Intro

Discover how to create a depreciation schedule in Excel with ease. Learn 5 simple methods to calculate depreciation, including straight-line, declining balance, and more. Master Excel formulas and functions to accurately track asset value over time. Boost your financial management skills with this comprehensive guide.

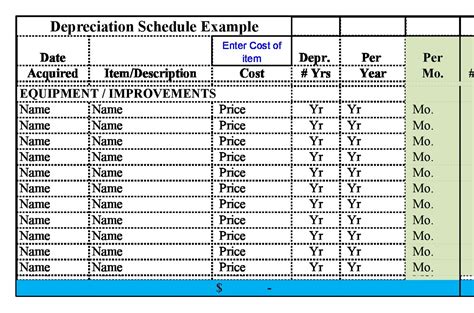

As a business owner or accountant, creating a depreciation schedule is an essential task to accurately track the decrease in value of your assets over time. Excel is a popular tool for creating depreciation schedules due to its flexibility and ease of use. In this article, we will explore five ways to create a depreciation schedule in Excel, including the straight-line method, declining balance method, and more.

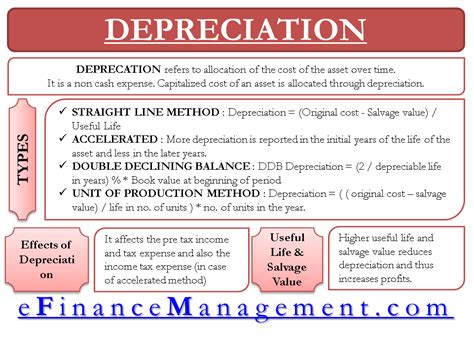

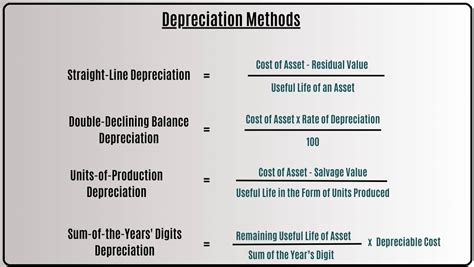

Understanding Depreciation

Before we dive into creating a depreciation schedule in Excel, it's essential to understand what depreciation is and how it works. Depreciation is the decrease in value of an asset over its useful life. It's a non-cash expense that represents the reduction in value of an asset due to wear and tear, obsolescence, or other factors.

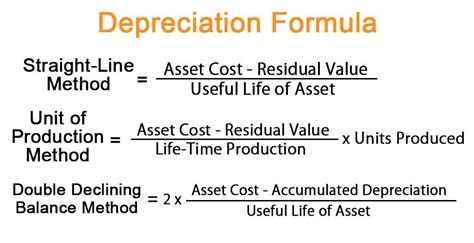

There are several methods of calculating depreciation, including the straight-line method, declining balance method, and units-of-production method. Each method has its own advantages and disadvantages, and the choice of method depends on the type of asset, its useful life, and other factors.

Methods of Calculating Depreciation

Here are some common methods of calculating depreciation:

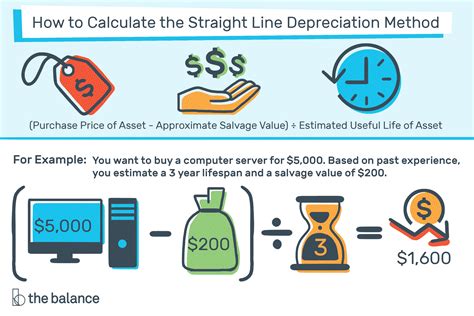

- Straight-line method: This method assumes that the asset loses its value evenly over its useful life.

- Declining balance method: This method assumes that the asset loses its value at a faster rate in the early years of its useful life.

- Units-of-production method: This method assumes that the asset loses its value based on the number of units produced or the number of hours used.

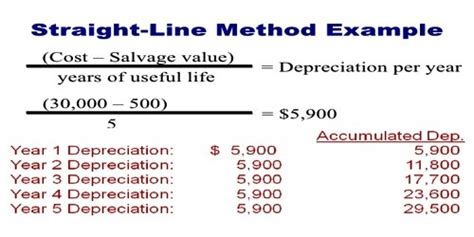

Method 1: Straight-Line Method

The straight-line method is the simplest method of calculating depreciation. It assumes that the asset loses its value evenly over its useful life. To create a depreciation schedule using the straight-line method in Excel, follow these steps:

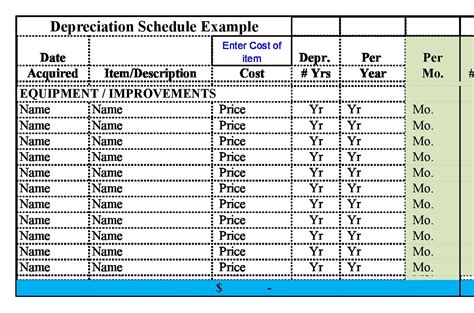

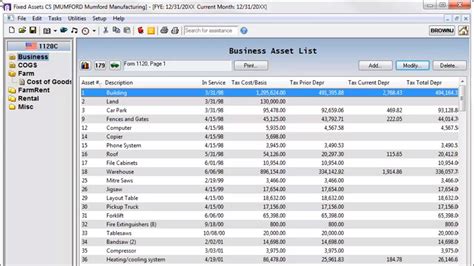

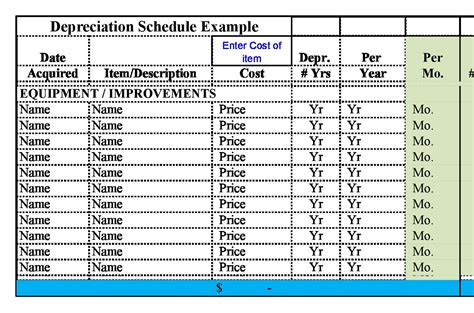

- Create a table with the following columns: Asset, Cost, Useful Life, Annual Depreciation, and Accumulated Depreciation.

- Enter the asset's cost, useful life, and annual depreciation rate.

- Calculate the annual depreciation by dividing the asset's cost by its useful life.

- Calculate the accumulated depreciation by adding the annual depreciation to the previous year's accumulated depreciation.

Here's an example of how to create a depreciation schedule using the straight-line method in Excel:

| Asset | Cost | Useful Life | Annual Depreciation | Accumulated Depreciation |

|---|---|---|---|---|

| Equipment | $10,000 | 5 years | $2,000 | $0 |

| $2,000 | $2,000 | |||

| $2,000 | $4,000 | |||

| $2,000 | $6,000 | |||

| $2,000 | $8,000 |

Formula Used:

- Annual Depreciation = Cost / Useful Life

- Accumulated Depreciation = Previous Year's Accumulated Depreciation + Annual Depreciation

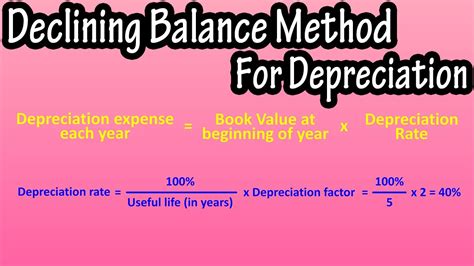

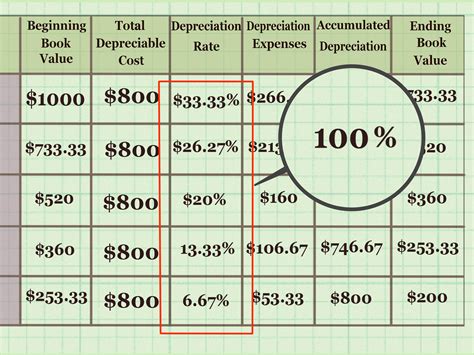

Method 2: Declining Balance Method

The declining balance method is another popular method of calculating depreciation. It assumes that the asset loses its value at a faster rate in the early years of its useful life. To create a depreciation schedule using the declining balance method in Excel, follow these steps:

- Create a table with the following columns: Asset, Cost, Useful Life, Annual Depreciation Rate, and Accumulated Depreciation.

- Enter the asset's cost, useful life, and annual depreciation rate.

- Calculate the annual depreciation by multiplying the asset's cost by the annual depreciation rate.

- Calculate the accumulated depreciation by adding the annual depreciation to the previous year's accumulated depreciation.

Here's an example of how to create a depreciation schedule using the declining balance method in Excel:

| Asset | Cost | Useful Life | Annual Depreciation Rate | Accumulated Depreciation |

|---|---|---|---|---|

| Equipment | $10,000 | 5 years | 20% | $0 |

| $2,000 | $2,000 | |||

| $1,600 | $3,600 | |||

| $1,280 | $4,880 | |||

| $1,024 | $5,904 |

Formula Used:

- Annual Depreciation = Cost x Annual Depreciation Rate

- Accumulated Depreciation = Previous Year's Accumulated Depreciation + Annual Depreciation

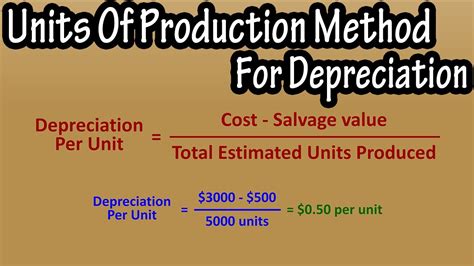

Method 3: Units-of-Production Method

The units-of-production method is a method of calculating depreciation based on the number of units produced or the number of hours used. To create a depreciation schedule using the units-of-production method in Excel, follow these steps:

- Create a table with the following columns: Asset, Cost, Units Produced, Unit Cost, and Accumulated Depreciation.

- Enter the asset's cost, units produced, and unit cost.

- Calculate the annual depreciation by multiplying the number of units produced by the unit cost.

- Calculate the accumulated depreciation by adding the annual depreciation to the previous year's accumulated depreciation.

Here's an example of how to create a depreciation schedule using the units-of-production method in Excel:

| Asset | Cost | Units Produced | Unit Cost | Accumulated Depreciation |

|---|---|---|---|---|

| Equipment | $10,000 | 1,000 units | $10 | $0 |

| 1,200 units | $10 | $1,000 | ||

| 1,500 units | $10 | $2,500 | ||

| 1,800 units | $10 | $4,500 | ||

| 2,000 units | $10 | $6,000 |

Formula Used:

- Annual Depreciation = Units Produced x Unit Cost

- Accumulated Depreciation = Previous Year's Accumulated Depreciation + Annual Depreciation

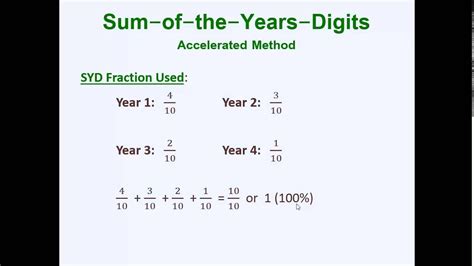

Method 4: Sum-of-the-Years'-Digits Method

The sum-of-the-years'-digits method is a method of calculating depreciation that assumes the asset loses its value at a faster rate in the early years of its useful life. To create a depreciation schedule using the sum-of-the-years'-digits method in Excel, follow these steps:

- Create a table with the following columns: Asset, Cost, Useful Life, Annual Depreciation, and Accumulated Depreciation.

- Enter the asset's cost, useful life, and annual depreciation rate.

- Calculate the annual depreciation by multiplying the asset's cost by the annual depreciation rate.

- Calculate the accumulated depreciation by adding the annual depreciation to the previous year's accumulated depreciation.

Here's an example of how to create a depreciation schedule using the sum-of-the-years'-digits method in Excel:

| Asset | Cost | Useful Life | Annual Depreciation Rate | Accumulated Depreciation |

|---|---|---|---|---|

| Equipment | $10,000 | 5 years | 20% | $0 |

| $2,000 | $2,000 | |||

| $1,600 | $3,600 | |||

| $1,280 | $4,880 | |||

| $1,024 | $5,904 |

Formula Used:

- Annual Depreciation = Cost x Annual Depreciation Rate

- Accumulated Depreciation = Previous Year's Accumulated Depreciation + Annual Depreciation

Method 5: Double Declining Balance Method

The double declining balance method is a method of calculating depreciation that assumes the asset loses its value at a faster rate in the early years of its useful life. To create a depreciation schedule using the double declining balance method in Excel, follow these steps:

- Create a table with the following columns: Asset, Cost, Useful Life, Annual Depreciation Rate, and Accumulated Depreciation.

- Enter the asset's cost, useful life, and annual depreciation rate.

- Calculate the annual depreciation by multiplying the asset's cost by the annual depreciation rate.

- Calculate the accumulated depreciation by adding the annual depreciation to the previous year's accumulated depreciation.

Here's an example of how to create a depreciation schedule using the double declining balance method in Excel:

| Asset | Cost | Useful Life | Annual Depreciation Rate | Accumulated Depreciation |

|---|---|---|---|---|

| Equipment | $10,000 | 5 years | 40% | $0 |

| $4,000 | $4,000 | |||

| $2,400 | $6,400 | |||

| $1,440 | $7,840 | |||

| $864 | $8,704 |

Formula Used:

- Annual Depreciation = Cost x Annual Depreciation Rate

- Accumulated Depreciation = Previous Year's Accumulated Depreciation + Annual Depreciation

Depreciation Schedule Image Gallery

In conclusion, creating a depreciation schedule in Excel is a straightforward process that can be done using various methods. The straight-line method, declining balance method, units-of-production method, sum-of-the-years'-digits method, and double declining balance method are some of the most common methods used to calculate depreciation. By following the steps outlined in this article, you can create a depreciation schedule that accurately reflects the decrease in value of your assets over time.

We hope this article has been helpful in understanding the different methods of calculating depreciation and how to create a depreciation schedule in Excel. If you have any questions or need further assistance, please don't hesitate to ask. Share your thoughts and experiences with us in the comments section below.