Millions of Americans rely on food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), to provide for their families' nutritional needs. The program is designed to help low-income individuals and families purchase food and maintain a healthy diet. However, what happens when SNAP recipients work overtime? Does it affect their eligibility for food stamps? In this article, we will explore three ways food stamps count overtime and provide guidance on how to navigate this complex issue.

What Counts as Overtime?

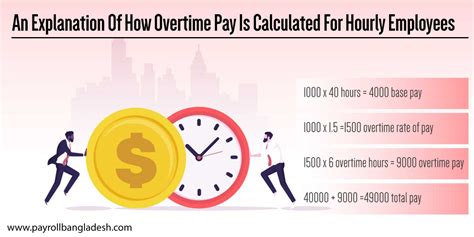

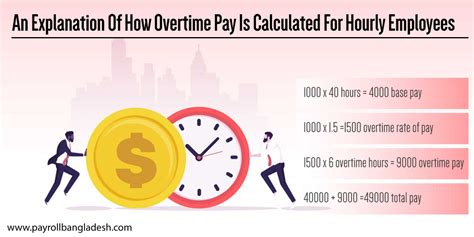

Before we dive into the three ways food stamps count overtime, it's essential to understand what constitutes overtime. Overtime refers to the hours worked beyond the standard full-time schedule, typically 40 hours per week. When calculating overtime, SNAP considers the total number of hours worked, including overtime, to determine the individual's or family's gross income.

1. Gross Income Calculation

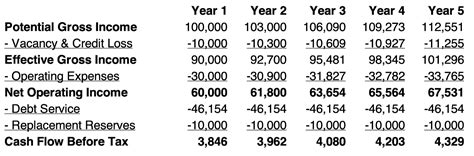

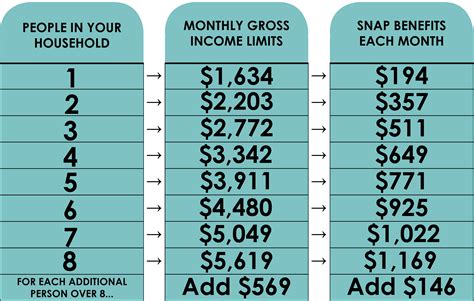

When determining eligibility for food stamps, SNAP considers the gross income of all household members. This includes wages, salaries, and tips, as well as overtime pay. The program uses a gross income test to determine whether the household's income is below the maximum allowed for their family size. If the household's gross income, including overtime, exceeds the maximum allowed, they may be ineligible for food stamps.

For example, let's say John works 40 hours a week at a manufacturing plant and earns $15 per hour. He also works 10 hours of overtime per week, earning an additional $22.50 per hour. His total gross income per week would be:

40 hours x $15 per hour = $600 10 hours x $22.50 per hour = $225 Total gross income per week = $825

If John's household size is three, and the maximum allowed gross income for a three-person household is $2,600 per month, his household would be eligible for food stamps. However, if John's overtime increases his gross income above the maximum allowed, his household may become ineligible.

2. Income Deductions

SNAP allows for certain income deductions to reduce the household's gross income. These deductions can help households with high expenses, such as child care or medical bills, qualify for food stamps. When calculating overtime, SNAP may allow deductions for expenses related to the overtime work, such as transportation costs or work-related expenses.

For instance, let's say Sarah works as a nurse and earns $25 per hour. She works 12 hours of overtime per week, earning an additional $37.50 per hour. Her total gross income per week would be:

40 hours x $25 per hour = $1,000 12 hours x $37.50 per hour = $450 Total gross income per week = $1,450

However, Sarah also incurs transportation costs of $50 per week related to her overtime work. If SNAP allows this deduction, Sarah's gross income would be reduced to:

$1,450 (gross income) - $50 (transportation deduction) = $1,400

This reduced gross income may make Sarah's household eligible for food stamps, depending on their family size and other factors.

3. 60-Month Rule

The 60-month rule is a critical aspect of SNAP's overtime calculation. This rule states that households with earned income, including overtime, may be eligible for food stamps for a maximum of 60 months (five years) if they meet certain conditions. During this period, SNAP disregards a portion of the household's gross income, including overtime, when determining eligibility.

For example, let's say Michael works as a construction worker and earns $20 per hour. He works 15 hours of overtime per week, earning an additional $30 per hour. His total gross income per week would be:

40 hours x $20 per hour = $800 15 hours x $30 per hour = $450 Total gross income per week = $1,250

However, if Michael's household is eligible for the 60-month rule, SNAP may disregard a portion of his gross income, including overtime. This could make his household eligible for food stamps, even if their gross income exceeds the maximum allowed.

In conclusion, food stamps count overtime in three primary ways: gross income calculation, income deductions, and the 60-month rule. Understanding these rules is crucial for SNAP recipients who work overtime, as it can affect their eligibility for food stamps. By considering these factors, households can make informed decisions about their employment and benefits.

We hope this article has provided valuable insights into the complex world of food stamps and overtime. If you have any questions or concerns, please feel free to comment below.

Gallery of Food Stamps and Overtime

Food Stamps and Overtime Image Gallery