If you're one of the millions of Americans who rely on food stamps to help make ends meet, you may be wondering how this assistance affects your tax return. The good news is that food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), have a minimal impact on your tax situation. In this article, we'll delve into the details of how food stamps affect your tax return and provide guidance on what you need to know.

What are Food Stamps?

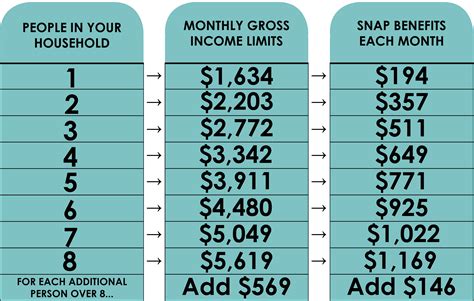

Food stamps, or SNAP, are a government-funded program designed to help low-income individuals and families purchase food. The program is administered by the United States Department of Agriculture (USDA) and is available to eligible individuals and families who meet certain income and resource requirements.

Are Food Stamps Considered Taxable Income?

The short answer is no, food stamps are not considered taxable income. According to the Internal Revenue Service (IRS), SNAP benefits are not subject to federal income tax. This means that you won't need to report your food stamp benefits on your tax return, and they won't affect your taxable income.

How Do Food Stamps Affect My Tax Return?

While food stamps are not considered taxable income, they can still have an indirect impact on your tax return. Here are a few ways in which food stamps might affect your tax situation:

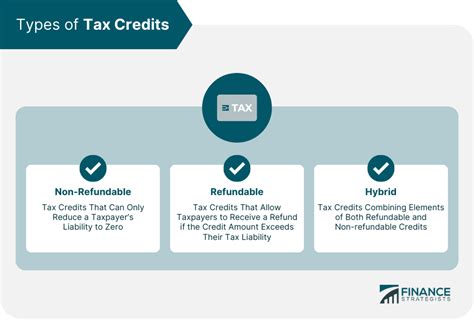

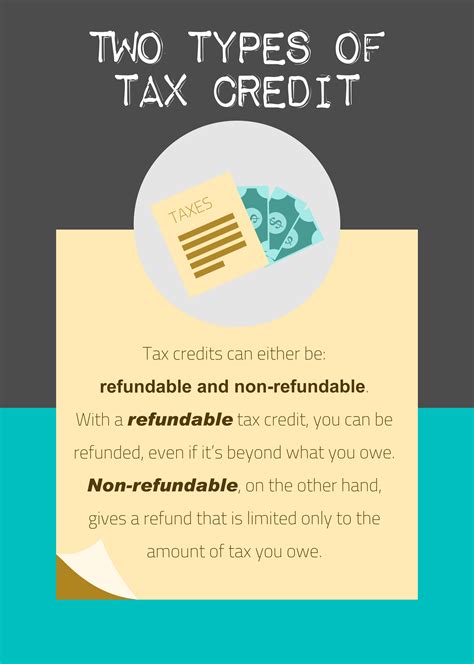

- Earned Income Tax Credit (EITC): If you receive food stamps, you may be eligible for the Earned Income Tax Credit (EITC). The EITC is a refundable tax credit that helps low-income working individuals and families offset their federal income taxes. While food stamps don't directly affect your EITC eligibility, your income and family size, which are used to determine your SNAP benefits, can also impact your EITC eligibility.

- Child Tax Credit: If you have children and receive food stamps, you may also be eligible for the Child Tax Credit. This credit provides a tax credit of up to $2,000 per child, depending on your income and family size. While food stamps don't directly affect your Child Tax Credit eligibility, your income and family size, which are used to determine your SNAP benefits, can also impact your Child Tax Credit eligibility.

Reporting Food Stamps on Your Tax Return

As mentioned earlier, you don't need to report your food stamp benefits on your tax return. However, you will need to report other sources of income, such as wages, self-employment income, and investments. If you're unsure about what income to report or how to report it, it's always best to consult with a tax professional or use tax preparation software.

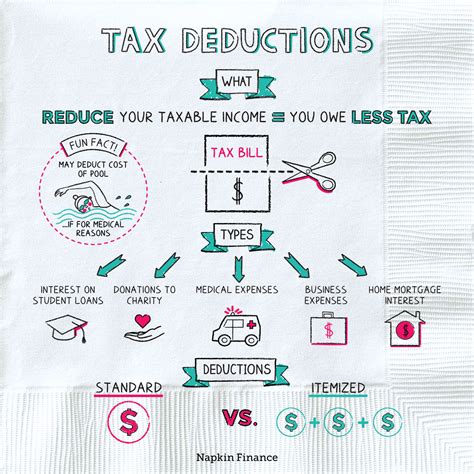

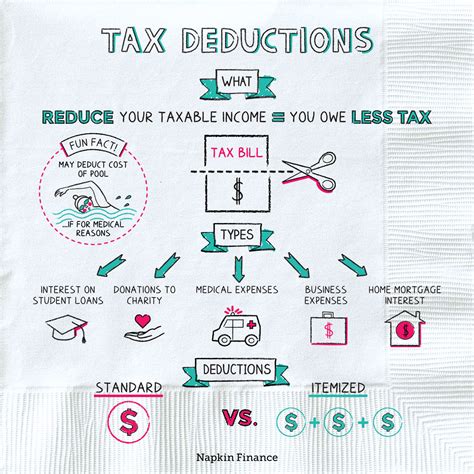

Additional Tax Credits and Deductions

In addition to the EITC and Child Tax Credit, there are several other tax credits and deductions that you may be eligible for if you receive food stamps. Some of these include:

- Standard Deduction: If you receive food stamps, you may be eligible for the standard deduction, which can help reduce your taxable income.

- Earned Income Deduction: If you have earned income from a job, you may be eligible for the earned income deduction, which can help reduce your taxable income.

- Child and Dependent Care Credit: If you have children and pay for child care so that you can work or attend school, you may be eligible for the Child and Dependent Care Credit.

Frequently Asked Questions

Here are some frequently asked questions about how food stamps affect your tax return:

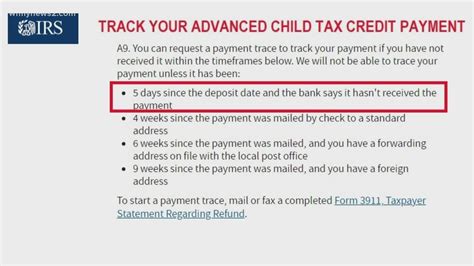

- Q: Do I need to report my food stamp benefits on my tax return? A: No, food stamp benefits are not considered taxable income and do not need to be reported on your tax return.

- Q: Can I claim the EITC if I receive food stamps? A: Yes, if you receive food stamps, you may be eligible for the EITC, depending on your income and family size.

- Q: Can I claim the Child Tax Credit if I receive food stamps? A: Yes, if you have children and receive food stamps, you may be eligible for the Child Tax Credit, depending on your income and family size.

Gallery of Tax-Related Images

Tax-Related Images

Final Thoughts

While food stamps don't have a direct impact on your tax return, they can still affect your eligibility for certain tax credits and deductions. By understanding how food stamps affect your tax situation, you can make informed decisions about your finances and ensure that you're taking advantage of all the tax credits and deductions available to you. If you have any questions or concerns about your tax situation, it's always best to consult with a tax professional or use tax preparation software.