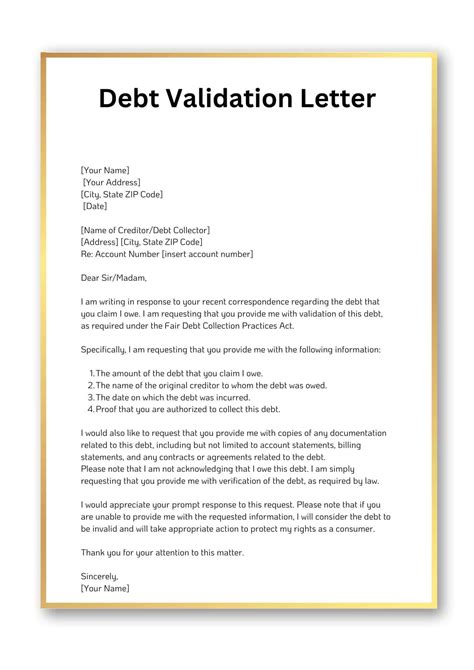

Sample Debt Validation Letter Template

Here is a sample debt validation letter template that you can use:

[Your Name] [Your Address] [City, State, Zip] [Date]

[Debt Collector's Name] [Debt Collector's Address] [City, State, Zip]

Re: Debt Validation for [Account Number]

Dear [Debt Collector's Name],

I am writing to request validation of the debt that your company claims I owe. I have received several letters and phone calls from your company, but I have not received any proof of the debt.

I am requesting that you provide me with the following information:

- A copy of the original contract or agreement that I signed

- A copy of the account statement that shows the amount of the debt

- A copy of any communication that your company has sent to me regarding the debt

I also request that you stop contacting me until you have provided me with this information.

Sincerely,

[Your Name]

How to Send a Debt Validation Letter

Once you have written your debt validation letter, you should send it to the debt collector via certified mail with return receipt requested. This will provide you with proof that the debt collector received your letter.

What to Expect After Sending a Debt Validation Letter

After sending a debt validation letter, you can expect the debt collector to respond with one of the following:

- A copy of the proof of the debt

- A statement that the debt is invalid

- A request for more information

If the debt collector responds with proof of the debt, you can then decide whether to pay the debt or dispute it further. If the debt collector responds with a statement that the debt is invalid, you can request that they remove the debt from your credit reports.

Conclusion

A debt validation letter is a powerful tool in your debt relief journey. By using this letter, you can challenge any errors or inaccuracies on your debt reports and stop harassment from debt collectors. Remember to include all the necessary information in your letter and to send it via certified mail with return receipt requested.

We hope this article has provided you with the information you need to take control of your finances and dispute any errors or inaccuracies on your debt reports. If you have any further questions or concerns, please don't hesitate to reach out.

Debt Relief Image Gallery

Please share your thoughts on debt validation letters and debt relief in the comments below. If you found this article helpful, please share it with others who may be struggling with debt.