Intro

Unlock accurate investment analysis with our comprehensive DCF Model Excel Template. Learn how to estimate a companys present value using forecasted cash flows, discount rates, and terminal values. Master the art of intrinsic value calculation, relative valuation, and investment appraisal with this step-by-step guide and downloadable template.

DCF Model Excel Template: A Comprehensive Guide for Investment Analysis

Investment analysis is a critical process for any business or individual looking to make informed decisions about their investments. One of the most widely used tools for investment analysis is the Discounted Cash Flow (DCF) model. In this article, we will explore the DCF model Excel template and its application in investment analysis.

What is a DCF Model?

A DCF model is a financial model that estimates the present value of future cash flows using a discount rate. The model takes into account the time value of money, which states that a dollar received today is worth more than a dollar received in the future. The DCF model is commonly used to evaluate the potential return on investment (ROI) of a project or business.

How Does a DCF Model Work?

A DCF model works by estimating the future cash flows of a project or business and then discounting those cash flows back to their present value using a discount rate. The discount rate is typically based on the cost of capital, which is the minimum return required by investors. The present value of the future cash flows is then compared to the initial investment to determine the ROI.

Benefits of Using a DCF Model Excel Template

Using a DCF model Excel template can simplify the investment analysis process and provide several benefits, including:

- Improved accuracy: A DCF model Excel template can help reduce errors and improve the accuracy of the investment analysis.

- Increased efficiency: The template can save time and effort by automating many of the calculations.

- Better decision-making: The DCF model can provide a clear and comprehensive picture of the potential ROI, enabling better decision-making.

- Customization: The template can be customized to suit specific investment analysis needs.

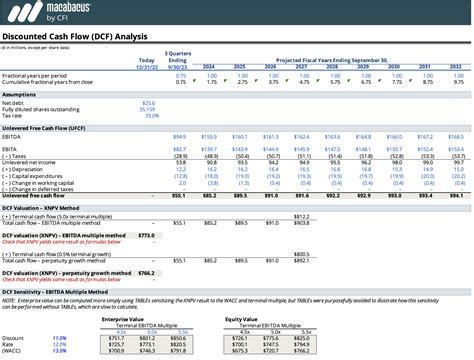

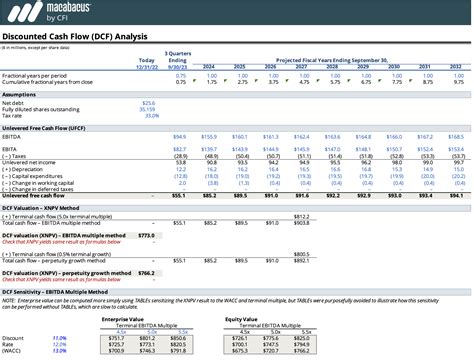

Key Components of a DCF Model Excel Template

A DCF model Excel template typically includes the following key components:

- Input sheet: This sheet is used to input the key assumptions and data, such as the initial investment, growth rate, and discount rate.

- Cash flow sheet: This sheet is used to estimate the future cash flows of the project or business.

- Discount rate sheet: This sheet is used to calculate the discount rate based on the cost of capital.

- Present value sheet: This sheet is used to calculate the present value of the future cash flows using the discount rate.

- Output sheet: This sheet is used to display the results of the investment analysis, including the ROI and payback period.

How to Create a DCF Model Excel Template

Creating a DCF model Excel template can be a complex task, but it can be simplified by following these steps:

- Determine the key assumptions and data: Identify the key assumptions and data required for the investment analysis, such as the initial investment, growth rate, and discount rate.

- Set up the input sheet: Create an input sheet to input the key assumptions and data.

- Create the cash flow sheet: Create a cash flow sheet to estimate the future cash flows of the project or business.

- Calculate the discount rate: Calculate the discount rate based on the cost of capital.

- Calculate the present value: Calculate the present value of the future cash flows using the discount rate.

- Create the output sheet: Create an output sheet to display the results of the investment analysis.

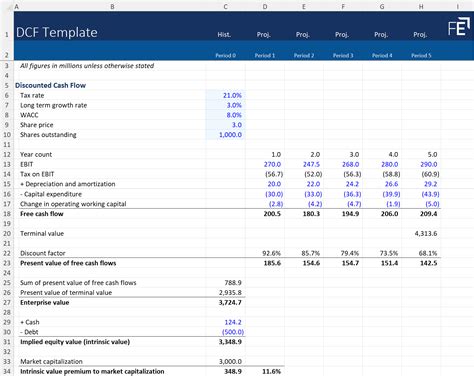

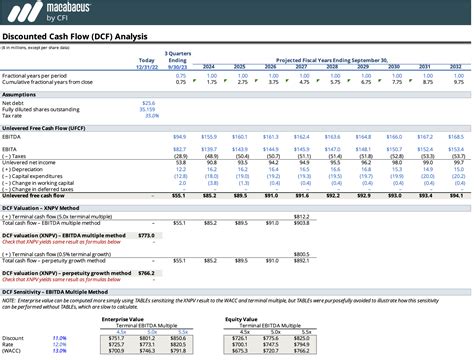

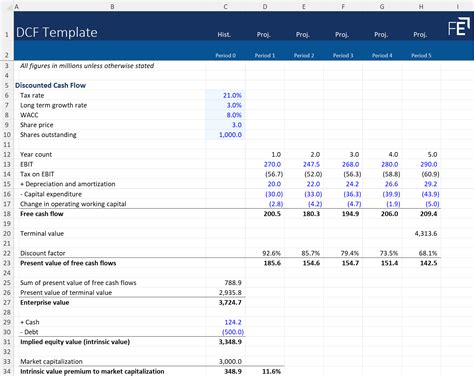

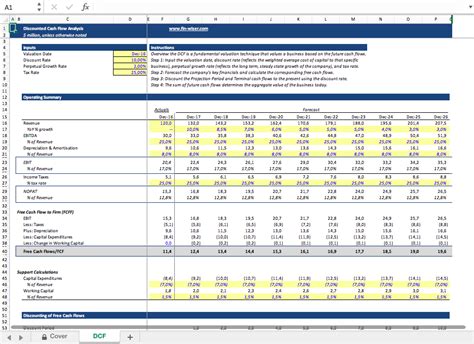

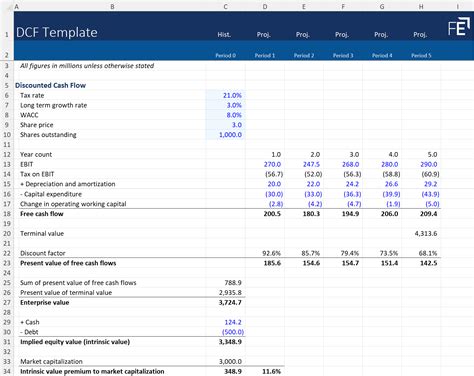

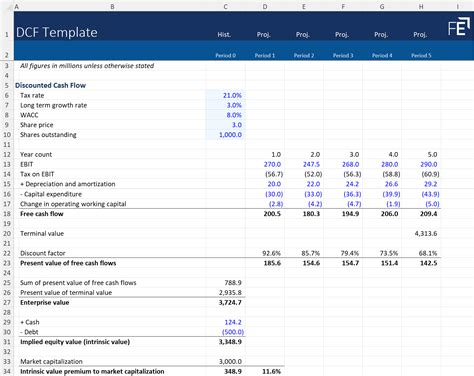

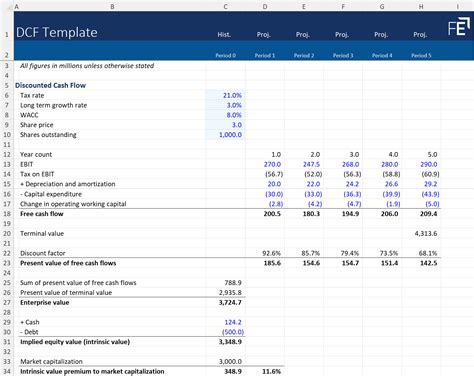

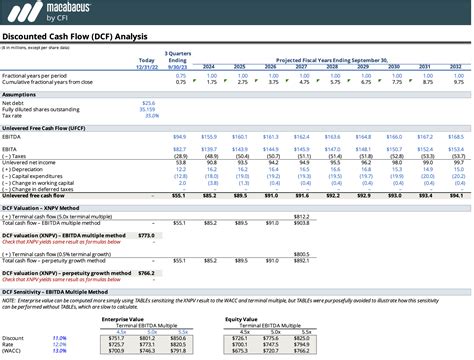

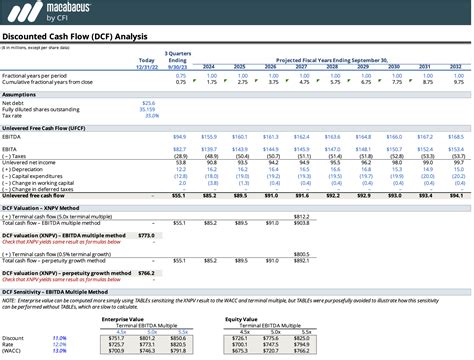

Example of a DCF Model Excel Template

Here is an example of a simple DCF model Excel template:

| Input | Value |

|---|---|

| Initial Investment | $100,000 |

| Growth Rate | 10% |

| Discount Rate | 15% |

| Cash Flow | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Revenue | $150,000 | $165,000 | $181,500 | $199,650 | $219,465 |

| Expenses | $50,000 | $55,000 | $60,500 | $66,550 | $73,085 |

| Net Cash Flow | $100,000 | $110,000 | $121,000 | $133,100 | $146,380 |

| Present Value | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Discount Rate | 15% | 15% | 15% | 15% | 15% |

| Present Value | $86,956 | $95,538 | $104,943 | $115,222 | $126,421 |

| Output | Value |

|---|---|

| ROI | 25% |

| Payback Period | 4 years |

Gallery of DCF Model Excel Templates

DCF Model Excel Template Gallery

Conclusion

In conclusion, a DCF model Excel template is a powerful tool for investment analysis. It can help investors and businesses make informed decisions about their investments by providing a clear and comprehensive picture of the potential ROI. By following the steps outlined in this article, you can create a DCF model Excel template that meets your specific needs.

We hope this article has been helpful in understanding the DCF model Excel template and its application in investment analysis. If you have any questions or comments, please feel free to share them below.