Reporting CalWORKs on Your Taxes: What You Need to Know

As a recipient of CalWORKs benefits, you may be wondering how these benefits will affect your taxes. Understanding how to report CalWORKs on your taxes is crucial to ensure you're in compliance with the law and to avoid any potential penalties. In this article, we'll delve into the world of tax reporting and provide you with the necessary information to navigate this complex process.

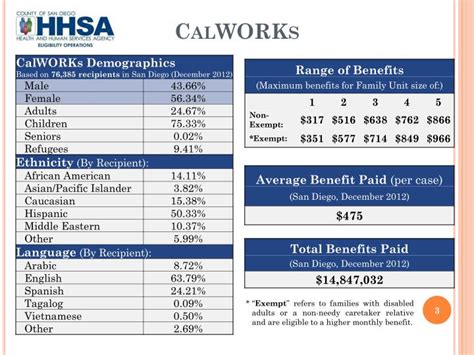

CalWORKs, or California Work Opportunity and Responsibility to Kids, is a welfare program designed to provide financial assistance to low-income families with children. While the program offers vital support, it's essential to understand how these benefits are treated for tax purposes.

How CalWORKs Benefits Are Taxed

CalWORKs benefits are considered non-taxable income, meaning you don't need to report them as income on your tax return. According to the California Department of Social Services, CalWORKs benefits are exempt from federal and state income taxes.

However, it's essential to note that while CalWORKs benefits themselves are non-taxable, other types of income you may receive while participating in the program may be subject to taxation. For example, if you receive earned income from a job while receiving CalWORKs benefits, that income will be subject to taxation.

Reporting CalWORKs on Your Tax Return

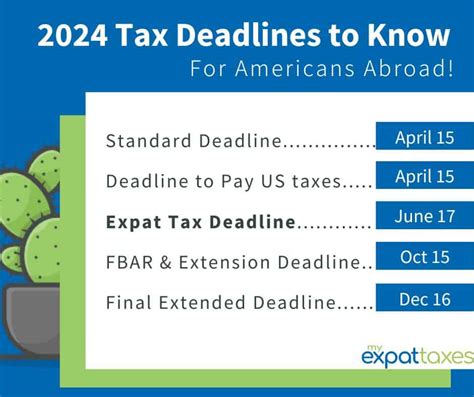

Although CalWORKs benefits are non-taxable, you may still need to report them on your tax return. The California Franchise Tax Board requires you to report CalWORKs benefits on your state tax return, but only if you're claiming a credit or deduction related to the benefits.

For example, if you're claiming the Earned Income Tax Credit (EITC), you'll need to report your CalWORKs benefits on your tax return. This is because the EITC is a refundable credit that's based on your earned income, and CalWORKs benefits may affect the amount of the credit you're eligible for.

How to Report CalWORKs on Your Tax Return

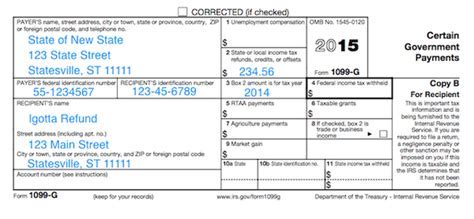

If you need to report CalWORKs benefits on your tax return, you'll need to complete Form 540, California Resident Income Tax Return. You'll report your CalWORKs benefits on Schedule CA (540), California Adjustments, under the section for "Other Income."

You'll need to provide the following information:

- The amount of CalWORKs benefits you received

- The date you received the benefits

- The type of benefits you received (e.g., cash assistance, food assistance)

Tips for Reporting CalWORKs on Your Tax Return

To ensure you're reporting CalWORKs benefits correctly on your tax return, follow these tips:

- Keep accurate records of your CalWORKs benefits, including the date and amount of each payment.

- Consult with a tax professional or contact the California Franchise Tax Board if you're unsure about how to report your CalWORKs benefits.

- Make sure to report all other types of income you received during the tax year, including earned income from a job.

Common Mistakes to Avoid

When reporting CalWORKs benefits on your tax return, it's essential to avoid common mistakes that can trigger an audit or delay your refund. Here are some mistakes to watch out for:

- Failing to report CalWORKs benefits altogether

- Reporting CalWORKs benefits as taxable income

- Failing to claim the EITC or other credits related to CalWORKs benefits

Conclusion

Reporting CalWORKs on your taxes requires attention to detail and an understanding of the tax laws surrounding these benefits. By following the tips and guidelines outlined in this article, you can ensure you're in compliance with the law and avoid any potential penalties. Remember to keep accurate records of your CalWORKs benefits and consult with a tax professional if you're unsure about how to report them on your tax return.

Gallery of CalWORKs and Taxes

CalWORKs and Taxes Image Gallery

We hope this article has provided you with a comprehensive understanding of how to report CalWORKs on your taxes. If you have any further questions or concerns, please don't hesitate to comment below.