Investing in the stock market can be a lucrative way to grow your wealth over time. One of the key benefits of investing in stocks is the potential to earn dividend income. Dividends are payments made by a corporation to its shareholders, usually as a way to distribute profits. To maximize your dividend income, it's essential to keep track of your dividend-paying stocks and their corresponding dividend payments.

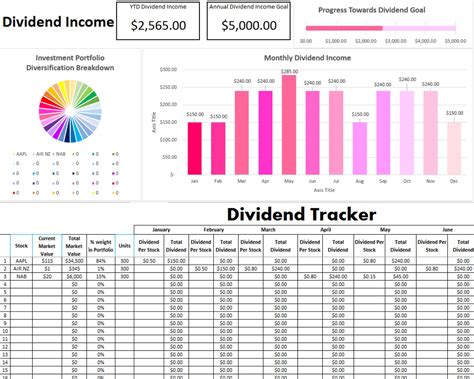

A dividend tracker spreadsheet can help you stay organized and on top of your dividend income. In this article, we'll discuss the importance of using a dividend tracker spreadsheet, its benefits, and provide a comprehensive guide on how to create one using Excel.

The Importance of Tracking Dividends

Tracking dividends is crucial for any investor looking to maximize their returns. Here are some reasons why:

- Accurate record-keeping: A dividend tracker spreadsheet helps you keep accurate records of your dividend income, including the dividend amount, payment date, and yield.

- Tax purposes: Dividend income is taxable, and having a record of your dividend payments can help you prepare your tax returns accurately.

- Investment decisions: Tracking dividends can help you make informed investment decisions, such as identifying high-yielding stocks or determining whether to reinvest dividends.

Benefits of Using a Dividend Tracker Spreadsheet

Using a dividend tracker spreadsheet offers several benefits, including:

- Streamlined record-keeping: A spreadsheet automates the process of tracking dividends, making it easier to keep accurate records.

- Customizable: You can customize the spreadsheet to fit your specific needs, including adding or removing columns, tracking different types of investments, and more.

- Improved investment decisions: By having a clear picture of your dividend income, you can make more informed investment decisions.

Creating a Dividend Tracker Spreadsheet in Excel

Creating a dividend tracker spreadsheet in Excel is a straightforward process. Here's a step-by-step guide to get you started:

Step 1: Set up the spreadsheet

Open a new Excel spreadsheet and set up the following columns:

- Ticker Symbol: The stock's ticker symbol

- Company Name: The company's name

- Dividend Amount: The dividend amount per share

- Dividend Yield: The dividend yield (annual dividend per share ÷ stock price)

- Payment Date: The dividend payment date

- Record Date: The record date (the date by which shareholders must own the stock to receive the dividend)

- Total Dividend Income: The total dividend income for the year

Step 2: Add formulas and formatting

Add the following formulas and formatting to your spreadsheet:

- Dividend Yield: Use the formula

=DIVIDEND AMOUNT/STOCK PRICEto calculate the dividend yield. - Total Dividend Income: Use the formula

=SUM(DIVIDEND AMOUNT)to calculate the total dividend income for the year. - Formatting: Use Excel's built-in formatting options to make your spreadsheet more readable, such as using headers, borders, and number formatting.

Step 3: Add data

Start adding data to your spreadsheet, including the ticker symbol, company name, dividend amount, dividend yield, payment date, and record date.

Tips and Variations

Here are some tips and variations to enhance your dividend tracker spreadsheet:

- Use Excel's built-in templates: Excel offers pre-built templates for tracking investments, including a dividend tracker template.

- Add additional columns: Consider adding columns for tracking other investment metrics, such as stock price, market value, or return on investment.

- Use conditional formatting: Use conditional formatting to highlight cells that meet certain conditions, such as dividend yields above a certain threshold.

- Automate updates: Consider automating updates to your spreadsheet using Excel's built-in functions or third-party add-ins.

Common Mistakes to Avoid

When creating a dividend tracker spreadsheet, avoid the following common mistakes:

- Inaccurate data entry: Ensure that you enter accurate data, including dividend amounts, payment dates, and record dates.

- Incorrect formulas: Double-check your formulas to ensure that they are accurate and functional.

- Insufficient customization: Customize your spreadsheet to fit your specific needs, including adding or removing columns.

Best Practices

Here are some best practices to keep in mind when using a dividend tracker spreadsheet:

- Regularly update your spreadsheet: Regularly update your spreadsheet to reflect changes in dividend payments, stock prices, and other investment metrics.

- Use multiple spreadsheets: Consider using multiple spreadsheets to track different types of investments, such as stocks, bonds, or real estate.

- Backup your data: Regularly backup your data to prevent loss in case of a technical issue or error.

Conclusion

A dividend tracker spreadsheet is a powerful tool for investors looking to maximize their dividend income. By following the steps outlined in this article, you can create a comprehensive and customizable spreadsheet to track your dividend payments. Remember to regularly update your spreadsheet, use multiple spreadsheets, and backup your data to ensure accurate and efficient tracking of your dividend income.

Dividend Tracker Spreadsheet Image Gallery

We hope this article has provided you with a comprehensive guide on creating a dividend tracker spreadsheet using Excel. Remember to regularly update your spreadsheet, use multiple spreadsheets, and backup your data to ensure accurate and efficient tracking of your dividend income.