Intro

Discover how child support affects food stamps in your state. Learn the 5 key facts about child supports impact on food stamp eligibility, including income calculations, allocation rules, and reporting requirements. Get informed about the intersection of child support and food stamp benefits, including Supplemental Nutrition Assistance Program (SNAP) regulations.

Child support payments can have a significant impact on a family's financial situation, including their eligibility for food stamps. Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), are a vital resource for many low-income families to help them purchase food and groceries. However, the relationship between child support and food stamps can be complex, and it's essential to understand how one affects the other.

Child support payments are a crucial source of income for many families, providing financial assistance to children who live with one parent or guardian. On the other hand, food stamps are a vital resource for low-income families to help them access basic necessities like food. However, when child support payments are involved, it can affect a family's eligibility for food stamps.

Here are five key facts about how child support affects food stamps:

Child Support Payments Can Affect Food Stamp Eligibility

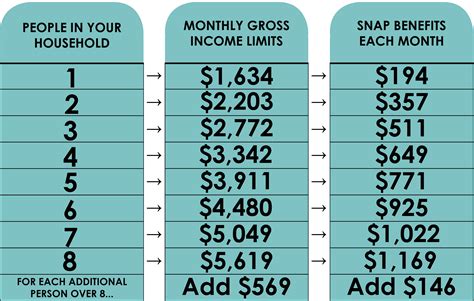

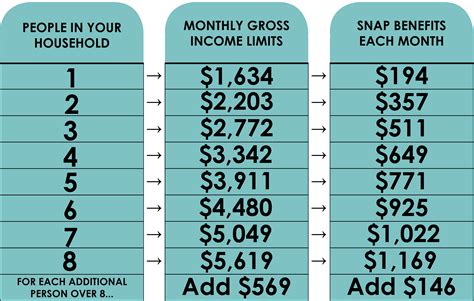

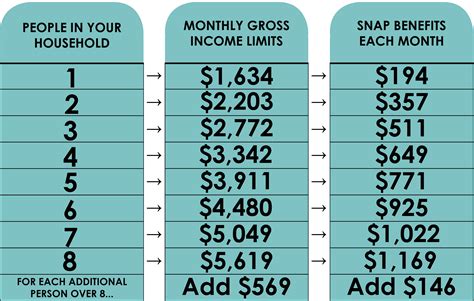

When a family applies for food stamps, their income is evaluated to determine their eligibility. Child support payments are considered income, and they can affect a family's eligibility for food stamps. If the child support payments are substantial, they may reduce the family's eligibility for food stamps or even disqualify them from receiving benefits.

How Child Support Payments Affect Food Stamp Benefits

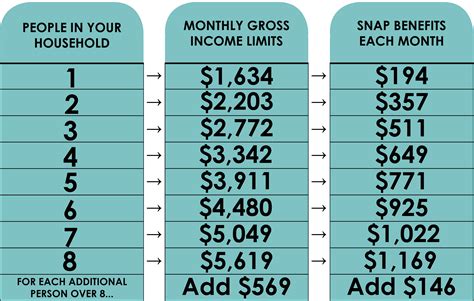

The way child support payments affect food stamp benefits varies from state to state. In some states, child support payments are not counted as income when determining eligibility for food stamps. However, in other states, child support payments are considered income, and they can reduce the amount of food stamp benefits a family receives.

For example, let's say a single mother receives $500 per month in child support payments. If she applies for food stamps, the child support payments may be counted as income, reducing her eligibility for food stamp benefits. However, if the state does not count child support payments as income, she may still be eligible for full food stamp benefits.

Child Support Payments Can Affect the Amount of Food Stamp Benefits

If a family is eligible for food stamps, child support payments can also affect the amount of benefits they receive. In some states, child support payments are used to calculate the family's gross income, which can affect the amount of food stamp benefits they receive.

For example, let's say a family receives $800 per month in child support payments. If the state uses the child support payments to calculate the family's gross income, the family may receive fewer food stamp benefits. However, if the state does not count child support payments as income, the family may receive more food stamp benefits.

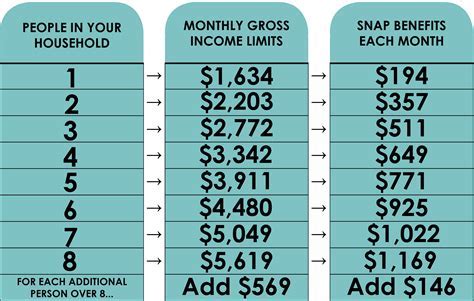

The Impact of Child Support Payments on Food Stamp Benefits Varies by State

The impact of child support payments on food stamp benefits varies significantly from state to state. Some states count child support payments as income, while others do not. Some states also have different rules for how child support payments affect food stamp benefits.

For example, some states may have a "disregard" rule, which ignores a certain amount of child support payments when calculating income. Other states may have a "pass-through" rule, which passes a certain amount of child support payments directly to the family.

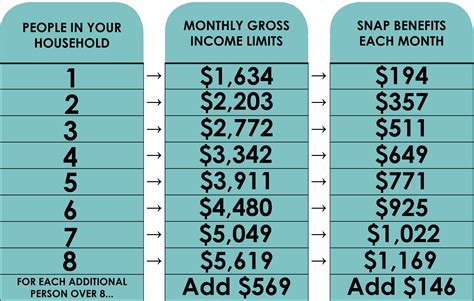

Families Can Take Steps to Minimize the Impact of Child Support Payments on Food Stamp Benefits

If a family is concerned about the impact of child support payments on their food stamp benefits, there are steps they can take to minimize the effect. One option is to work with a social services agency or a non-profit organization that specializes in food stamp benefits. These organizations can help families navigate the complex rules and regulations surrounding food stamp benefits and child support payments.

Another option is to negotiate with the child support payment recipient to reduce the amount of payments. This can help reduce the family's gross income and minimize the impact on food stamp benefits.

Families Should Understand Their Rights and Responsibilities

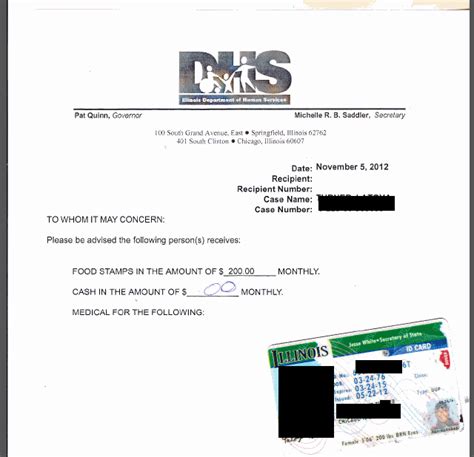

It's essential for families to understand their rights and responsibilities when it comes to child support payments and food stamp benefits. Families should know how child support payments affect their eligibility for food stamps and the amount of benefits they receive.

Families should also be aware of the rules and regulations surrounding child support payments and food stamp benefits in their state. This can help them navigate the complex system and ensure they receive the benefits they are eligible for.

In Conclusion

Child support payments can have a significant impact on a family's eligibility for food stamps. It's essential for families to understand how child support payments affect their food stamp benefits and take steps to minimize the impact. By working with social services agencies, negotiating with the child support payment recipient, and understanding their rights and responsibilities, families can ensure they receive the benefits they are eligible for.

Gallery of Child Support and Food Stamps

We hope this article has provided you with valuable information about how child support affects food stamps. If you have any questions or concerns, please don't hesitate to comment below. We'd love to hear from you!