Intro

As a gig economy worker, reporting your income from food delivery services like DoorDash to the Supplemental Nutrition Assistance Program (SNAP), also known as food stamps, can be a bit tricky. In this article, we'll break down what you need to know about reporting your DoorDash income to SNAP and how it may affect your benefits.

How DoorDash Income Affects Food Stamps

When you're receiving food stamps, it's essential to report all sources of income, including earnings from gig economy jobs like DoorDash. The amount of money you earn from DoorDash can impact the amount of benefits you receive from SNAP.

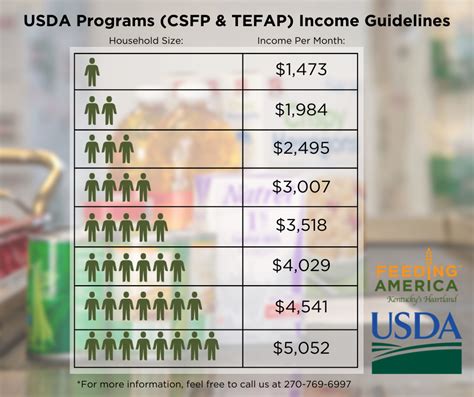

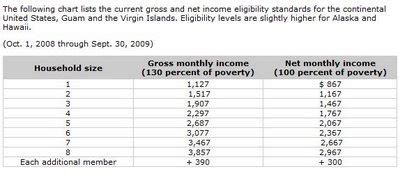

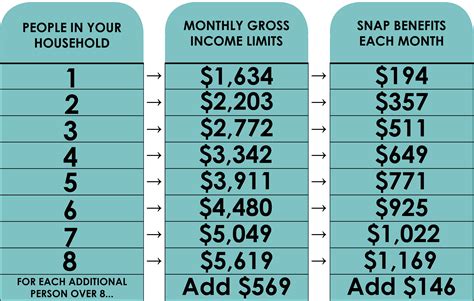

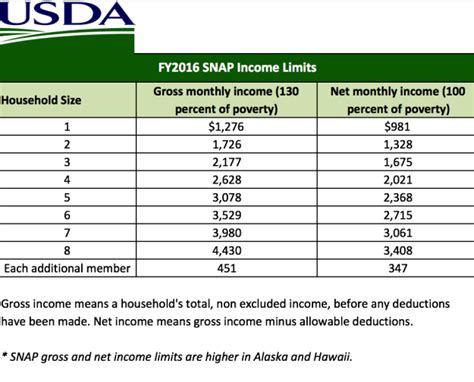

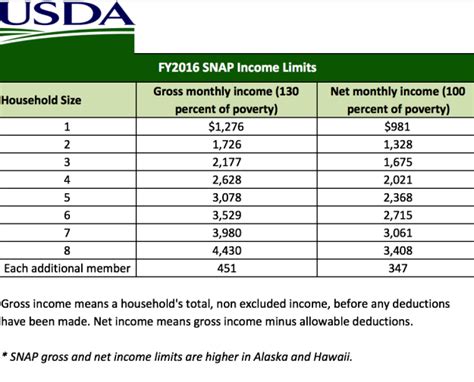

In the United States, the SNAP program is administered by the Department of Agriculture's Food and Nutrition Service. The program aims to help low-income individuals and families purchase food by providing them with a monthly stipend. However, to qualify for SNAP, applicants must meet specific income and resource requirements.

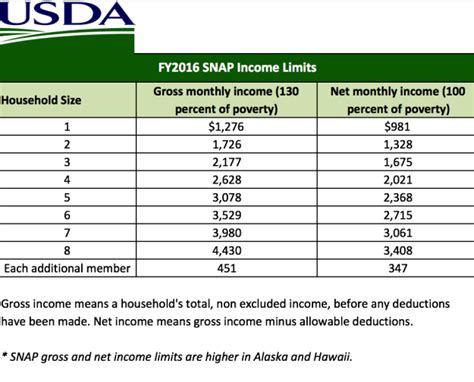

If you're working as a Dasher and receiving food stamps, you'll need to report your earnings to the SNAP office. This includes:

- Gross income (before taxes and expenses)

- Net income (after taxes and expenses)

How to Report DoorDash Income to Food Stamps

To report your DoorDash income to SNAP, follow these steps:

- Gather necessary documents: Collect your DoorDash earnings statements, which can be found in the DoorDash app or on the company's website.

- Contact your local SNAP office: Reach out to your local SNAP office to inquire about the specific requirements for reporting income. You can find the contact information for your local SNAP office by visiting the USDA's website.

- Complete the necessary forms: Your SNAP office will provide you with the necessary forms to report your income. You'll need to fill out these forms accurately and completely.

- Submit the forms: Return the completed forms to your SNAP office, either in person, by mail, or via fax (if available).

DoorDash Income and SNAP Eligibility

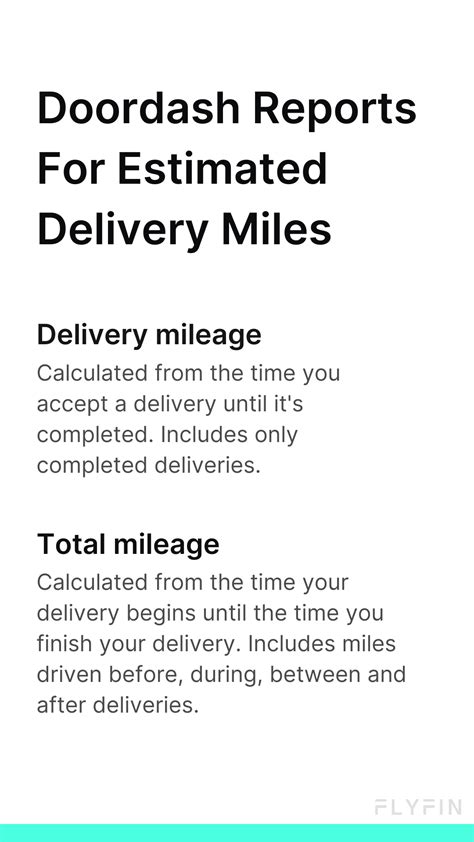

The amount of money you earn from DoorDash can affect your eligibility for SNAP benefits. In most states, gross income is used to determine eligibility for SNAP. However, some states may use net income.

- Gross income: If you're earning a significant amount from DoorDash, it may reduce your SNAP benefits or even make you ineligible for the program.

- Net income: If you're reporting net income, you may be able to deduct certain expenses, such as gas, maintenance, and other business-related costs. This could help reduce your reported income and increase your SNAP benefits.

Expenses and Deductions for DoorDash Drivers

As a DoorDash driver, you may be able to deduct certain expenses from your gross income. These expenses can include:

- Gas and fuel

- Vehicle maintenance and repairs

- Insurance premiums

- Business use of your home (if applicable)

- Other business-related expenses

Keep accurate records of your expenses, as you'll need to provide documentation to support your claims. Consult with a tax professional or accountant to ensure you're taking advantage of all eligible deductions.

Tips for Reporting DoorDash Income to Food Stamps

When reporting your DoorDash income to SNAP, keep the following tips in mind:

- Be accurate and honest: Report your income accurately and truthfully. Failing to report income or providing false information can result in penalties and even termination of benefits.

- Keep records: Keep detailed records of your income and expenses. This will help you complete the necessary forms and provide documentation if required.

- Consult with a professional: If you're unsure about reporting your income or have complex tax situations, consult with a tax professional or accountant.

- Report changes promptly: If your income changes, report the changes promptly to your SNAP office.

Frequently Asked Questions

Here are some frequently asked questions about reporting DoorDash income to food stamps:

- Q: Do I need to report my DoorDash income to SNAP? A: Yes, you must report all sources of income, including earnings from gig economy jobs like DoorDash.

- Q: How do I report my DoorDash income to SNAP? A: Contact your local SNAP office for specific instructions on reporting your income.

- Q: Will my DoorDash income affect my SNAP benefits? A: Yes, your DoorDash income can affect your eligibility for SNAP benefits or the amount of benefits you receive.

Gallery of Food Stamps and DoorDash Income

By following these tips and guidelines, you can ensure that you're reporting your DoorDash income accurately and complying with SNAP requirements. Remember to consult with a professional if you have complex tax situations or are unsure about reporting your income.