Intro

Discover how claiming a dependent affects your food stamp benefits. Learn the 5 key ways claiming a dependent impacts food stamps, including changes to household size, income limits, and benefit calculations. Understand the intricacies of SNAP eligibility and maximize your food assistance with our expert guide on dependent claiming and food stamp implications.

Claiming someone as a dependent on your taxes can have a significant impact on various government benefits, including food stamps. While claiming a dependent can provide tax benefits, it's essential to understand how it affects your eligibility for food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP). Here's how claiming a dependent can impact your food stamp benefits.

What is Claiming a Dependent?

Claiming a dependent on your taxes means you are declaring someone, typically a family member or relative, as financially dependent on you. This can include children, spouses, parents, or other relatives who meet specific income and relationship tests. Claiming a dependent can provide tax benefits, such as a lower taxable income and potentially higher refund.

How Does Claiming a Dependent Affect Food Stamps?

Claiming a dependent can impact your food stamp benefits in several ways:

1. Income Calculation

When you claim a dependent, their income is combined with yours to determine your household's total income. This can affect your eligibility for food stamps, as the program considers household income when determining benefit amounts. If your dependent's income is high, it may reduce or eliminate your food stamp benefits.

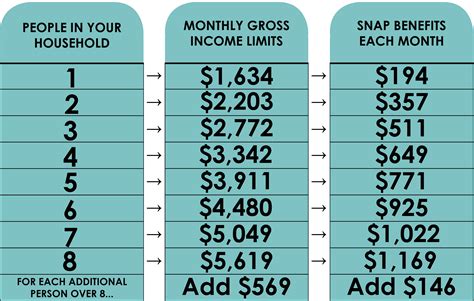

2. Household Size

Claiming a dependent increases your household size, which can impact your food stamp benefits. A larger household size may qualify you for more benefits, but it also means you'll need to meet a higher income threshold to be eligible.

3. Resource Calculation

Some dependents, such as parents or relatives, may have resources like cash, savings, or investments that are considered when determining food stamp eligibility. If your dependent has significant resources, it may impact your household's overall resources and affect your food stamp benefits.

4. Deductions and Expenses

Claiming a dependent can also impact the deductions and expenses you can claim when applying for food stamps. For example, if you're claiming a dependent child, you may be able to deduct child care expenses or educational costs. However, these deductions can also affect your household's overall income and resources.

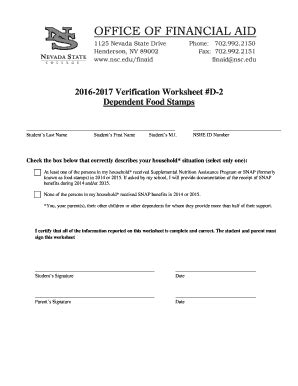

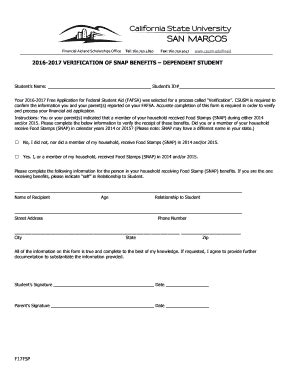

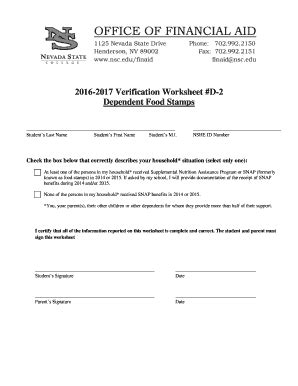

5. Verification Process

When you claim a dependent, you may need to provide additional documentation to verify their income, resources, and expenses. This can slow down the food stamp application process and may require more paperwork and documentation.

Who is Considered a Dependent?

The IRS considers the following individuals as dependents:

- Children under the age of 19 (or under 24 if a full-time student)

- Spouses

- Parents or relatives who meet specific income and relationship tests

- Disabled individuals who meet specific income and relationship tests

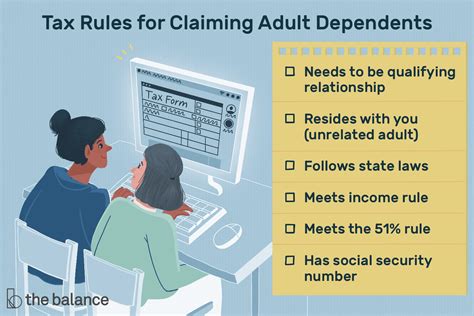

How to Claim a Dependent on Your Taxes

To claim a dependent on your taxes, you'll need to meet specific tests, including:

- Relationship test: The individual must be a relative, such as a child, spouse, or parent.

- Residency test: The individual must have lived with you for at least six months of the tax year.

- Income test: The individual's income must be below a certain threshold, typically $4,300 or less.

- Support test: You must provide more than half of the individual's support, including food, shelter, and other expenses.

Conclusion

Claiming a dependent can have a significant impact on your food stamp benefits. It's essential to understand how claiming a dependent affects your household's income, resources, and expenses. By considering these factors, you can make informed decisions about claiming a dependent and ensure you're receiving the correct food stamp benefits.

Gallery of Claiming a Dependent and Food Stamps

Claiming a Dependent and Food Stamps Image Gallery

FAQs

Q: Who is considered a dependent for tax purposes? A: The IRS considers children under 19 (or under 24 if a full-time student), spouses, parents or relatives who meet specific income and relationship tests, and disabled individuals who meet specific income and relationship tests as dependents.

Q: How does claiming a dependent affect my food stamp benefits? A: Claiming a dependent can impact your food stamp benefits by combining their income with yours, increasing your household size, and affecting your deductions and expenses.

Q: Can I claim a dependent if they live with me but don't contribute to household expenses? A: Yes, you can claim a dependent if they live with you for at least six months of the tax year and meet the income and relationship tests, even if they don't contribute to household expenses.

Q: How do I claim a dependent on my taxes? A: To claim a dependent, you'll need to meet the relationship, residency, income, and support tests, and provide documentation to verify their income, resources, and expenses.

**We hope you found this article informative and helpful. If you have any questions or comments, please leave them below. Share this article with others who may benefit from this information.