Intro

Discover how food stamps consider car payments in determining income eligibility. Learn how Supplemental Nutrition Assistance Program (SNAP) guidelines treat vehicle expenses, including loan payments, insurance, and fuel costs. Find out if car payments are counted as income and how they impact your food stamp benefits.

Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), provide financial assistance to low-income individuals and families to help them purchase food. To determine eligibility, the program takes into account various factors, including income, expenses, and household size. One common question among applicants is whether car payments are considered income when applying for food stamps. In this article, we'll explore the answer to this question and provide a comprehensive understanding of how car payments are treated in the context of SNAP.

Understanding Food Stamp Eligibility

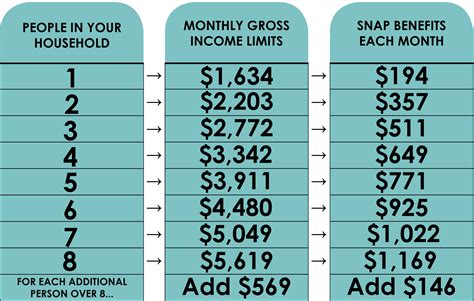

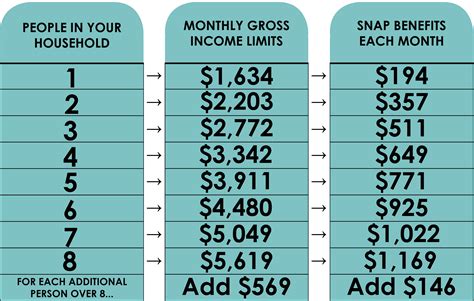

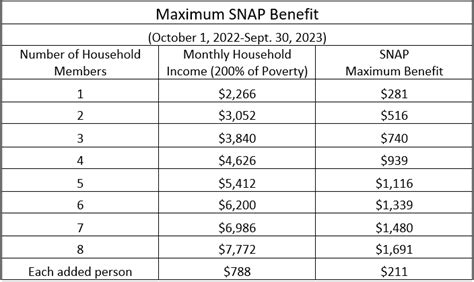

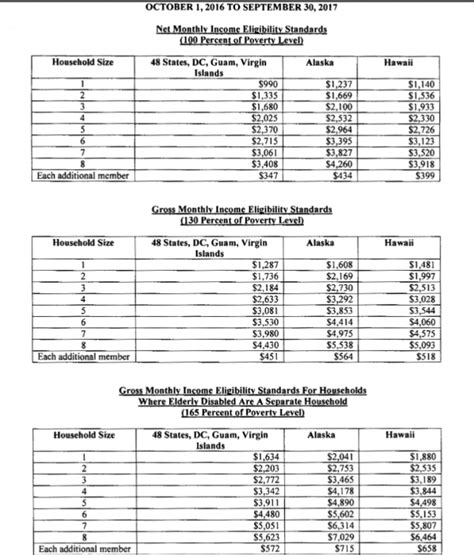

To be eligible for food stamps, households must meet certain income and resource requirements. The program considers gross income, which includes earnings from jobs, as well as other sources of income, such as social security benefits, unemployment benefits, and child support. However, not all types of income are treated equally. Some types of income, such as car payments, are not considered income for food stamp purposes.

Car Payments and Food Stamp Eligibility

Car payments are not considered income when applying for food stamps. The SNAP program excludes car payments from the calculation of gross income because they are considered a debt repayment rather than income. This means that if you're making car payments, the amount you pay each month will not be included in your gross income for food stamp purposes.

However, it's essential to note that the value of the car itself may be considered a resource. If you own a car, its value will be included in the calculation of your household's resources. The SNAP program allows households to own one car with an unlimited value, but if you own multiple cars or have a car with a value above a certain threshold, it may affect your eligibility.

How Car Payments Affect Food Stamp Benefits

While car payments are not considered income, they can still affect your food stamp benefits. If you're making car payments, you may be able to deduct a portion of those payments as a shelter deduction. Shelter deductions are expenses related to housing, such as rent or mortgage payments, property taxes, and insurance. If you're making car payments, you may be able to include a portion of those payments as a shelter deduction, which could potentially increase your food stamp benefits.

Other Expenses Considered in Food Stamp Eligibility

In addition to car payments, there are other expenses that may be considered when determining food stamp eligibility. These include:

- Housing costs, such as rent or mortgage payments

- Utilities, such as electricity and gas

- Child care costs

- Medical expenses

- Child support payments

These expenses can affect your gross income and may impact your eligibility for food stamps. It's essential to report all relevant expenses when applying for the program to ensure you receive the correct benefit amount.

Gallery of Food Stamp-Related Images

Food Stamp Image Gallery

Frequently Asked Questions

- Do car payments affect food stamp eligibility?

Car payments are not considered income when applying for food stamps. However, the value of the car itself may be considered a resource.

- How do I report car payments on my food stamp application?

You should report car payments as a debt repayment, not as income.

- Can I deduct car payments as a shelter deduction?

Yes, you may be able to deduct a portion of your car payments as a shelter deduction, which could potentially increase your food stamp benefits.

Final Thoughts

In conclusion, car payments are not considered income when applying for food stamps. However, the value of the car itself may be considered a resource, and you may be able to deduct a portion of your car payments as a shelter deduction. It's essential to understand how car payments affect your food stamp eligibility and benefits to ensure you receive the correct benefit amount. If you have any further questions or concerns, please don't hesitate to ask. Share your thoughts and experiences with us in the comments below!