Intro

As a recipient of food stamps, you may wonder if it's possible to buy a house while still receiving government assistance for groceries. The good news is that receiving food stamps does not necessarily preclude you from becoming a homeowner. However, there are some important factors to consider before embarking on the journey to homeownership.

For many individuals and families, food stamps are a vital lifeline, helping to make ends meet during difficult financial times. But as your financial situation improves, you may start to think about investing in a home of your own. While it's true that food stamps can provide a necessary safety net, it's essential to understand how they may impact your ability to secure a mortgage and purchase a home.

In this article, we'll delve into the world of food stamps and buying a house, exploring the key considerations and potential challenges you may face. We'll also examine the ways in which food stamps can affect your credit score, mortgage eligibility, and overall financial situation.

Understanding Food Stamps and Their Impact on Homeownership

Before we dive into the specifics, it's essential to understand the basics of food stamps and how they work. Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), are a type of government assistance designed to help low-income individuals and families purchase groceries.

The SNAP program is administered by the United States Department of Agriculture (USDA) and is available to eligible individuals and families in all 50 states. To qualify for SNAP benefits, you must meet specific income and resource requirements, which vary depending on your location and household size.

Now, let's talk about how food stamps might impact your ability to buy a house. The key factor to consider is that food stamps are a form of government assistance, and as such, they can affect your credit score and mortgage eligibility.

How Food Stamps Affect Credit Scores

When it comes to credit scores, food stamps are generally not considered a negative factor. In fact, receiving food stamps can be seen as a positive indicator that you're taking steps to support your financial well-being.

However, there are some potential issues to be aware of. For example, if you have a history of missed payments or outstanding debts, this could negatively impact your credit score, regardless of whether you receive food stamps.

To minimize the potential impact of food stamps on your credit score, it's essential to:

- Make timely payments on any outstanding debts

- Keep credit utilization ratios low

- Monitor your credit report for errors or inaccuracies

Mortgage Eligibility and Food Stamps

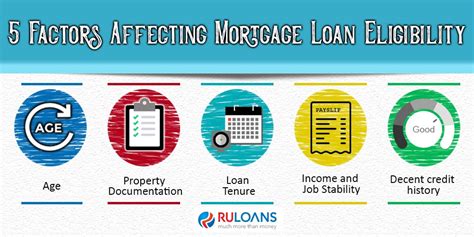

When it comes to mortgage eligibility, food stamps can play a role in determining whether you qualify for a home loan. Lenders typically consider several factors when evaluating mortgage applications, including:

- Income

- Credit score

- Debt-to-income ratio

- Employment history

Receiving food stamps can affect your mortgage eligibility in a few ways:

- Income: While food stamps are not considered taxable income, they can be viewed as a form of income when calculating your debt-to-income ratio.

- Credit score: As mentioned earlier, a history of missed payments or outstanding debts can negatively impact your credit score, making it more challenging to secure a mortgage.

To improve your mortgage eligibility, focus on:

- Building a stable income stream

- Reducing debt and improving credit utilization ratios

- Maintaining a good credit score

Steps to Take Before Buying a House

If you're receiving food stamps and thinking about buying a house, there are several steps you can take to prepare:

- Check your credit report: Obtain a copy of your credit report and review it for errors or inaccuracies.

- Improve your credit score: Focus on making timely payments, reducing debt, and improving credit utilization ratios.

- Build a stable income stream: Ensure you have a reliable source of income and a stable employment history.

- Reduce debt: Work on paying down outstanding debts and improving your debt-to-income ratio.

- Research mortgage options: Explore different mortgage options and lenders to find the best fit for your financial situation.

Additional Considerations

In addition to the factors mentioned above, there are a few more things to consider when buying a house while receiving food stamps:

- Housing costs: Make sure you have a clear understanding of the costs associated with homeownership, including mortgage payments, property taxes, and maintenance expenses.

- Financial stability: Ensure you have a stable financial situation and a plan in place for managing expenses and debt.

- Government assistance programs: Depending on your location and income level, you may be eligible for government assistance programs designed to help low-income homebuyers.

Gallery of Food Stamps and Homeownership

Food Stamps and Homeownership Image Gallery

Conclusion

Buying a house while receiving food stamps requires careful planning and consideration. By understanding the potential impact of food stamps on your credit score and mortgage eligibility, you can take steps to improve your financial situation and increase your chances of securing a mortgage.

Remember to focus on building a stable income stream, reducing debt, and improving your credit score. With patience, persistence, and the right guidance, you can achieve your dream of homeownership, even while receiving food stamps.

We hope this article has provided valuable insights and information to help you navigate the process of buying a house while receiving food stamps. If you have any further questions or concerns, please don't hesitate to reach out.

Share Your Thoughts

Have you had experience buying a house while receiving food stamps? Share your story and any tips or advice you may have in the comments below.