Intro

Discover how inheritance impacts food stamps eligibility. Learn the 5 ways inherited assets, income, and resources affect Supplemental Nutrition Assistance Program (SNAP) benefits. Understand the rules on inheritance and food stamps, including exemptions, penalties, and reporting requirements. Ensure youre eligible for SNAP benefits after receiving an inheritance.

Inheritance can have a significant impact on an individual's or family's financial situation, and it may also affect their eligibility for government assistance programs, such as food stamps. The Supplemental Nutrition Assistance Program (SNAP), also known as food stamps, is a program designed to help low-income individuals and families purchase food. However, the rules surrounding inheritance and food stamps eligibility can be complex, and it's essential to understand how inheritance may impact your benefits.

Understanding Inheritance and Food Stamps Eligibility

When you inherit assets, such as cash, property, or investments, it can affect your financial situation and, consequently, your eligibility for food stamps. The SNAP program considers various factors, including income, resources, and expenses, to determine eligibility. Inheritance can impact these factors in different ways, depending on the type and value of the inherited assets.

How Inheritance Affects Food Stamps Eligibility

Here are five ways inheritance can affect food stamps eligibility:

1. Cash Inheritance and Food Stamps Eligibility

Receiving a cash inheritance can significantly impact your food stamps eligibility. If you inherit a substantial amount of cash, it may affect your income and resource levels, potentially disqualifying you from receiving benefits. However, the impact of cash inheritance on food stamps eligibility depends on the state you live in and the specific SNAP rules in your area.

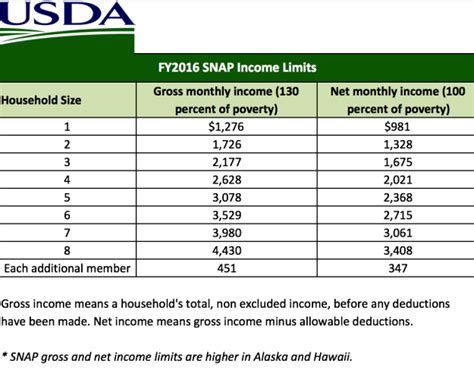

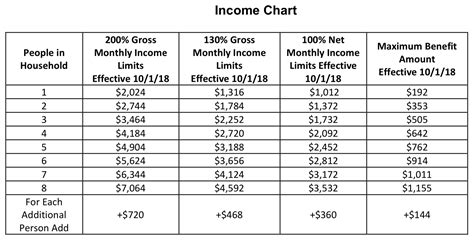

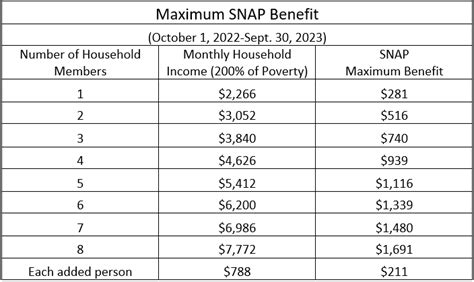

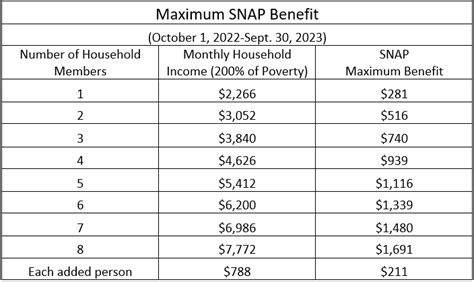

Resource Limits and Cash Inheritance

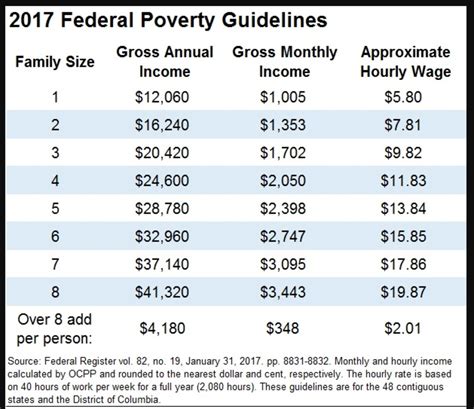

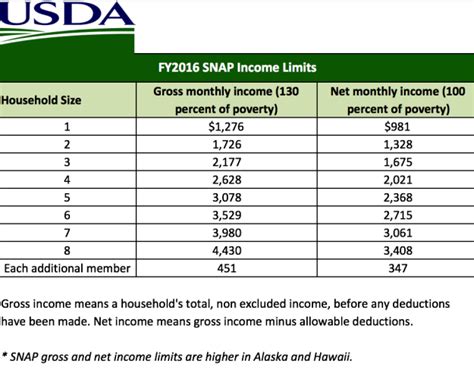

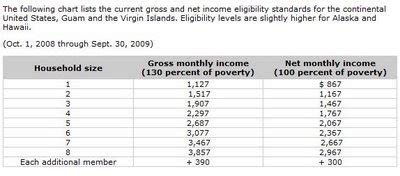

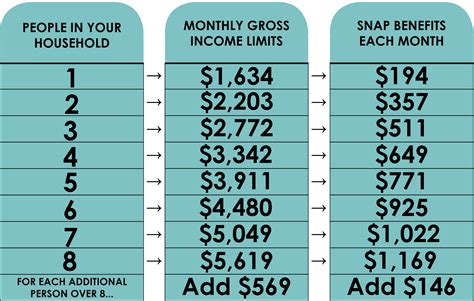

In most states, there are resource limits for SNAP eligibility, which include cash, savings, and other liquid assets. If you inherit cash and your total resources exceed the state's resource limit, you may no longer be eligible for food stamps. However, some states have more generous resource limits or exempt certain types of assets, such as retirement accounts.

2. Inherited Property and Food Stamps Eligibility

Inheriting property, such as a house or land, can also impact your food stamps eligibility. If you inherit property that generates income, such as rental income, it may affect your income level and, consequently, your eligibility for benefits. However, the value of the property itself is not typically considered a resource for SNAP purposes.

Income from Inherited Property

If you inherit property that generates income, you must report this income when applying for or reapplying for food stamps. The income from the property may be considered when determining your eligibility for benefits. However, the type and amount of income from the property can impact your eligibility, and you may need to provide documentation to verify the income.

3. Inherited Investments and Food Stamps Eligibility

Inheriting investments, such as stocks or bonds, can also affect your food stamps eligibility. The value of the investments themselves may be considered a resource for SNAP purposes, and the income generated from the investments may impact your income level.

Resource Limits and Inherited Investments

Similar to cash inheritance, the value of inherited investments can impact your resource levels and, consequently, your eligibility for food stamps. If the value of the investments exceeds the state's resource limit, you may no longer be eligible for benefits. However, some states have more generous resource limits or exempt certain types of investments.

4. Inherited Retirement Accounts and Food Stamps Eligibility

Inheriting retirement accounts, such as a 401(k) or IRA, can also impact your food stamps eligibility. The value of the retirement accounts themselves may be considered a resource for SNAP purposes, and the income generated from the accounts may impact your income level.

Exemptions for Inherited Retirement Accounts

However, some states exempt inherited retirement accounts from resource limits, and the income generated from the accounts may not be considered when determining eligibility. It's essential to check with your state's SNAP agency to determine how inherited retirement accounts are treated.

5. Reporting Inheritance and Food Stamps Eligibility

When you inherit assets, it's essential to report the inheritance to your state's SNAP agency. Failing to report the inheritance can result in an overpayment of benefits, which may need to be repaid.

Consequences of Not Reporting Inheritance

If you fail to report the inheritance and it's discovered that you were not eligible for benefits due to the inheritance, you may be required to repay the benefits you received. Additionally, you may be subject to penalties or even prosecution for fraud.

Food Stamps Eligibility Image Gallery

We hope this article has provided you with a comprehensive understanding of how inheritance can affect food stamps eligibility. If you have any further questions or concerns, please don't hesitate to reach out to your state's SNAP agency. Remember to report any inheritance to ensure you're in compliance with the program's rules and regulations.