Intro

In-Home Supportive Services (IHSS) is a program that provides financial assistance to elderly, blind, or disabled individuals who require assistance with daily living tasks. Many people who receive IHSS benefits also rely on other forms of government assistance, such as food stamps, to make ends meet. But does IHSS count as income for food stamps benefits? In this article, we'll explore the answer to this question and provide guidance on how IHSS benefits may impact food stamp eligibility.

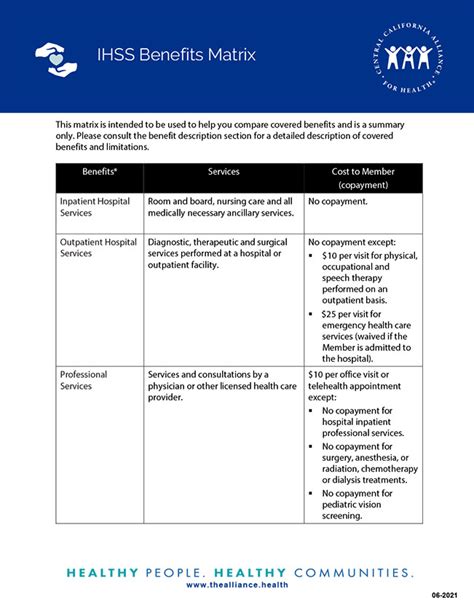

What is IHSS?

IHSS is a program that allows eligible individuals to hire and manage their own caregivers, who can assist with daily living tasks such as bathing, dressing, and meal preparation. The program is designed to help individuals remain in their own homes rather than being institutionalized. IHSS benefits are paid directly to the caregiver, who is usually a family member or friend.

How does IHSS impact food stamp eligibility?

Food stamp eligibility is determined by the California Department of Social Services (CDSS) and is based on a variety of factors, including income, expenses, and household size. When determining eligibility, CDSS considers all sources of income, including IHSS benefits.

However, IHSS benefits are considered "excludable income" for food stamp purposes. This means that IHSS benefits are not counted as income when determining food stamp eligibility. According to the CDSS, IHSS benefits are excluded from income because they are considered "in-kind" benefits, meaning they are paid directly to the caregiver rather than to the individual receiving IHSS services.

What are the implications of IHSS not being counted as income for food stamps?

If IHSS benefits are not counted as income for food stamps, it means that individuals who receive IHSS benefits may be eligible for food stamps even if their income from other sources is higher than the eligibility limit. This can be beneficial for individuals who rely on IHSS benefits to pay for caregiving services, as it allows them to maintain their eligibility for food stamps.

However, it's essential to note that other sources of income, such as wages, pensions, or Social Security benefits, may still be counted as income when determining food stamp eligibility. Therefore, individuals who receive IHSS benefits should still report all other sources of income when applying for food stamps.

How to report IHSS benefits when applying for food stamps

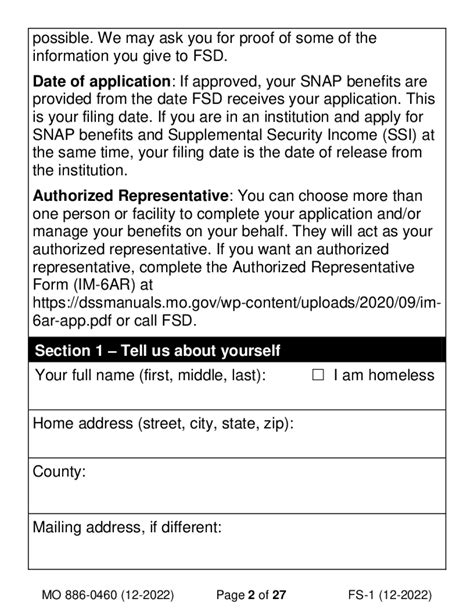

When applying for food stamps, individuals who receive IHSS benefits should report their IHSS benefits on the application. However, they should not include IHSS benefits as income. Instead, they should report the IHSS benefits as a "deduction" or "exclusion" on the application.

For example, if an individual receives $1,000 per month in IHSS benefits and also earns $1,500 per month in wages, they would report the IHSS benefits as a deduction or exclusion on the application. The CDSS would then disregard the IHSS benefits when determining food stamp eligibility.

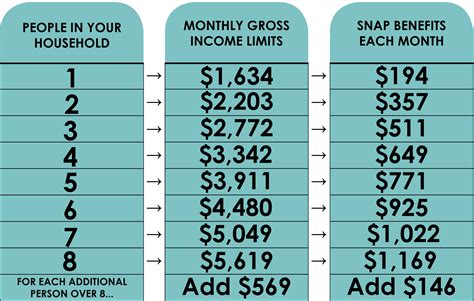

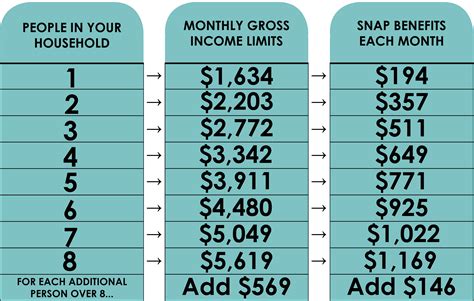

What are the income limits for food stamps in California?

The income limits for food stamps in California vary depending on household size and composition. For example, as of 2022, the gross income limit for a household of one is $1,733 per month, while the net income limit is $1,276 per month. For a household of two, the gross income limit is $2,357 per month, while the net income limit is $1,726 per month.

How to apply for food stamps in California

To apply for food stamps in California, individuals can visit the CDSS website or contact their local county social services office. They will need to provide documentation, such as proof of income, expenses, and household size, to determine eligibility.

Gallery of Food Stamps Benefits

Food Stamps Benefits Image Gallery

Conclusion

IHSS benefits do not count as income for food stamps purposes, which means that individuals who receive IHSS benefits may be eligible for food stamps even if their income from other sources is higher than the eligibility limit. When applying for food stamps, individuals should report their IHSS benefits as a deduction or exclusion on the application. It's essential to note that other sources of income, such as wages or Social Security benefits, may still be counted as income when determining food stamp eligibility.

We hope this article has provided valuable information on how IHSS benefits impact food stamp eligibility. If you have any further questions or concerns, please don't hesitate to reach out to us in the comments section below.

FAQs

Q: Do IHSS benefits count as income for food stamps? A: No, IHSS benefits are considered "excludable income" for food stamp purposes and are not counted as income when determining eligibility.

Q: How do I report IHSS benefits when applying for food stamps? A: When applying for food stamps, individuals should report their IHSS benefits as a deduction or exclusion on the application.

Q: What are the income limits for food stamps in California? A: The income limits for food stamps in California vary depending on household size and composition. For example, as of 2022, the gross income limit for a household of one is $1,733 per month, while the net income limit is $1,276 per month.

Q: How do I apply for food stamps in California? A: To apply for food stamps in California, individuals can visit the CDSS website or contact their local county social services office. They will need to provide documentation, such as proof of income, expenses, and household size, to determine eligibility.