Intro

Tax season can be a stressful time for many individuals and families, especially those who rely on government assistance programs such as food stamps. One of the most common concerns is how tax refunds might impact their eligibility for these programs. In this article, we will explore three ways tax refunds can affect food stamps and provide guidance on how to navigate this situation.

Receiving a tax refund can be a welcome surprise, but it's essential to understand how it might influence your food stamp benefits. The Supplemental Nutrition Assistance Program (SNAP), also known as food stamps, is a government program designed to help low-income individuals and families purchase food. However, the program has strict eligibility requirements, and changes in income or assets can affect benefits.

The uncertainty surrounding tax refunds and food stamps can be overwhelming, especially for those who rely heavily on these programs. In the following sections, we will delve into the specifics of how tax refunds can impact food stamp benefits, providing clarity and reassurance for those who need it most.

Understanding How Tax Refunds Affect Food Stamps

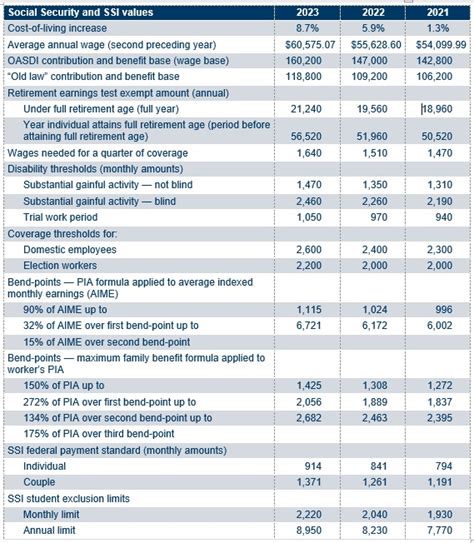

Before we dive into the specifics, it's essential to understand how tax refunds are treated in the context of food stamp benefits. When you receive a tax refund, it's considered income, which can impact your eligibility for food stamps. However, there are some nuances to consider.

The first thing to note is that tax refunds are not always considered income for SNAP purposes. If you receive a tax refund as a result of the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), it's not considered income. These credits are designed to help low-income working individuals and families, and they are not subject to the SNAP income limits.

However, if you receive a tax refund due to other reasons, such as overpayment of taxes or a refund from a state tax return, it may be considered income. This can impact your food stamp benefits, especially if you're already receiving the maximum benefit amount.

1. Impact on Income Limits

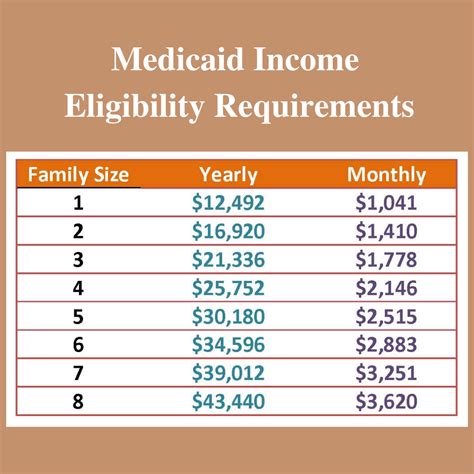

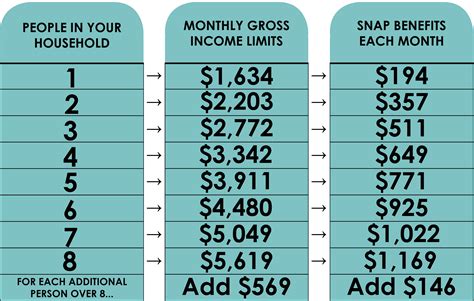

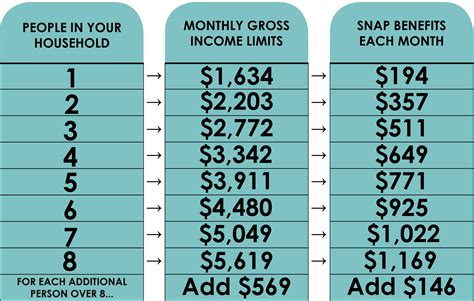

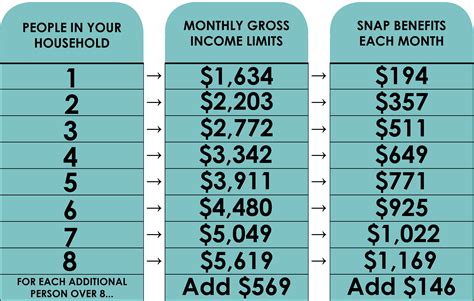

One of the primary ways tax refunds can affect food stamps is by impacting income limits. SNAP has strict income limits, which vary depending on the state and the number of people in the household. If you receive a tax refund, it may increase your income, potentially affecting your eligibility for food stamps.

For example, let's say you're a single person with a monthly income of $1,200. You receive a tax refund of $2,000, which increases your income to $3,200 for the month. If the income limit for a single person in your state is $2,500, your tax refund would put you above the limit, potentially affecting your eligibility for food stamps.

However, it's essential to note that tax refunds are only considered income for the month they're received. If you receive a tax refund in April, it will only impact your income for that month. If you're eligible for food stamps in May, your income will return to its usual level, and your benefits will not be affected.

2. Impact on Assets

Another way tax refunds can affect food stamps is by impacting assets. SNAP has asset limits, which vary depending on the state and the type of assets. If you receive a tax refund, it may increase your assets, potentially affecting your eligibility for food stamps.

For example, let's say you have $1,000 in a savings account and receive a tax refund of $2,000. Your total assets would increase to $3,000, potentially affecting your eligibility for food stamps. However, if you use the tax refund to pay off debt or cover essential expenses, it may not impact your assets.

It's essential to note that some assets, such as retirement accounts and primary residences, are exempt from the asset limit. If you're unsure how your tax refund will impact your assets, it's best to consult with a SNAP representative or a financial advisor.

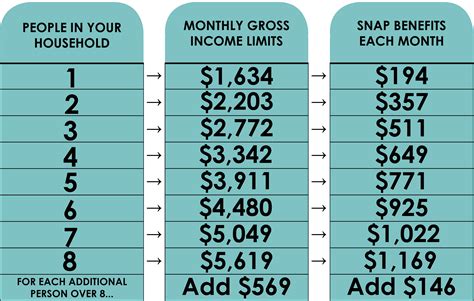

3. Impact on Benefit Amounts

Finally, tax refunds can impact the amount of food stamp benefits you receive. If you receive a tax refund, it may increase your income, potentially reducing your benefit amount. However, this impact is usually temporary, as tax refunds are only considered income for the month they're received.

For example, let's say you receive a tax refund of $2,000 in April, which increases your income to $3,200 for the month. If you're eligible for the maximum food stamp benefit amount of $192, your tax refund may reduce your benefit amount to $150 for the month. However, in May, your income will return to its usual level, and your benefit amount will increase to the maximum amount.

It's essential to note that the impact of tax refunds on benefit amounts can vary depending on the state and the individual's circumstances. If you're unsure how your tax refund will impact your benefit amount, it's best to consult with a SNAP representative.

Conclusion

Receiving a tax refund can be a welcome surprise, but it's essential to understand how it might impact your food stamp benefits. Tax refunds can affect income limits, assets, and benefit amounts, potentially impacting your eligibility for food stamps. However, the impact is usually temporary, and it's essential to consult with a SNAP representative or a financial advisor to understand how your tax refund will affect your benefits.

If you're receiving food stamps and expect to receive a tax refund, it's essential to report the income to your SNAP representative. They can help you understand how the tax refund will impact your benefits and provide guidance on how to navigate the situation.

Remember, tax refunds are only considered income for the month they're received, and they may not impact your eligibility for food stamps in the long term. If you're unsure about how your tax refund will affect your food stamp benefits, don't hesitate to reach out to a SNAP representative for guidance.

Food Stamps and Tax Refunds Image Gallery

If you have any questions or concerns about how tax refunds affect food stamps, feel free to ask in the comments below. Share this article with others who may be impacted by tax refunds and food stamps, and don't hesitate to reach out to a SNAP representative for guidance.