Intro

Individual Retirement Accounts (IRAs) have become an essential tool for Americans to save for their future. However, the impact of IRAs on food stamp eligibility is a crucial aspect that many people are unaware of. In this article, we will delve into the seven ways IRAs can affect food stamp eligibility and provide valuable insights to help individuals navigate this complex issue.

Firstly, it's essential to understand how IRAs are viewed by the government when it comes to food stamp eligibility. IRAs are considered assets, and as such, they can affect an individual's eligibility for food stamps. However, the impact of IRAs on food stamp eligibility is not always straightforward.

Understanding Food Stamp Eligibility

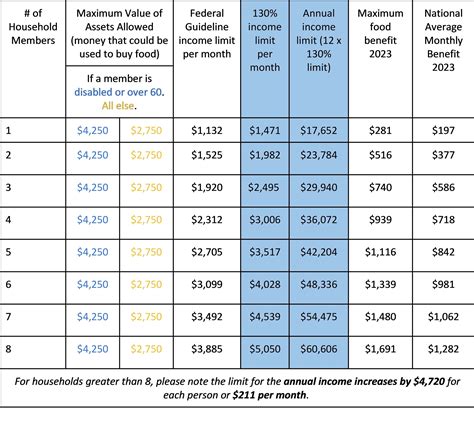

Before we dive into the seven ways IRAs can impact food stamp eligibility, it's crucial to understand the basics of food stamp eligibility. The Supplemental Nutrition Assistance Program (SNAP) is a government program that provides food assistance to low-income individuals and families. To be eligible for food stamps, individuals must meet specific income and resource requirements.

Income Requirements

To be eligible for food stamps, individuals must meet the income requirements set by their state. The income limits vary depending on the state, family size, and composition. Generally, individuals who earn less than 130% of the federal poverty level (FPL) may be eligible for food stamps.

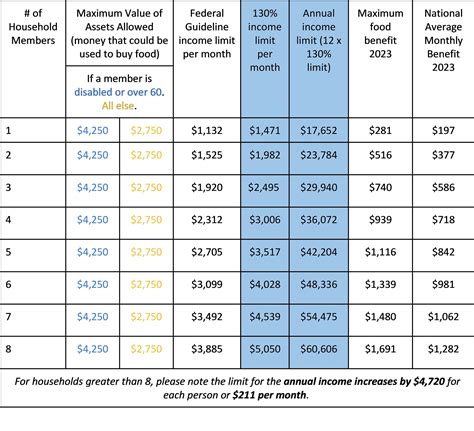

Resource Requirements

In addition to income requirements, individuals must also meet the resource requirements. Resources include assets such as cash, savings, and investments. The resource limit varies depending on the state, but generally, individuals who have assets above a certain threshold may not be eligible for food stamps.

7 Ways IRAs Can Impact Food Stamp Eligibility

Now that we have a basic understanding of food stamp eligibility, let's explore the seven ways IRAs can impact food stamp eligibility.

1. Asset Limitations

As mentioned earlier, IRAs are considered assets, and as such, they can affect an individual's eligibility for food stamps. If an individual has an IRA that exceeds the resource limit set by their state, they may not be eligible for food stamps.

2. Income Calculations

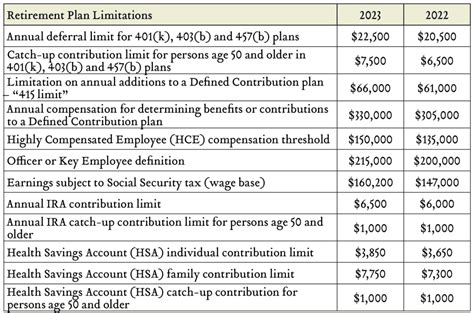

IRAs can also impact food stamp eligibility by affecting income calculations. If an individual takes a distribution from their IRA, it may be considered income, which can affect their eligibility for food stamps.

3. Resource Exclusions

Some IRAs, such as Roth IRAs, may be excluded from the resource calculation. This means that if an individual has a Roth IRA, it may not be considered an asset when determining food stamp eligibility.

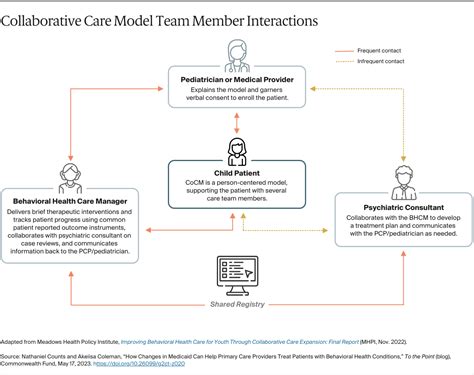

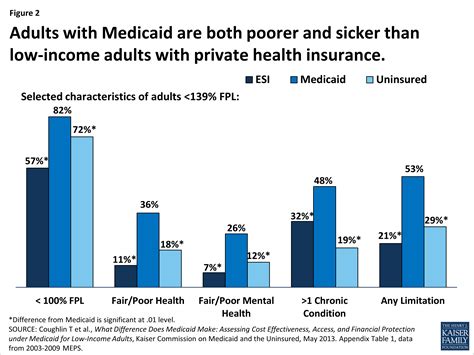

4. Medicaid Interactions

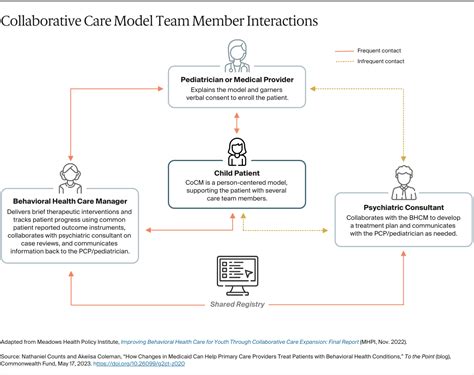

IRAs can also interact with Medicaid, which can impact food stamp eligibility. If an individual is eligible for Medicaid, they may also be eligible for food stamps, even if they have an IRA that exceeds the resource limit.

5. Spousal Exclusions

If an individual is married, their spouse's IRA may be excluded from the resource calculation. This means that if one spouse has an IRA that exceeds the resource limit, it may not affect the other spouse's eligibility for food stamps.

6. Disability Interactions

IRAs can also interact with disability benefits, which can impact food stamp eligibility. If an individual receives disability benefits, they may be eligible for food stamps, even if they have an IRA that exceeds the resource limit.

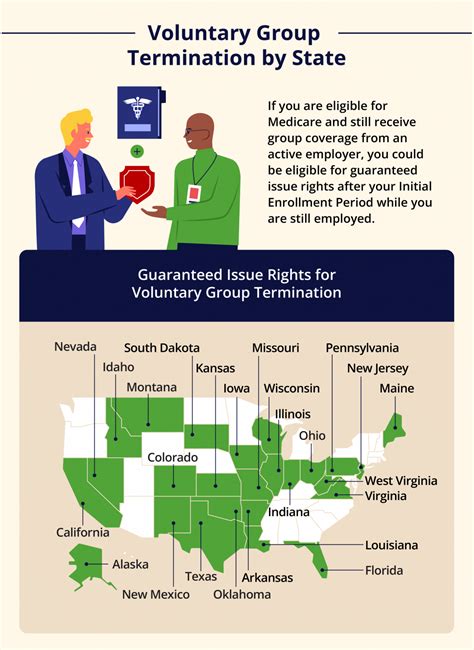

7. State-Specific Rules

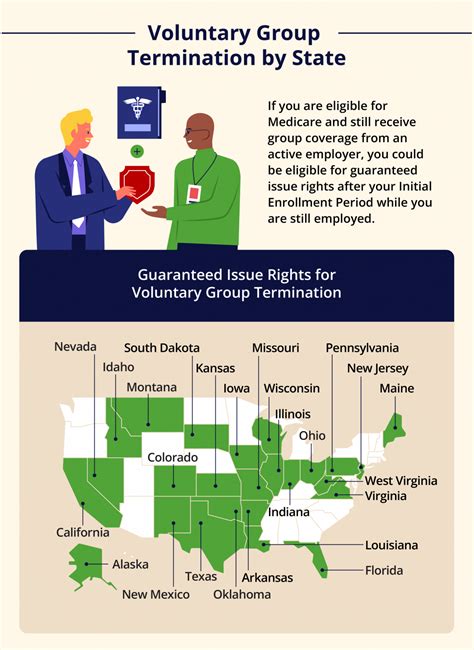

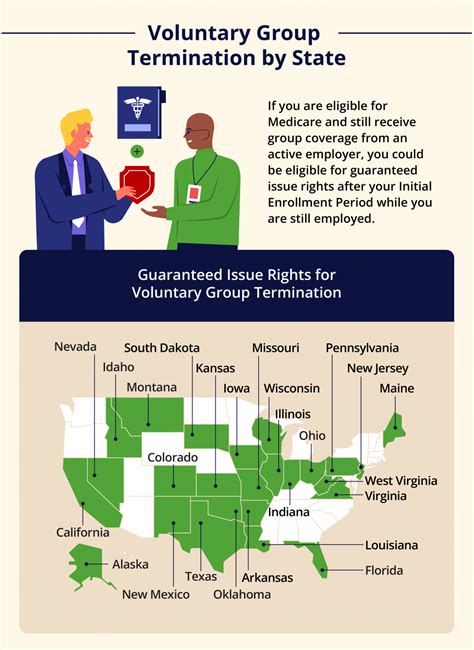

Finally, it's essential to note that state-specific rules can impact how IRAs affect food stamp eligibility. Some states may have more lenient rules regarding IRAs, while others may have stricter rules.

IRAs and Food Stamp Eligibility Image Gallery

In conclusion, IRAs can have a significant impact on food stamp eligibility. It's essential to understand the seven ways IRAs can affect food stamp eligibility and to consult with a financial advisor to ensure that your IRA does not affect your eligibility for food stamps. We hope this article has provided valuable insights into the complex relationship between IRAs and food stamp eligibility. If you have any questions or comments, please feel free to share them below.