Intro

As an investor, making informed decisions about investments requires a thorough understanding of a company's financial health and future prospects. One of the most effective tools for evaluating investment opportunities is the discounted cash flow (DCF) model. In this article, we will delve into the world of DCF modeling, explaining its importance, benefits, and providing a comprehensive template for investors.

What is a Discounted Cash Flow Model?

A discounted cash flow model is a valuation technique used to estimate the present value of a company's future cash flows. The model takes into account the time value of money, which states that a dollar received today is worth more than a dollar received in the future. By discounting future cash flows to their present value, investors can determine the intrinsic value of a company and make informed decisions about investments.

Benefits of Using a DCF Model

- Accurate valuation: DCF models provide a more accurate estimate of a company's value compared to other valuation methods, such as the price-to-earnings ratio.

- Flexibility: DCF models can be tailored to specific industries, companies, or investment scenarios.

- Forward-looking: DCF models focus on future cash flows, providing investors with a glimpse into a company's potential for growth and profitability.

- Comparability: DCF models enable investors to compare the intrinsic value of different companies, facilitating more informed investment decisions.

Components of a DCF Model

A typical DCF model consists of the following components:

1. Forecast Period

The forecast period represents the time frame during which a company's future cash flows are estimated. This period typically ranges from 5 to 10 years.

2. Discount Rate

The discount rate is the rate at which future cash flows are discounted to their present value. This rate reflects the time value of money and the risk associated with the investment.

3. Cash Flow Estimates

Cash flow estimates represent the projected inflows and outflows of cash over the forecast period. These estimates should include:

- Operating cash flows

- Investing cash flows

- Financing cash flows

4. Terminal Value

The terminal value represents the present value of all cash flows beyond the forecast period. This value is typically estimated using the perpetual growth model or the exit multiple method.

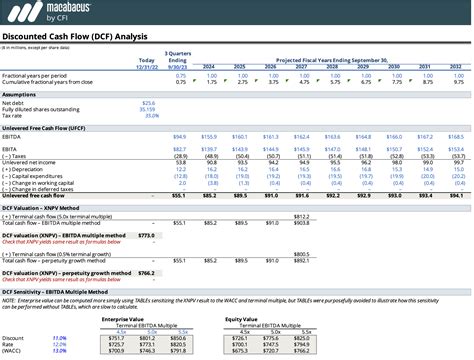

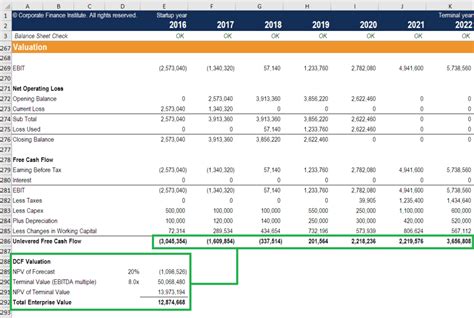

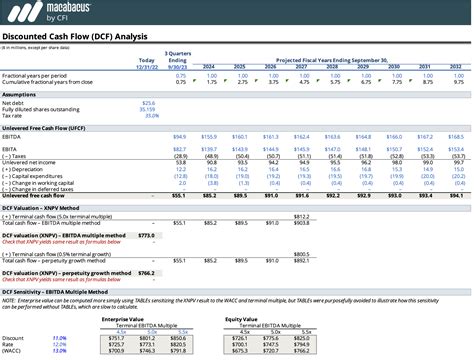

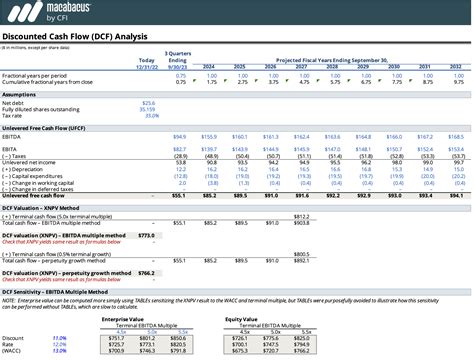

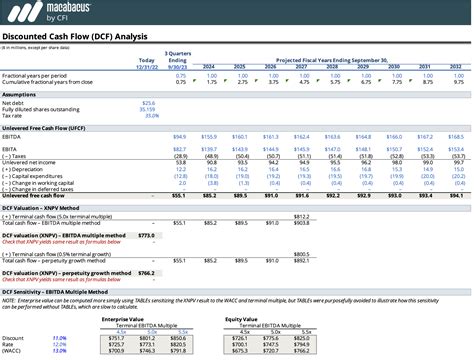

DCF Model Template for Investors

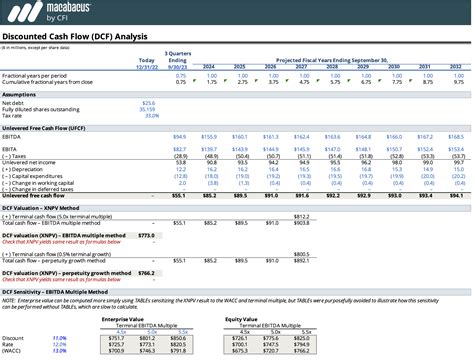

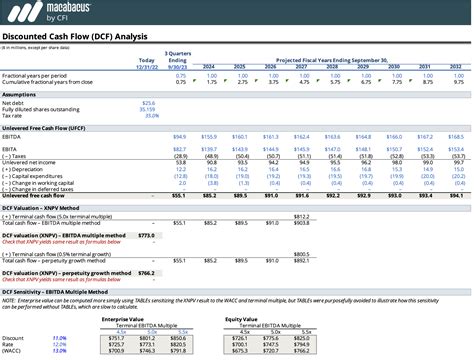

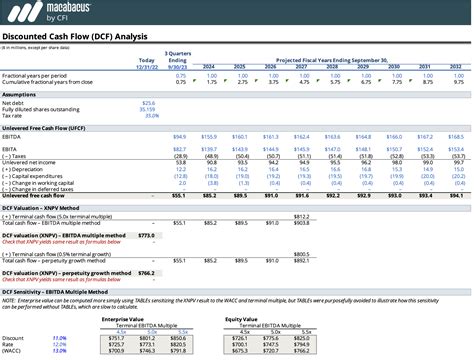

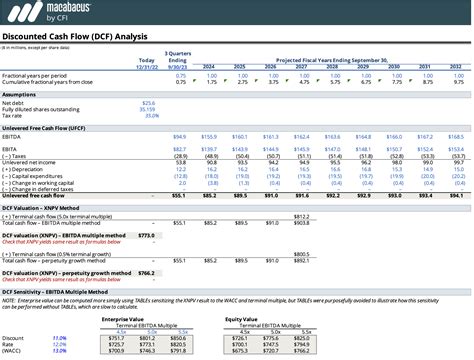

Here is a comprehensive DCF model template for investors:

Step 1: Input Assumptions

| Assumption | Value |

|---|---|

| Forecast period | 5 years |

| Discount rate | 10% |

| Growth rate | 5% |

| Terminal growth rate | 3% |

Step 2: Estimate Cash Flows

| Year | Operating Cash Flow | Investing Cash Flow | Financing Cash Flow | Total Cash Flow |

|---|---|---|---|---|

| 1 | $100 | ($50) | $20 | $70 |

| 2 | $120 | ($60) | $30 | $90 |

| 3 | $150 | ($70) | $40 | $120 |

| 4 | $180 | ($80) | $50 | $150 |

| 5 | $200 | ($90) | $60 | $170 |

Step 3: Calculate Discounted Cash Flows

| Year | Discount Factor | Discounted Cash Flow |

|---|---|---|

| 1 | 0.9091 | $63.64 |

| 2 | 0.8264 | $74.37 |

| 3 | 0.7513 | $90.02 |

| 4 | 0.6830 | $102.45 |

| 5 | 0.6209 | $106.18 |

Step 4: Calculate Terminal Value

| Terminal Value | $1,500.00 |

Step 5: Calculate Present Value

| Present Value | $1,212.11 |

This DCF model template provides a comprehensive framework for estimating the present value of a company's future cash flows. By inputting assumptions, estimating cash flows, calculating discounted cash flows, and determining terminal value, investors can arrive at a present value that represents the intrinsic value of the company.

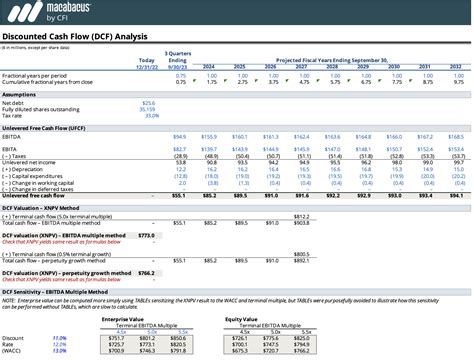

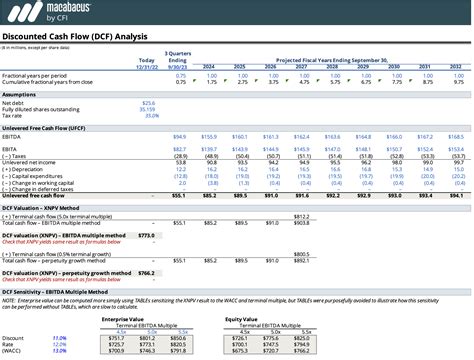

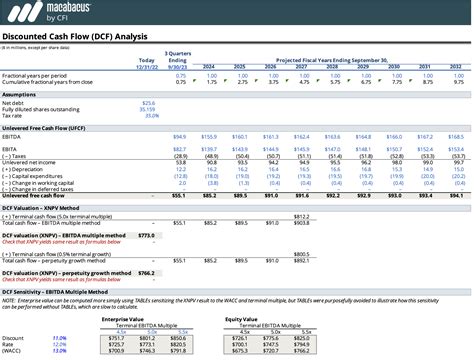

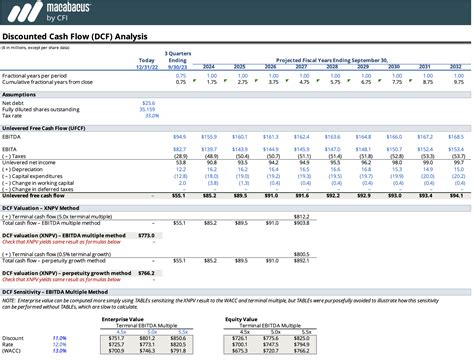

Gallery of DCF Model Templates

DCF Model Template Image Gallery

Conclusion

In conclusion, a discounted cash flow model is a powerful tool for investors to estimate the present value of a company's future cash flows. By using a DCF model template, investors can make more informed decisions about investments and gain a deeper understanding of a company's financial health and future prospects. Remember to input assumptions, estimate cash flows, calculate discounted cash flows, and determine terminal value to arrive at a present value that represents the intrinsic value of the company.

We hope this article has provided valuable insights into the world of DCF modeling. If you have any questions or would like to share your experiences with DCF modeling, please leave a comment below.