As a financial analyst, it's essential to have the right tools to evaluate investment opportunities and make informed decisions. One of the most widely used methods for financial analysis is the Discounted Cash Flow (DCF) model. In this article, we'll explore the importance of DCF analysis, its components, and provide a comprehensive guide on how to create a Discounted Cash Flow Excel template for financial analysis.

The Importance of Discounted Cash Flow Analysis

Discounted Cash Flow analysis is a valuation method used to estimate the present value of future cash flows. It's a widely accepted approach in the finance industry, as it helps investors and analysts understand the intrinsic value of a company or project. By discounting future cash flows to their present value, DCF analysis provides a comprehensive picture of a company's financial health and potential for growth.

Components of Discounted Cash Flow Analysis

A typical DCF model consists of the following components:

- Forecasted Cash Flows: These are the expected cash inflows and outflows of a company or project over a specific period.

- Discount Rate: This is the rate used to discount future cash flows to their present value. The discount rate reflects the time value of money and the risk associated with the investment.

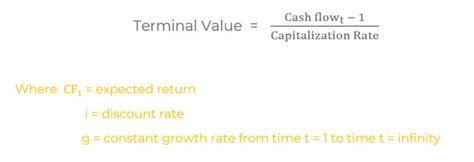

- Terminal Value: This is the present value of all cash flows beyond the forecast period. Terminal value is often estimated using the perpetual growth model or the exit multiple method.

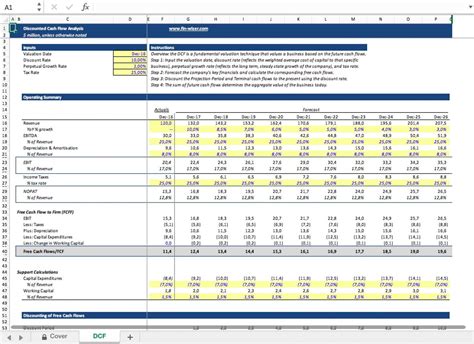

Creating a Discounted Cash Flow Excel Template

To create a DCF Excel template, follow these steps:

Step 1: Set up the Input Sheet

- Create a new Excel sheet and title it "Input."

- Set up the following input sections:

- Company Information: company name, ticker symbol, and industry.

- Forecast Period: start and end dates of the forecast period.

- Discount Rate: the discount rate used to discount future cash flows.

- Growth Rate: the growth rate used to estimate terminal value.

- Cash Flow Assumptions: assumptions about revenue growth, operating margins, and capital expenditures.

Step 2: Create the Forecast Sheet

- Create a new Excel sheet and title it "Forecast."

- Set up the following forecast sections:

- Revenue: forecasted revenue for each year of the forecast period.

- Operating Income: forecasted operating income for each year of the forecast period.

- Capital Expenditures: forecasted capital expenditures for each year of the forecast period.

- Free Cash Flow: calculated free cash flow for each year of the forecast period.

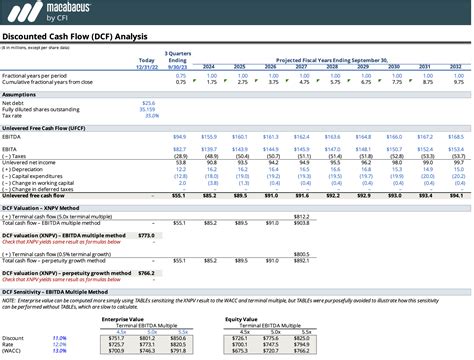

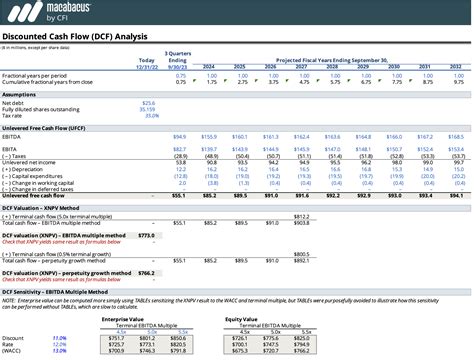

Step 3: Calculate the Discounted Cash Flows

- Create a new Excel sheet and title it "DCF."

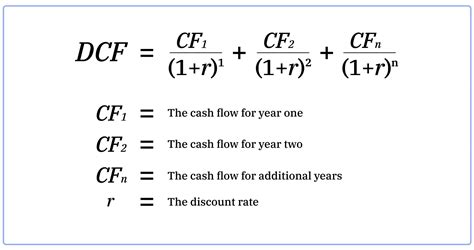

- Calculate the discounted cash flows using the following formula:

Present Value = Future Value / (1 + Discount Rate)^n

- Where:

- Present Value: the present value of the future cash flow.

- Future Value: the future cash flow.

- Discount Rate: the discount rate used to discount future cash flows.

- n: the number of periods.

Step 4: Calculate the Terminal Value

- Calculate the terminal value using the following formula:

Terminal Value = (Final Year Free Cash Flow x (1 + Growth Rate)) / (Discount Rate - Growth Rate)

- Where:

- Terminal Value: the present value of all cash flows beyond the forecast period.

- Final Year Free Cash Flow: the free cash flow of the final year of the forecast period.

- Growth Rate: the growth rate used to estimate terminal value.

- Discount Rate: the discount rate used to discount future cash flows.

Step 5: Calculate the Equity Value

- Calculate the equity value by adding the discounted cash flows and terminal value.

Equity Value = Discounted Cash Flows + Terminal Value

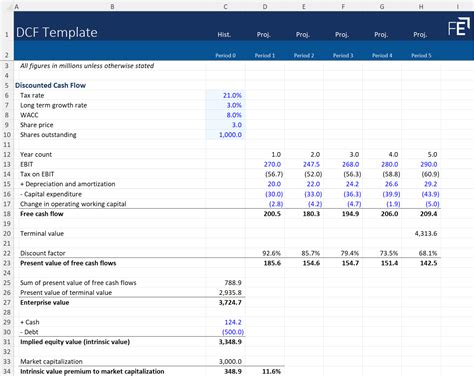

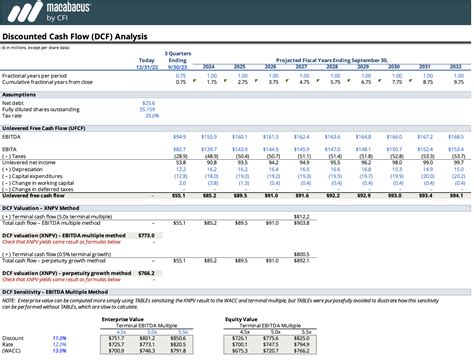

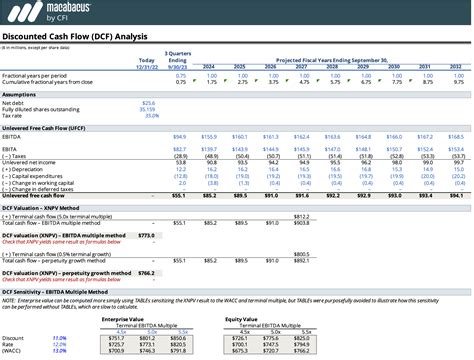

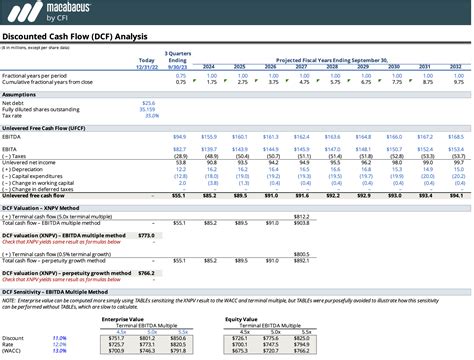

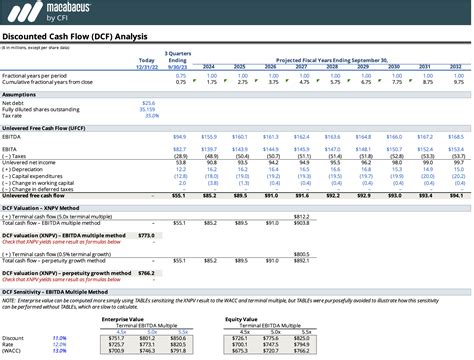

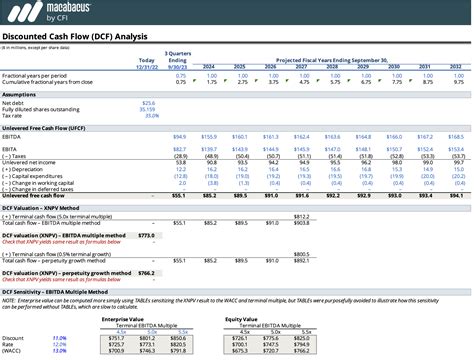

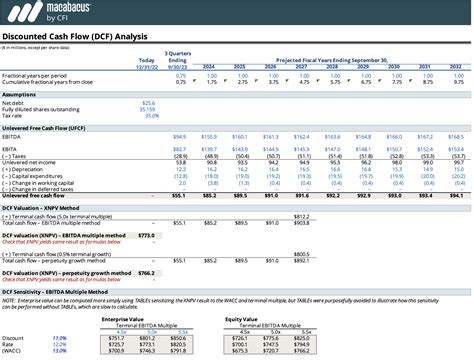

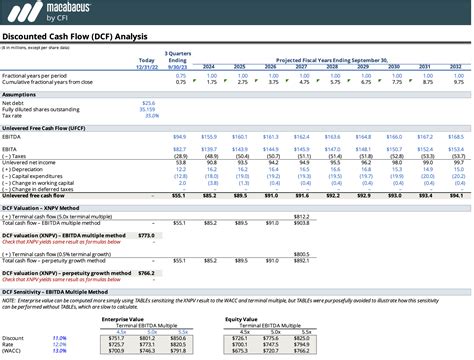

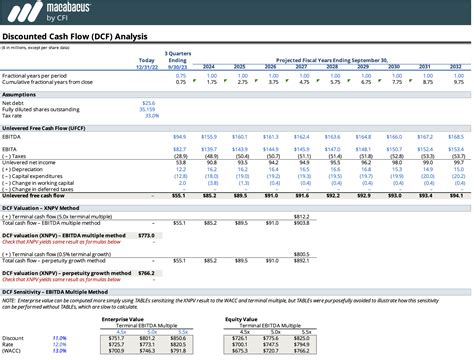

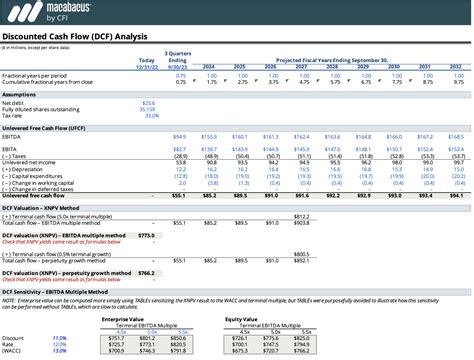

Gallery of Discounted Cash Flow Excel Templates

Discounted Cash Flow Excel Template Gallery

Conclusion

In conclusion, creating a Discounted Cash Flow Excel template is a valuable skill for any financial analyst. By following the steps outlined in this article, you can create a comprehensive DCF model that helps you estimate the intrinsic value of a company or project. Remember to always use the template as a starting point and adjust the assumptions and inputs to fit your specific needs.

If you have any questions or need further clarification on any of the steps, please don't hesitate to ask. We'd be happy to help you create a Discounted Cash Flow Excel template that meets your needs.

Share your thoughts and experiences with creating Discounted Cash Flow Excel templates in the comments section below. We'd love to hear from you!