Intro

Discover how cash gifts impact food stamps in 5 significant ways. Learn how lump sum payments, income calculations, and resource limits affect food assistance eligibility. Understand the rules surrounding cash gifts and their implications for food stamp recipients, including changes to benefit amounts and potential disqualification.

Receiving cash gifts can have a significant impact on food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP). The effects of cash gifts on food stamps can be complex and far-reaching, affecting not only the recipient's eligibility for the program but also their overall financial well-being. In this article, we will explore the five ways cash gifts can impact food stamps.

Understanding Food Stamps and Cash Gifts

Before we dive into the impact of cash gifts on food stamps, it's essential to understand how the program works. Food stamps, or SNAP, is a government program designed to help low-income individuals and families purchase food. Eligibility for the program is based on income, expenses, and household size. Cash gifts, on the other hand, are gifts of money given to an individual or household. These gifts can be given by friends, family, or others.

1. Income and Eligibility

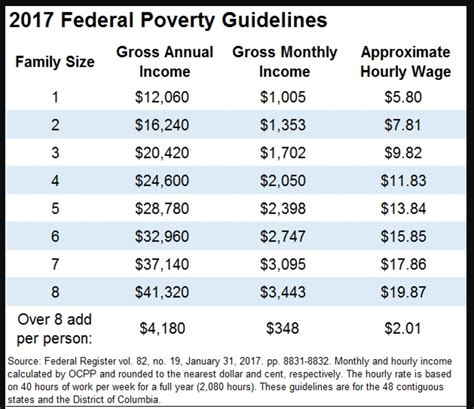

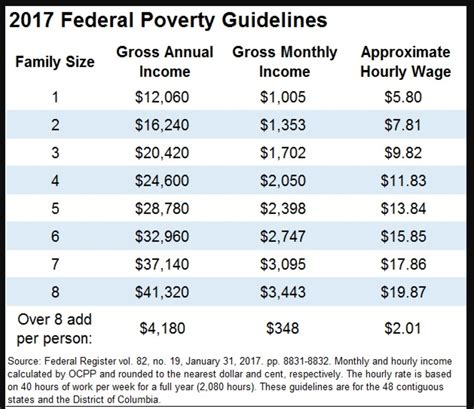

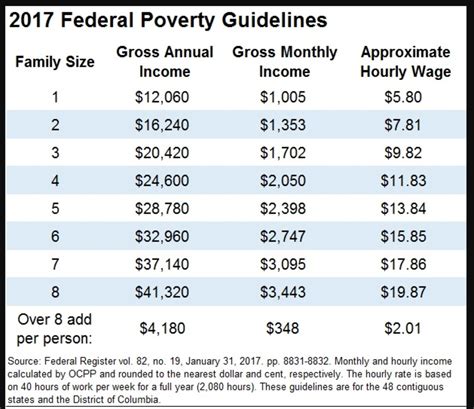

Receiving cash gifts can affect an individual's or household's eligibility for food stamps. SNAP considers cash gifts as income, which can impact the household's overall income level. If the cash gift increases the household's income above the eligibility threshold, they may no longer qualify for food stamps.

For example, let's say a household receives a cash gift of $1,000. If their monthly income is $1,500, and the eligibility threshold is $2,000, the cash gift would increase their income to $2,500, making them ineligible for food stamps.

How to Report Cash Gifts

If you receive a cash gift, it's essential to report it to your local SNAP office. Failing to report the gift can result in termination of benefits or even prosecution for fraud. You can report the gift by:

- Calling your local SNAP office

- Visiting your local SNAP office in person

- Reporting it on your SNAP application or renewal form

2. Resource Limits

SNAP has resource limits, which include cash, savings, and other assets. Receiving a cash gift can increase a household's resources, potentially exceeding the limit. If the resource limit is exceeded, the household may no longer qualify for food stamps.

For example, let's say a household has $1,000 in savings and receives a cash gift of $2,000. If the resource limit is $2,500, the household would exceed the limit and no longer qualify for food stamps.

Exempt Resources

Some resources are exempt from the limit, including:

- Primary residence

- Vehicle (up to a certain value)

- Retirement accounts

It's essential to understand which resources are exempt and which are not to avoid exceeding the limit.

3. Tax Implications

Cash gifts are generally tax-free to the recipient, but there may be tax implications for the giver. If the gift exceeds a certain amount, the giver may be required to pay gift tax.

For example, in 2022, the gift tax exemption is $16,000. If the giver gives a cash gift of $20,000, they would be required to pay gift tax on the excess amount.

Tax Implications for SNAP Recipients

As a SNAP recipient, you may be required to report the cash gift on your tax return. You may also be eligible for a tax credit or deduction for the gift.

4. Impact on Other Benefits

Receiving a cash gift can impact other benefits, including Medicaid, Temporary Assistance for Needy Families (TANF), and housing assistance. If the cash gift increases the household's income or resources, they may no longer qualify for these benefits.

For example, let's say a household receives a cash gift of $5,000 and is currently receiving Medicaid. If the cash gift increases their income above the Medicaid eligibility threshold, they may no longer qualify for Medicaid.

Coordinating Benefits

It's essential to coordinate benefits with your local SNAP office and other benefit providers to ensure you're receiving the correct benefits and avoiding any potential conflicts.

5. Financial Planning

Receiving a cash gift can provide an opportunity for financial planning. You can use the gift to:

- Pay off debt

- Build an emergency fund

- Invest in education or job training

- Purchase essential items, such as food or clothing

Financial Planning Tips

When receiving a cash gift, consider the following financial planning tips:

- Create a budget to manage the gift

- Prioritize needs over wants

- Avoid impulse purchases

- Consider seeking advice from a financial advisor

Gallery of Cash Gifts and Food Stamps

Cash Gifts and Food Stamps Image Gallery

Conclusion: Navigating Cash Gifts and Food Stamps

Receiving a cash gift can have a significant impact on food stamps, affecting eligibility, resource limits, tax implications, and other benefits. It's essential to understand the rules and regulations surrounding cash gifts and food stamps to ensure you're receiving the correct benefits and avoiding any potential conflicts. By reporting cash gifts, understanding exempt resources, and coordinating benefits, you can navigate the complex world of cash gifts and food stamps.