Intro

Create a accurate depreciation schedule with our free Excel template and step-by-step tutorial. Learn how to calculate depreciation using straight-line, declining balance, and sum-of-years-digits methods. Download the template and master asset depreciation tracking, including MACRS, useful life, and residual value. Simplify your accounting and tax calculations today!

Effective financial management is crucial for businesses to thrive in today's competitive market. One essential aspect of financial management is accounting for depreciation, which can significantly impact a company's bottom line. A depreciation schedule is a valuable tool that helps businesses track and calculate the decrease in value of their assets over time. In this article, we will discuss the importance of depreciation schedules, how to create a depreciation schedule in Excel, and provide a downloadable template to get you started.

Understanding Depreciation

Depreciation is the process of allocating the cost of a tangible asset over its useful life. It represents the decrease in value of an asset due to wear and tear, obsolescence, or other factors. Depreciation is a non-cash expense, meaning it doesn't involve the actual outlay of cash. However, it can significantly impact a company's financial statements, including the balance sheet and income statement.

Types of Depreciation Methods

There are several depreciation methods, including:

- Straight-Line Method: This is the most common method, where the asset's cost is divided by its useful life to determine the annual depreciation expense.

- Declining Balance Method: This method involves applying a fixed percentage to the asset's book value each year to calculate the depreciation expense.

- Units-of-Production Method: This method is used for assets that have a specific production capacity, where the depreciation expense is calculated based on the number of units produced.

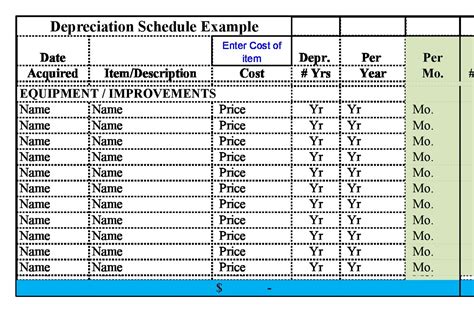

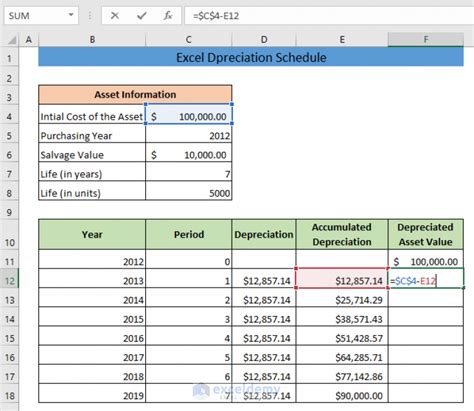

Creating a Depreciation Schedule in Excel

Creating a depreciation schedule in Excel is a straightforward process. Here's a step-by-step guide:

Step 1: Set up the Template

Create a new Excel spreadsheet and set up the following columns:

| Asset | Cost | Useful Life | Depreciation Method | Annual Depreciation |

|---|

Step 2: Enter Asset Information

Enter the asset information, including the asset name, cost, useful life, and depreciation method.

Step 3: Calculate Annual Depreciation

Calculate the annual depreciation expense using the chosen depreciation method.

Step 4: Create a Depreciation Schedule

Create a depreciation schedule by calculating the depreciation expense for each year of the asset's useful life.

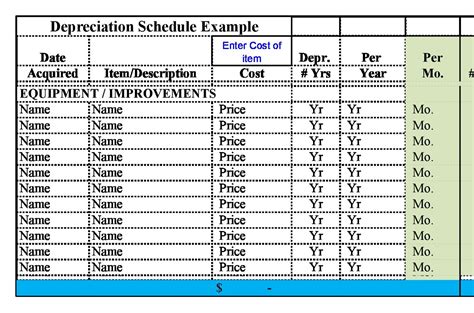

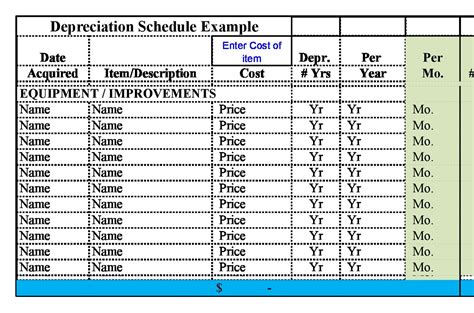

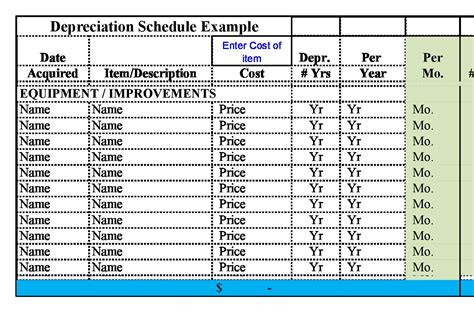

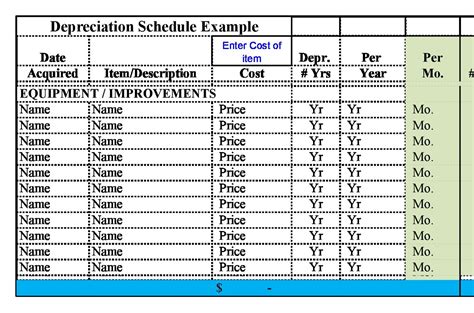

Depreciation Schedule Excel Template

To make it easier for you to create a depreciation schedule, we've created a downloadable Excel template. The template includes the following features:

- Easy-to-use interface: Simply enter the asset information, and the template will calculate the depreciation expense for you.

- Supports multiple depreciation methods: Choose from the straight-line, declining balance, or units-of-production method.

- Automatic calculations: The template will calculate the annual depreciation expense and create a depreciation schedule for you.

To download the template, click the link below:

Depreciation Schedule Excel Template

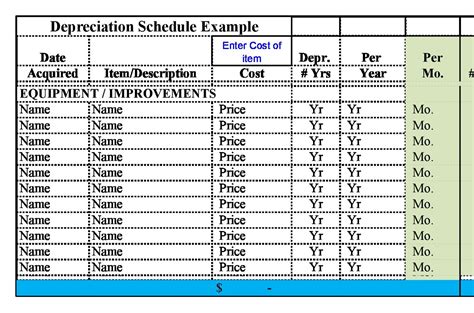

Using the Depreciation Schedule Template

To use the template, follow these steps:

- Download the template and save it to your computer.

- Open the template in Excel and enter the asset information, including the asset name, cost, useful life, and depreciation method.

- The template will automatically calculate the annual depreciation expense and create a depreciation schedule.

- Review the depreciation schedule and make any necessary adjustments.

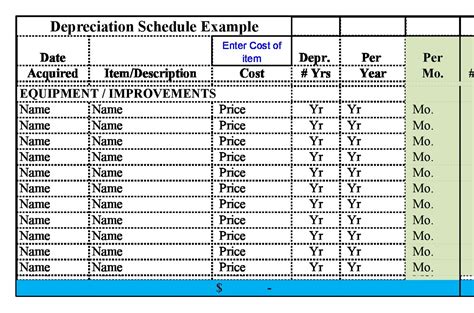

Benefits of Using a Depreciation Schedule

Using a depreciation schedule can have several benefits for your business, including:

- Improved financial management: A depreciation schedule helps you track the decrease in value of your assets over time, ensuring accurate financial reporting.

- Tax savings: Depreciation expenses can be deducted from taxable income, reducing your tax liability.

- Better decision-making: A depreciation schedule provides valuable insights into the performance of your assets, helping you make informed decisions about future investments.

Common Mistakes to Avoid

When creating a depreciation schedule, there are several common mistakes to avoid, including:

- Incorrect depreciation method: Using the wrong depreciation method can result in inaccurate calculations and financial reporting.

- Inaccurate asset information: Entering incorrect asset information, such as cost or useful life, can lead to errors in the depreciation schedule.

- Failure to update the schedule: Failing to update the depreciation schedule regularly can result in inaccurate financial reporting and tax errors.

Conclusion

Creating a depreciation schedule is an essential part of financial management for businesses. By using a depreciation schedule, you can ensure accurate financial reporting, reduce tax liability, and make informed decisions about future investments. Our downloadable Excel template makes it easy to create a depreciation schedule, and our tutorial provides step-by-step instructions on how to use it. By avoiding common mistakes and using a depreciation schedule, you can take control of your business's financial management and drive growth and success.

Depreciation Schedule Excel Template Gallery