Intro

Discover how to claim cash assistance on taxes with our expert guide. Learn three ways to maximize your refund, including the Earned Income Tax Credit (EITC), Child Tax Credit, and Additional Child Tax Credit. Get insider tips on tax credits, deductions, and benefits to boost your tax savings.

As the tax season approaches, many individuals and families are looking for ways to maximize their refunds and claim the cash assistance they are eligible for. Claiming cash assistance on taxes can be a great way to receive some extra money, but it can be overwhelming to navigate the process. In this article, we will explore three ways to claim cash assistance on taxes, making it easier for you to get the refund you deserve.

What is Cash Assistance on Taxes?

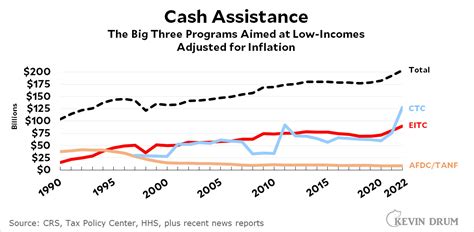

Before we dive into the three ways to claim cash assistance on taxes, let's first understand what it is. Cash assistance on taxes refers to the various programs and credits available to individuals and families that can help reduce their tax liability or provide a refund. These programs and credits are designed to support low-income individuals and families, as well as those who have incurred specific expenses, such as childcare or education costs.

1. Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) is a popular cash assistance program available to low-income individuals and families. The EITC is a refundable credit, meaning that even if you don't owe taxes, you can still receive a refund. To qualify for the EITC, you must meet certain income and eligibility requirements, which vary based on your filing status, number of children, and other factors.

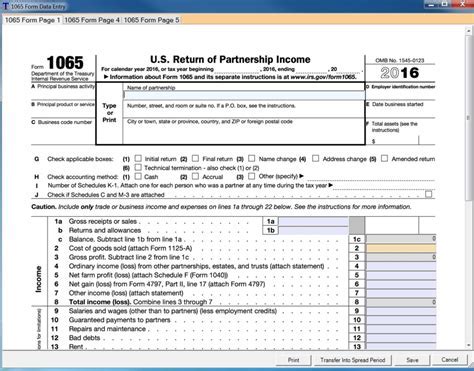

To claim the EITC, you will need to file Form 1040 and complete Schedule EIC. You can also use tax preparation software, such as TurboTax or H&R Block, to guide you through the process. The IRS also offers free tax preparation services, including the Volunteer Income Tax Assistance (VITA) program, for eligible individuals.

How to Claim the EITC:

- Meet the income and eligibility requirements

- File Form 1040 and complete Schedule EIC

- Use tax preparation software or seek free tax preparation services

2. Child Tax Credit

The Child Tax Credit is another cash assistance program available to families with qualifying children. The credit can provide up to $2,000 per child, depending on your income and other factors. To qualify for the Child Tax Credit, your child must meet certain age and relationship requirements, and you must meet the income and eligibility requirements.

To claim the Child Tax Credit, you will need to file Form 1040 and complete Schedule 8812. You can also use tax preparation software to guide you through the process. It's essential to note that the Child Tax Credit is a non-refundable credit, meaning that it can only reduce your tax liability to zero.

How to Claim the Child Tax Credit:

- Meet the income and eligibility requirements

- File Form 1040 and complete Schedule 8812

- Use tax preparation software or seek free tax preparation services

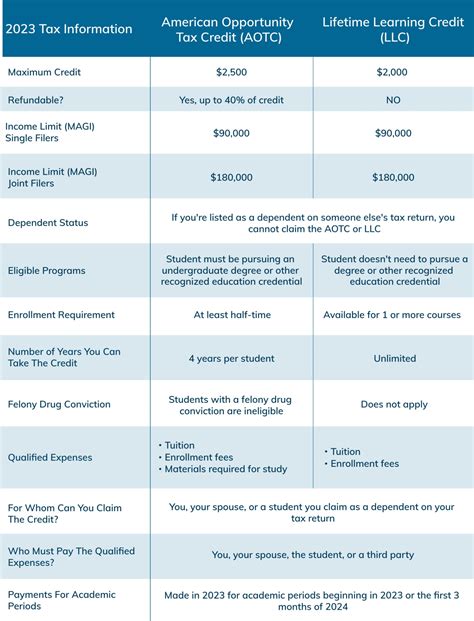

3. Education Credits

Education credits, such as the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), can provide cash assistance to individuals and families who have incurred education expenses. The AOTC provides up to $2,500 per eligible student, while the LLC provides up to $2,000 per tax return.

To claim education credits, you will need to file Form 1040 and complete Form 8863. You can also use tax preparation software to guide you through the process. It's essential to note that education credits are non-refundable, meaning that they can only reduce your tax liability to zero.

How to Claim Education Credits:

- Meet the income and eligibility requirements

- File Form 1040 and complete Form 8863

- Use tax preparation software or seek free tax preparation services

Gallery of Cash Assistance on Taxes

Cash Assistance on Taxes Image Gallery

FAQs

- What is cash assistance on taxes?

- How do I claim cash assistance on taxes?

- What are the eligibility requirements for cash assistance on taxes?

- Can I claim cash assistance on taxes if I don't owe taxes?

- How do I know if I'm eligible for cash assistance on taxes?

Take Action Today!

Don't miss out on the cash assistance you're eligible for. Take action today and file your taxes to claim the credits and refunds you deserve. Use tax preparation software or seek free tax preparation services to guide you through the process. Remember to meet the income and eligibility requirements and file the necessary forms to claim your cash assistance on taxes.

We hope this article has provided you with valuable information on how to claim cash assistance on taxes. Share this article with your friends and family who may be eligible for these programs. Let's work together to make sure everyone receives the cash assistance they deserve!