Intro

Discover how applying for food stamps affects your credit score. Learn the impact of SNAP benefits on credit reports, scores, and history. Understand the relationship between government assistance and creditworthiness. Get the facts on food stamp eligibility, application process, and potential credit consequences to make informed decisions.

Applying for food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), is a crucial step for many individuals and families struggling to make ends meet. However, there's a common concern that arises when considering applying for food stamps: will it affect my credit score? In this article, we'll delve into the relationship between food stamps and credit scores, providing you with the information you need to make an informed decision.

The good news is that applying for food stamps typically does not affect your credit score. The SNAP program is a government-funded initiative designed to provide financial assistance for low-income individuals and families to purchase food. The program's eligibility criteria are based on income, resources, and expenses, rather than creditworthiness.

Here's why applying for food stamps won't impact your credit score:

How Food Stamps Work

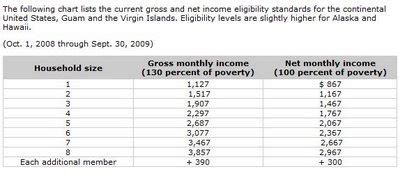

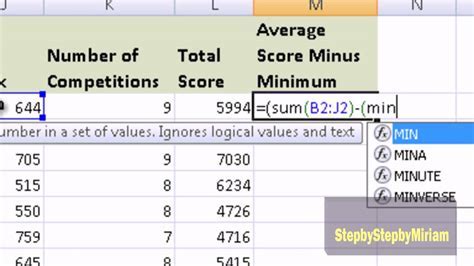

When you apply for food stamps, you'll need to provide documentation, such as proof of income, identification, and expenses. The application process involves a review of your financial situation to determine eligibility. The SNAP program uses a formula to calculate your net income, which is then compared to the federal poverty guidelines.

No Credit Checks Involved

The SNAP program does not require credit checks as part of the application process. This means that your credit score will not be affected by applying for food stamps. The program's focus is on providing assistance to those in need, rather than assessing creditworthiness.

Benefits of Food Stamps

While applying for food stamps may not affect your credit score, the program provides numerous benefits for eligible individuals and families. Some of these benefits include:

- Financial assistance for food purchases

- Access to nutritious food options

- Reduced food insecurity

- Improved health and well-being

- Support for low-income households

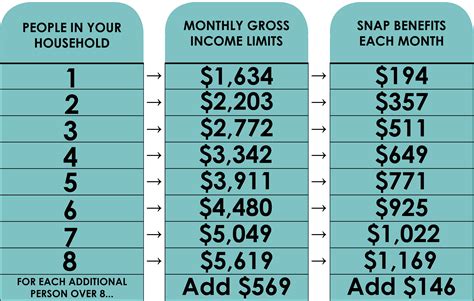

Eligibility Criteria

To be eligible for food stamps, you'll need to meet certain criteria, including:

- Income limits: Your gross income must be at or below 130% of the federal poverty guidelines.

- Resource limits: Your resources, such as cash, savings, and investments, must be below a certain threshold.

- Expense deductions: You may be eligible for deductions for expenses like housing, utilities, and childcare.

Maintaining Good Credit

While applying for food stamps won't affect your credit score, it's essential to maintain good credit habits to ensure a healthy credit score. Here are some tips to help you maintain good credit:

- Make on-time payments

- Keep credit utilization low

- Monitor your credit report

- Avoid new credit inquiries

- Build a long credit history

Additional Resources

If you're struggling to make ends meet, there are additional resources available to help. These include:

- Medicaid: A government-funded health insurance program for low-income individuals and families.

- Temporary Assistance for Needy Families (TANF): A program providing financial assistance for low-income families.

- Women, Infants, and Children (WIC) Program: A program providing nutrition assistance for pregnant and postpartum women, infants, and young children.

Food Stamps and Credit Score Image Gallery

Conclusion

Applying for food stamps is a vital step for individuals and families struggling to make ends meet. While it's natural to worry about the potential impact on your credit score, the good news is that applying for food stamps typically does not affect your credit score. By understanding how the SNAP program works and maintaining good credit habits, you can ensure a healthy credit score while receiving the financial assistance you need.

We hope this article has provided you with the information and reassurance you need to take the next step. If you have any questions or concerns, please don't hesitate to reach out. Share your thoughts and experiences in the comments below, and don't forget to share this article with others who may benefit from this information.