Intro

Many individuals and families rely on government assistance programs, such as food stamps, to make ends meet. However, there is often confusion and concern about how receiving these benefits may impact one's credit score. In this article, we will delve into the relationship between food stamps and credit scores, and explore what you need to know.

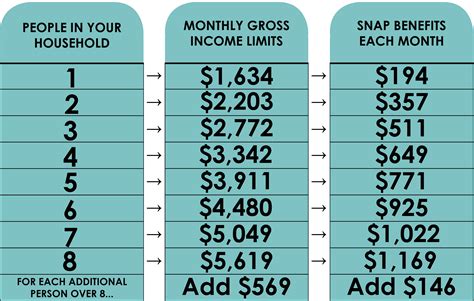

Receiving food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), is a vital lifeline for many households. It provides essential support to help individuals and families access nutritious food, despite financial challenges. However, when it comes to credit scores, there is a common misconception that participating in government assistance programs can negatively impact one's credit score.

Understanding Credit Scores

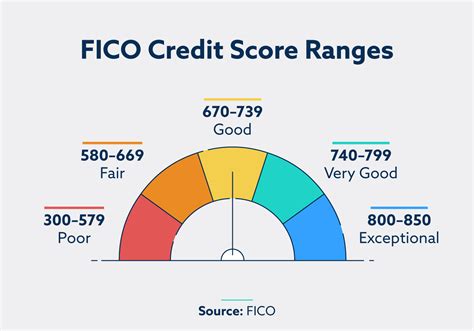

Credit scores are three-digit numbers that represent an individual's creditworthiness, based on their credit history. The most widely used credit score is the FICO score, which ranges from 300 to 850. A good credit score can help you qualify for loans, credit cards, and other financial products with favorable interest rates and terms.

How Credit Scores are Calculated

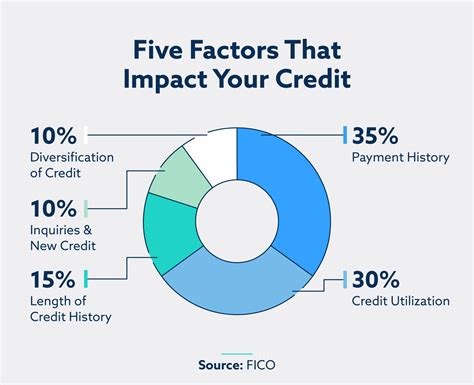

Credit scores are calculated based on the following factors:

- Payment history (35%)

- Credit utilization (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit (10%)

These factors are used to evaluate an individual's creditworthiness and determine their credit score.

Does Receiving Food Stamps Affect Your Credit Score?

The short answer is no, receiving food stamps does not directly affect your credit score. The SNAP program is a government assistance program, and participation in it is not reported to the credit bureaus. This means that receiving food stamps will not appear on your credit report, and therefore will not impact your credit score.

Why Receiving Food Stamps May Indirectly Affect Your Credit Score

While receiving food stamps may not directly affect your credit score, there are some indirect ways in which it may impact your creditworthiness.

- If you are relying on food stamps due to financial difficulties, you may be more likely to miss payments on other debts, such as credit cards or loans. This can negatively impact your credit score.

- Receiving food stamps may also indicate that you are experiencing financial difficulties, which can make it more challenging to qualify for credit or loans in the future.

Other Government Assistance Programs and Credit Scores

In addition to food stamps, there are other government assistance programs that may not directly affect your credit score, but can still have an indirect impact.

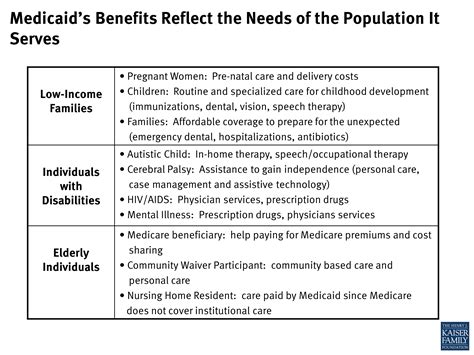

- Medicaid: Like food stamps, Medicaid is a government assistance program that provides health coverage to low-income individuals and families. Participation in Medicaid is not reported to the credit bureaus, and therefore will not directly impact your credit score.

- Housing assistance: Receiving housing assistance, such as Section 8 housing, may not directly impact your credit score. However, if you are struggling to pay rent or mortgage payments, it can negatively impact your credit score.

How to Maintain a Good Credit Score While Receiving Government Assistance

While receiving government assistance may not directly impact your credit score, it is still essential to maintain good credit habits to ensure you have access to credit and loans in the future.

- Make on-time payments: Continue to make payments on other debts, such as credit cards and loans, to demonstrate responsible credit behavior.

- Keep credit utilization low: Keep credit utilization below 30% to avoid negatively impacting your credit score.

- Monitor your credit report: Check your credit report regularly to ensure there are no errors or inaccuracies.

Conclusion

Receiving food stamps or other government assistance programs may not directly impact your credit score. However, it is essential to maintain good credit habits to ensure you have access to credit and loans in the future. By understanding how credit scores are calculated and taking steps to maintain a good credit score, you can ensure you have a strong financial foundation, regardless of your participation in government assistance programs.

Government Assistance Programs and Credit Scores Image Gallery

Share Your Thoughts

We would love to hear your thoughts on how government assistance programs impact credit scores. Share your experiences and insights in the comments below. Additionally, if you found this article informative, please share it with others who may benefit from this information.