Receiving food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), can have implications for your taxes. Many individuals who receive food stamps are unsure if they need to claim this benefit on their tax return. In this article, we will explore the relationship between food stamps and taxes, and provide guidance on whether you need to claim food stamps on your taxes.

What are Food Stamps?

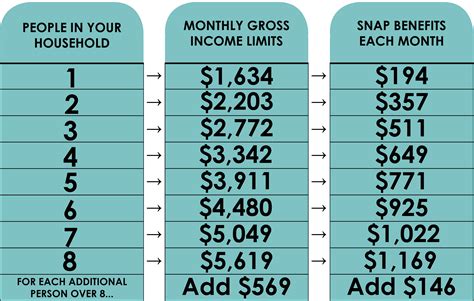

Food stamps, also known as SNAP, are a government-funded program designed to provide financial assistance to low-income individuals and families to purchase food. The program is administered by the United States Department of Agriculture (USDA) and is available to eligible individuals in all 50 states.

Are Food Stamps Taxable?

The good news is that food stamps are not considered taxable income by the Internal Revenue Service (IRS). According to the IRS, SNAP benefits are not subject to federal income tax and do not need to be reported on your tax return.

Why are Food Stamps Not Taxable?

The reason food stamps are not taxable is that they are considered a form of government assistance, rather than income. The purpose of food stamps is to provide financial assistance to individuals and families who are struggling to purchase food, rather than to provide income.

Do I Need to Report Food Stamps on My Tax Return?

As mentioned earlier, food stamps are not taxable and do not need to be reported on your tax return. However, if you receive other forms of government assistance, such as Social Security benefits or unemployment compensation, you may need to report these benefits on your tax return.

Other Forms of Government Assistance

While food stamps are not taxable, other forms of government assistance may be subject to taxation. For example:

- Social Security benefits: Up to 85% of Social Security benefits may be taxable, depending on your income level.

- Unemployment compensation: Unemployment benefits are generally taxable and must be reported on your tax return.

- Welfare benefits: Some welfare benefits, such as Temporary Assistance for Needy Families (TANF), may be taxable.

How to Report Government Assistance on Your Tax Return

If you receive government assistance that is subject to taxation, you will need to report this income on your tax return. You will typically receive a Form 1099-G or Form SSA-1099, which will show the amount of benefits you received during the tax year.

Form 1099-G

Form 1099-G is used to report government payments, such as unemployment compensation and state and local income tax refunds. If you receive a Form 1099-G, you will need to report the income on your tax return using Form 1040.

Form SSA-1099

Form SSA-1099 is used to report Social Security benefits. If you receive a Form SSA-1099, you will need to report the benefits on your tax return using Form 1040.

Conclusion

Receiving food stamps can be a lifesaver for individuals and families who are struggling to make ends meet. Fortunately, food stamps are not taxable and do not need to be reported on your tax return. However, if you receive other forms of government assistance, such as Social Security benefits or unemployment compensation, you may need to report this income on your tax return. It's always a good idea to consult with a tax professional or seek guidance from the IRS to ensure you are reporting your government assistance correctly.

Food Stamps Image Gallery

FAQs

Q: Are food stamps taxable? A: No, food stamps are not taxable and do not need to be reported on your tax return.

Q: Do I need to report food stamps on my tax return? A: No, you do not need to report food stamps on your tax return.

Q: What forms of government assistance are taxable? A: Social Security benefits, unemployment compensation, and some welfare benefits may be taxable.

Q: How do I report government assistance on my tax return? A: You will typically receive a Form 1099-G or Form SSA-1099, which will show the amount of benefits you received during the tax year. You will need to report this income on your tax return using Form 1040.