Intro

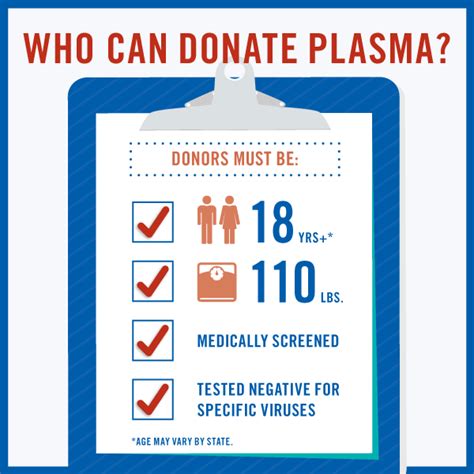

The financial struggles of everyday life can be overwhelming, and for many individuals, government assistance programs like food stamps are a vital lifeline. However, the eligibility requirements for these programs can be complex, and there's often confusion about what types of income or financial activities may affect benefits. One common concern is whether plasma donations can impact food stamp eligibility.

Plasma donations have become a popular way for individuals to earn some extra money, with many centers paying donors for their plasma. However, there's often uncertainty about how this income is treated by government agencies, particularly when it comes to food stamp eligibility. In this article, we'll delve into the world of plasma donations and food stamps, exploring how they intersect and what you need to know to make informed decisions.

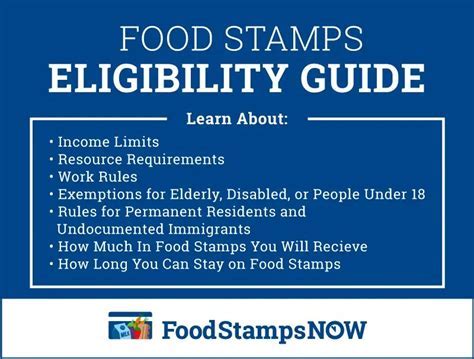

Understanding Food Stamp Eligibility

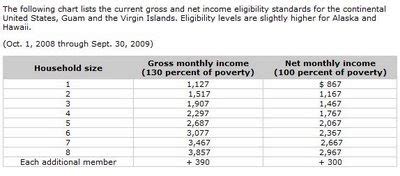

Before we dive into the specifics of plasma donations, it's essential to understand the basics of food stamp eligibility. The Supplemental Nutrition Assistance Program (SNAP), also known as food stamps, is a government program designed to help low-income individuals and families purchase food. To be eligible for SNAP benefits, you must meet specific income and resource requirements, which vary by state.

In general, eligibility is based on your household's gross income, which includes all sources of income, such as wages, self-employment income, and certain types of unearned income. Your household's size, composition, and expenses are also taken into account when determining eligibility.

Types of Income Affecting Food Stamp Eligibility

Not all types of income are treated equally when it comes to food stamp eligibility. Some types of income, such as earned income from a job, are counted in full when determining eligibility. However, other types of income, such as certain types of unearned income or income from self-employment, may be treated differently.

For example, income from self-employment, such as freelance work or running a small business, may be subject to different eligibility rules. In some cases, only a portion of self-employment income may be counted when determining eligibility.

How Plasma Donations Are Treated

So, how are plasma donations treated when it comes to food stamp eligibility? The answer depends on the specific circumstances of your plasma donations. In general, income from plasma donations is considered earned income, which means it's counted in full when determining eligibility.

However, there may be some exceptions. For example, if you're donating plasma regularly, you may be considered self-employed, which could affect how your income is treated. In some cases, only a portion of your plasma donation income may be counted when determining eligibility.

Reporting Plasma Donation Income

If you're receiving plasma donation income, it's essential to report it accurately when applying for food stamps. Failure to report income correctly can result in ineligibility or even penalties.

When reporting plasma donation income, be sure to include all relevant information, such as the frequency and amount of your donations. You may also need to provide documentation, such as receipts or payment records, to support your income claims.

Other Factors Affecting Food Stamp Eligibility

While plasma donations can affect food stamp eligibility, they're not the only factor to consider. Other types of income, such as wages, self-employment income, and certain types of unearned income, can also impact eligibility.

Additionally, your household's size, composition, and expenses are also taken into account when determining eligibility. For example, if you have dependents or high medical expenses, you may be eligible for food stamps even if your income is higher.

Assets and Resources

In addition to income, your household's assets and resources can also affect food stamp eligibility. Assets, such as cash, savings, and investments, may be counted when determining eligibility.

However, some assets, such as your primary residence, may be excluded from consideration. Additionally, some resources, such as retirement accounts or education savings plans, may not be counted.

Conclusion: Navigating the Complex World of Food Stamp Eligibility

Navigating the complex world of food stamp eligibility can be overwhelming, especially when it comes to plasma donations. By understanding how plasma donations are treated and reporting income accurately, you can ensure you're making informed decisions about your eligibility.

Remember, food stamp eligibility is based on a variety of factors, including income, assets, and resources. If you're unsure about your eligibility or have questions about the application process, consider consulting with a qualified social services professional or seeking guidance from your local government agency.

By taking the time to understand the intricacies of food stamp eligibility, you can make informed decisions about your financial well-being and ensure you're taking advantage of the resources available to you.

Plasma Donations and Food Stamps: Frequently Asked Questions

Q: Will plasma donations affect my food stamp eligibility? A: Yes, plasma donations can affect your food stamp eligibility, as they're considered earned income.

Q: How do I report plasma donation income when applying for food stamps? A: When reporting plasma donation income, be sure to include all relevant information, such as the frequency and amount of your donations.

Q: Are there any exceptions to how plasma donation income is treated? A: Yes, in some cases, plasma donation income may be treated differently, such as if you're considered self-employed.

Q: What other factors can affect food stamp eligibility? A: Other factors, such as wages, self-employment income, and certain types of unearned income, can also impact eligibility.

Q: Can I still receive food stamps if I have assets or resources? A: Yes, having assets or resources doesn't necessarily disqualify you from receiving food stamps.

Plasma Donations and Food Stamps Image Gallery