Intro

Receiving food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), is a vital resource for millions of Americans who struggle to make ends meet. However, many individuals who rely on this assistance may wonder whether it affects their credit score. In this article, we will delve into the relationship between food stamps and credit scores, exploring how they interact and what you need to know.

The Purpose of Food Stamps and Credit Scores

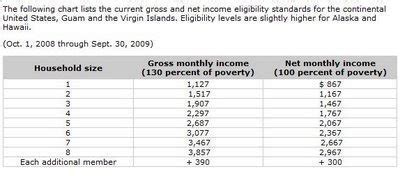

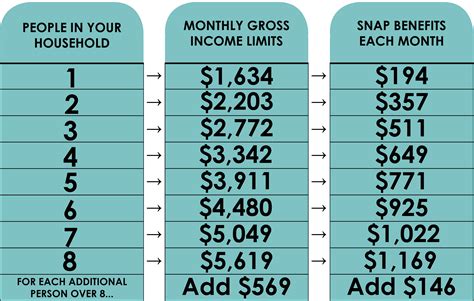

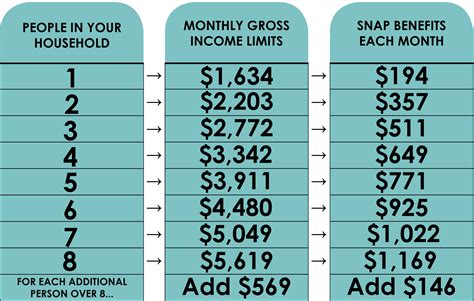

Before we dive into the details, let's first understand the purpose of food stamps and credit scores. Food stamps are a government-funded program designed to help low-income individuals and families purchase food and other essential household items. The program aims to alleviate hunger and food insecurity, providing a vital safety net for those in need.

On the other hand, credit scores are a three-digit number that represents an individual's creditworthiness. Credit scores are calculated based on their credit history, payment history, credit utilization, and other factors. Lenders use credit scores to determine the likelihood of repaying debts, and a good credit score can open doors to better loan terms, lower interest rates, and more.

Do Food Stamps Appear on Your Credit Report?

The answer is no; food stamps do not appear on your credit report. The SNAP program is a government-funded assistance program, and participation in the program is not reported to the three major credit bureaus: Equifax, Experian, and TransUnion.

Since food stamps are not a form of credit, they do not affect your credit utilization ratio or payment history, which are key factors in determining your credit score. You can receive food stamps without worrying about it impacting your credit score.

However, it's essential to note that other forms of government assistance, such as tax liens or court-ordered payments, may appear on your credit report and affect your credit score.

How Food Stamps Can Indirectly Affect Your Credit Score

While food stamps do not directly affect your credit score, there are some indirect ways in which receiving food stamps might impact your creditworthiness. For example:

- Income and Employment: Receiving food stamps may indicate that you have a low income or are experiencing financial difficulties. This can make it more challenging to obtain credit or loans, as lenders may view you as a higher risk.

- Utility Payments: If you're receiving food stamps, you might be more likely to fall behind on utility payments, such as electricity or gas bills. Late payments can negatively affect your credit score, even if you're not using credit to pay for utilities.

- Debt-to-Income Ratio: If you're relying on food stamps, you might be more likely to have a higher debt-to-income ratio, which can make it harder to obtain credit or loans.

Strategies for Managing Credit While Receiving Food Stamps

If you're receiving food stamps and want to maintain good credit, here are some strategies to consider:

- Make On-Time Payments: Continue making on-time payments on any existing debts, such as credit cards, loans, or mortgages.

- Keep Credit Utilization Low: Keep your credit utilization ratio low by avoiding new credit inquiries and keeping credit card balances low.

- Monitor Your Credit Report: Check your credit report regularly to ensure there are no errors or inaccuracies.

- Build an Emergency Fund: Try to build an emergency fund to cover unexpected expenses, reducing the need for credit or loans.

FAQs

Q: Can I get a loan while receiving food stamps?

A: Yes, you can still apply for loans while receiving food stamps. However, lenders may view you as a higher risk due to your income or employment situation.

Q: Will receiving food stamps affect my credit score?

A: No, receiving food stamps does not directly affect your credit score. However, indirect factors such as income and employment may impact your creditworthiness.

Q: Can I use food stamps to pay bills or debts?

A: No, food stamps are specifically designed to purchase food and other essential household items. You cannot use food stamps to pay bills or debts.

Gallery of Food Stamps and Credit Score

Food Stamps and Credit Score Image Gallery

Conclusion

Receiving food stamps is a vital resource for many individuals and families, but it's essential to understand how it interacts with your credit score. While food stamps do not directly affect your credit score, indirect factors such as income and employment may impact your creditworthiness.

By managing your credit responsibly, making on-time payments, and keeping credit utilization low, you can maintain good credit while receiving food stamps. Remember to monitor your credit report regularly and build an emergency fund to cover unexpected expenses.

Share your thoughts and experiences with food stamps and credit scores in the comments below. How have you managed your credit while receiving food stamps? Do you have any tips or advice to share with others?