Millions of Americans rely on food stamps to purchase groceries and other essential items. While food stamps are a vital resource for many, they can have unintended consequences on one's credit score. In this article, we will explore three ways that food stamps can affect your credit score.

Receiving food stamps is not inherently bad for your credit score. However, the circumstances that lead to the need for food stamps can have a negative impact on your credit. For example, if you are struggling to make ends meet and are unable to pay bills on time, this can negatively affect your credit score. Additionally, if you have a history of debt or have defaulted on loans, this can also harm your credit score.

One of the main ways that food stamps can affect your credit score is through the application process. When you apply for food stamps, your credit report may be pulled as part of the eligibility process. This can result in a hard inquiry on your credit report, which can temporarily lower your credit score. However, this impact is usually minor and short-term.

Another way that food stamps can affect your credit score is through the potential for debt accumulation. If you are struggling to make ends meet and are relying on food stamps to get by, you may be more likely to accumulate debt in other areas of your life. For example, you may be more likely to take out payday loans or use credit cards to cover essential expenses. This can lead to a cycle of debt that can negatively impact your credit score.

Finally, receiving food stamps can also affect your credit score by limiting your access to credit. If you are receiving food stamps, you may be considered a higher credit risk by lenders. This can make it more difficult to qualify for loans or credit cards, which can limit your access to credit and negatively impact your credit score.

How Food Stamps Impact Your Credit Score

It is essential to understand how food stamps can impact your credit score. While food stamps are not directly reported to the credit bureaus, the circumstances that lead to the need for food stamps can have a negative impact on your credit score.

Food Stamps and Credit Inquiries

When you apply for food stamps, your credit report may be pulled as part of the eligibility process. This can result in a hard inquiry on your credit report, which can temporarily lower your credit score. However, this impact is usually minor and short-term.

- A hard inquiry can remain on your credit report for up to two years.

- Multiple hard inquiries can have a more significant impact on your credit score.

- You can minimize the impact of hard inquiries by limiting your credit applications.

Food Stamps and Debt Accumulation

If you are struggling to make ends meet and are relying on food stamps to get by, you may be more likely to accumulate debt in other areas of your life. For example, you may be more likely to take out payday loans or use credit cards to cover essential expenses.

- Debt accumulation can have a significant impact on your credit score.

- High levels of debt can make it more difficult to qualify for loans or credit cards.

- You can minimize the impact of debt accumulation by creating a budget and sticking to it.

Food Stamps and Access to Credit

Receiving food stamps can also affect your credit score by limiting your access to credit. If you are receiving food stamps, you may be considered a higher credit risk by lenders.

- Limited access to credit can make it more difficult to qualify for loans or credit cards.

- You can minimize the impact of limited access to credit by building a positive credit history.

- Consider working with a credit counselor to improve your credit score.

How to Improve Your Credit Score While Receiving Food Stamps

If you are receiving food stamps and are concerned about the impact on your credit score, there are steps you can take to improve your credit score.

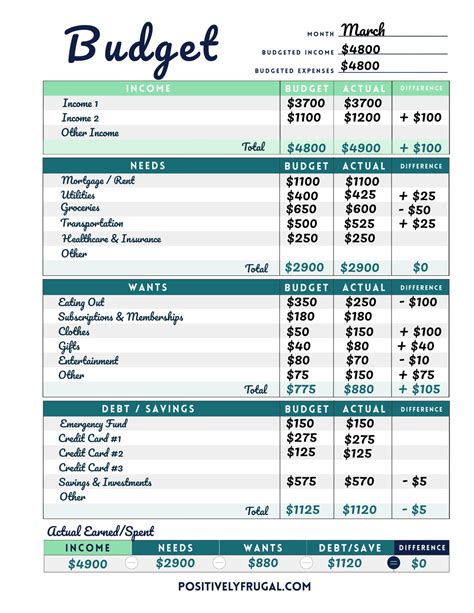

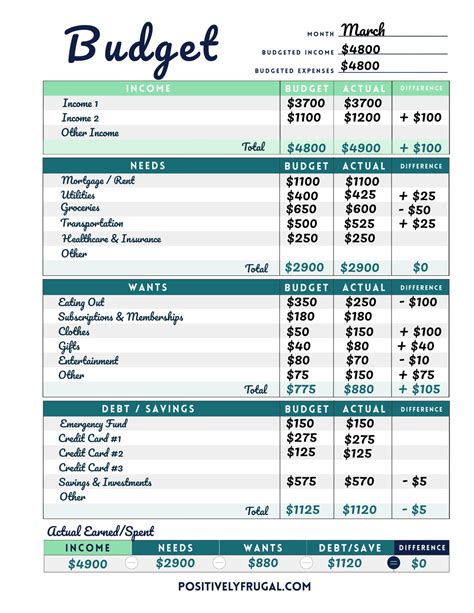

Create a Budget

Creating a budget can help you manage your finances and reduce debt.

- Start by tracking your income and expenses.

- Identify areas where you can cut back and allocate that money towards debt repayment.

- Consider working with a credit counselor to create a personalized budget.

Pay Bills on Time

Paying bills on time is essential for maintaining a positive credit score.

- Set up payment reminders to ensure you never miss a payment.

- Consider setting up automatic payments to make paying bills easier.

- Make timely payments on all bills, including rent/mortgage, utilities, and credit cards.

Monitor Your Credit Report

Monitoring your credit report can help you identify errors and take steps to improve your credit score.

- Request a free credit report from each of the three major credit bureaus.

- Review your credit report carefully and dispute any errors.

- Consider working with a credit counselor to improve your credit score.

Food Stamps and Credit Score Image Gallery

Conclusion

Receiving food stamps can have a negative impact on your credit score, but there are steps you can take to improve your credit score. By creating a budget, paying bills on time, and monitoring your credit report, you can improve your credit score and access to credit.