Creating a depreciation template in Excel can be a straightforward process that helps you calculate and track the decrease in value of assets over time. Depreciation is a crucial concept in accounting that allows businesses to spread the cost of an asset over its useful life. Here's a step-by-step guide on how to create a depreciation template in Excel easily.

Why Create a Depreciation Template in Excel?

Before we dive into creating the template, let's quickly discuss why you should create a depreciation template in Excel:

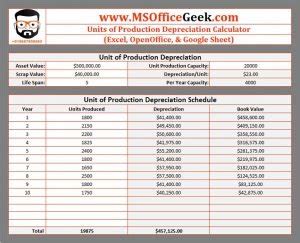

- Easy calculation: Excel makes it easy to calculate depreciation using various methods, such as straight-line, declining balance, and units-of-production.

- Customization: You can customize the template to fit your specific needs and asset types.

- Organization: The template helps you keep track of multiple assets and their depreciation schedules.

- Scalability: As your business grows, you can easily add more assets to the template.

Creating a Depreciation Template in Excel

To create a depreciation template in Excel, follow these steps:

Step 1: Set up the Template Structure

Create a new Excel workbook and set up the following columns:

| Asset ID | Asset Name | Cost | Useful Life | Depreciation Method | Annual Depreciation | Accumulated Depreciation |

|---|

Step 2: Enter Asset Information

Enter the asset information in the respective columns. For example:

| Asset ID | Asset Name | Cost | Useful Life | Depreciation Method |

|---|---|---|---|---|

| 1 | Computer | 1000 | 3 years | Straight-Line |

| 2 | Vehicle | 20000 | 5 years | Declining Balance |

Step 3: Calculate Annual Depreciation

Create formulas to calculate the annual depreciation for each asset. For example:

- Straight-Line Method:

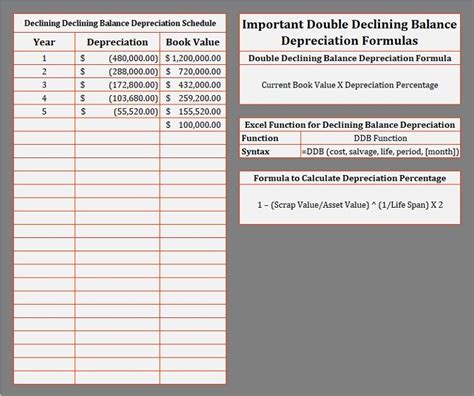

=Cost/Useful Life - Declining Balance Method:

=Cost*(1-((1-Depreciation Rate)^Useful Life))

Assuming the depreciation rate for the declining balance method is 20%, the formula would be:

=20000*(1-((1-0.2)^5))

Step 4: Calculate Accumulated Depreciation

Create a formula to calculate the accumulated depreciation for each asset. For example:

=SUM(Annual Depreciation)

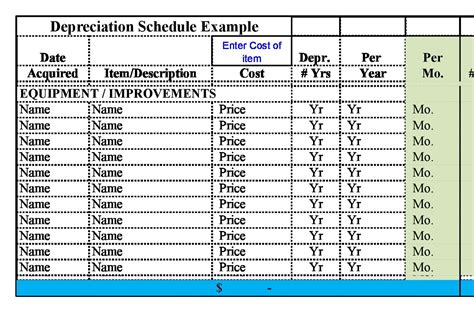

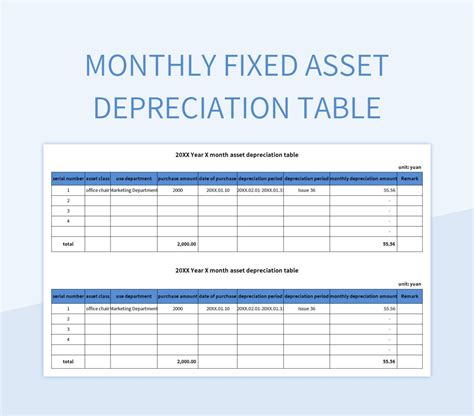

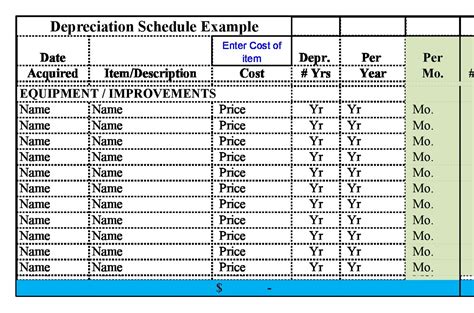

Step 5: Add a Depreciation Schedule

Create a table to display the depreciation schedule for each asset. Use the following columns:

| Year | Annual Depreciation | Accumulated Depreciation | Book Value |

|---|

Use formulas to calculate the annual depreciation, accumulated depreciation, and book value for each year.

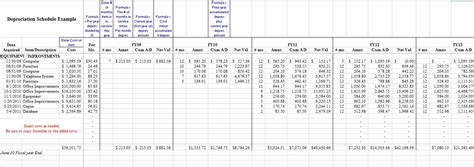

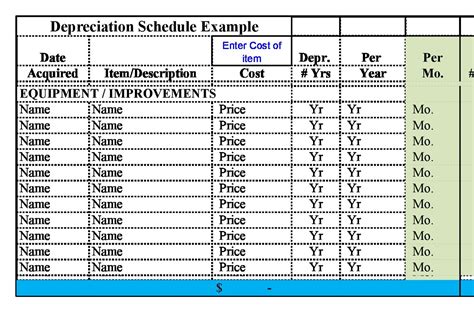

Example Template:

Gallery of Depreciation Templates

Depreciation Template Gallery

By following these steps, you can easily create a depreciation template in Excel that helps you calculate and track the depreciation of your assets. Remember to customize the template to fit your specific needs and asset types.