Intro

Discover how food stamps impact your tax return with our expert guide. Learn the 5 ways Supplemental Nutrition Assistance Program (SNAP) benefits affect your taxes, including eligibility, deductions, and credits. Understand the intricacies of tax returns with food stamps and maximize your refund.

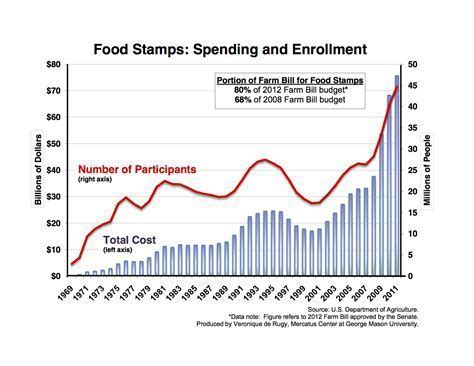

Receiving food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), can have an impact on your tax return. While the program is designed to provide financial assistance for food purchases, it can affect your tax obligations in several ways. In this article, we will explore five ways food stamps can impact your tax return.

Firstly, it is essential to understand that food stamps are not considered taxable income. According to the Internal Revenue Service (IRS), SNAP benefits are not subject to federal income tax. This means that you do not need to report the benefits on your tax return.

Impact on Tax Credits and Deductions

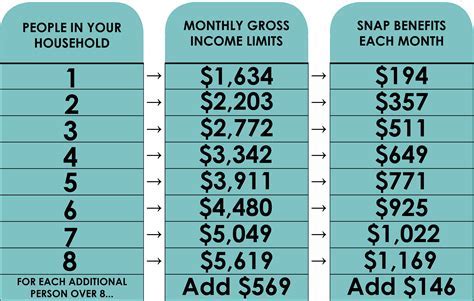

However, receiving food stamps can impact your eligibility for certain tax credits and deductions. For instance, the Earned Income Tax Credit (EITC) is a refundable tax credit for low-income working individuals and families. While receiving food stamps does not directly affect your EITC eligibility, it can impact your overall income level, which may reduce the amount of credit you are eligible for.

Additionally, if you are claiming the Child Tax Credit, receiving food stamps may affect your eligibility. The Child Tax Credit is a non-refundable tax credit of up to $2,000 per child. While SNAP benefits are not considered income for tax purposes, they can impact your overall household income, which may affect your eligibility for the credit.

Reporting of Food Stamp Benefits

While food stamp benefits are not taxable, you may need to report them on your tax return in certain circumstances. For example, if you received SNAP benefits and also received other forms of income, such as wages or self-employment income, you may need to report the benefits on your tax return.

It is essential to note that you should not report food stamp benefits as income on your tax return. However, you may need to complete Form 1099-G, Certain Government Payments, to report the benefits. You should consult with a tax professional or the IRS to determine if you need to report food stamp benefits on your tax return.

Impact on State and Local Taxes

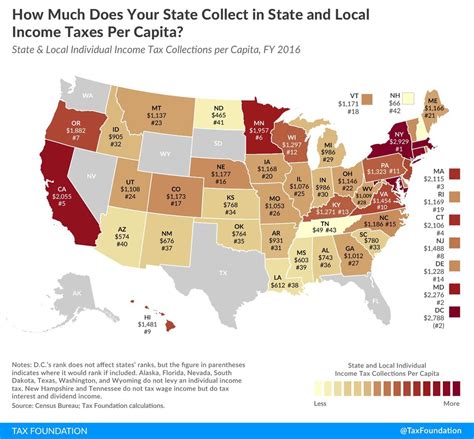

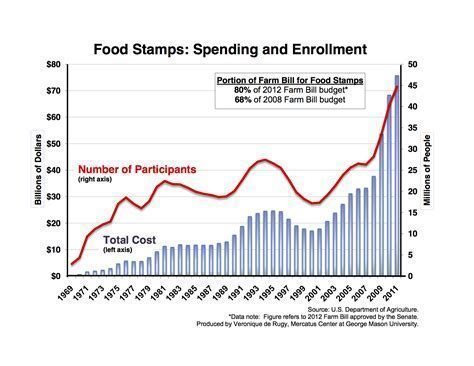

Receiving food stamps can also impact your state and local tax obligations. Some states consider SNAP benefits as taxable income, while others do not. You should check with your state and local tax authorities to determine if food stamp benefits are subject to state and local income taxes.

Furthermore, some states offer state-specific tax credits or deductions for low-income individuals and families receiving food stamps. For example, some states offer a state Earned Income Tax Credit (EITC) that is based on the federal EITC. You should check with your state tax authority to determine if you are eligible for any state-specific tax credits or deductions.

Food Stamp Benefits and Tax Filing Status

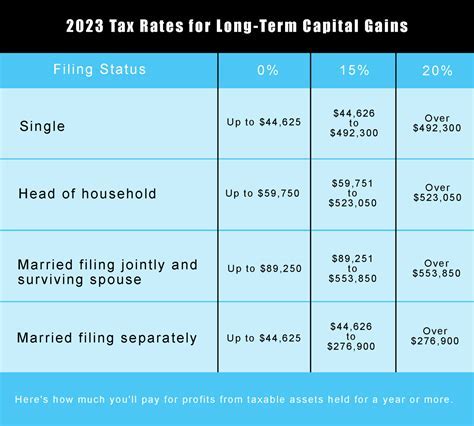

Receiving food stamps can also impact your tax filing status. If you are receiving SNAP benefits, you may be eligible to file as head of household, which can result in a lower tax liability. However, you should consult with a tax professional to determine the best filing status for your specific situation.

Additionally, if you are receiving food stamps and have dependents, you may be eligible for the Dependent Care Credit. This credit is designed to help low-income working individuals and families pay for childcare expenses while they work or attend school. You should consult with a tax professional to determine if you are eligible for the credit.

Conclusion

In conclusion, receiving food stamps can have an impact on your tax return in several ways. While food stamp benefits are not considered taxable income, they can affect your eligibility for certain tax credits and deductions, such as the Earned Income Tax Credit and the Child Tax Credit. Additionally, you may need to report food stamp benefits on your tax return in certain circumstances. It is essential to consult with a tax professional to determine the best course of action for your specific situation.

Food Stamps and Tax Return Image Gallery

We hope this article has provided you with a comprehensive understanding of how food stamps can impact your tax return. If you have any further questions or concerns, please do not hesitate to comment below or share this article with your friends and family.