Intro

Discover how life insurance affects food stamps eligibility. Learn 5 ways your policy can impact benefits, including income calculations, resource limits, and more. Understand the intricacies of Supplemental Nutrition Assistance Program (SNAP) benefits and life insurance policies to maximize your financial assistance. Get informed, stay eligible.

When considering life insurance, many people focus on the financial security it provides for their loved ones in the event of their passing. However, life insurance can have an impact on various aspects of one's life, including government assistance programs like food stamps. In this article, we will explore five ways life insurance affects food stamps.

Life insurance is an essential aspect of financial planning, providing a financial safety net for your family in the event of your passing. But have you ever wondered how life insurance affects government assistance programs like food stamps? If you or a family member receives food stamps, it's essential to understand how life insurance can impact your eligibility and benefits. In this article, we will delve into the world of life insurance and food stamps, exploring the ways in which they intersect.

For many families, food stamps are a vital source of support, helping to put food on the table during difficult times. However, the rules surrounding food stamps can be complex, and it's essential to understand how life insurance can affect your eligibility and benefits. Whether you're considering purchasing life insurance or already have a policy in place, it's crucial to know how it may impact your food stamps.

What are Food Stamps?

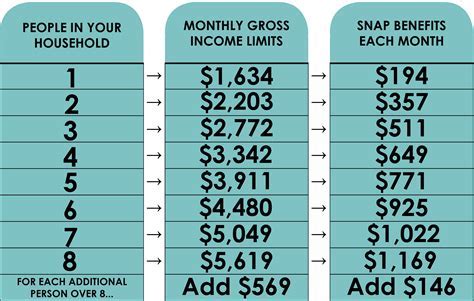

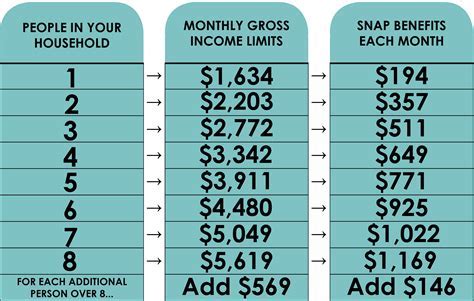

Before we dive into the ways life insurance affects food stamps, let's take a brief look at what food stamps are and how they work. Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), are a government assistance program designed to help low-income families purchase food. Eligibility for food stamps is based on income, expenses, and family size, and benefits are distributed through an Electronic Benefits Transfer (EBT) card.

1. Life Insurance Policy Value and Food Stamps Eligibility

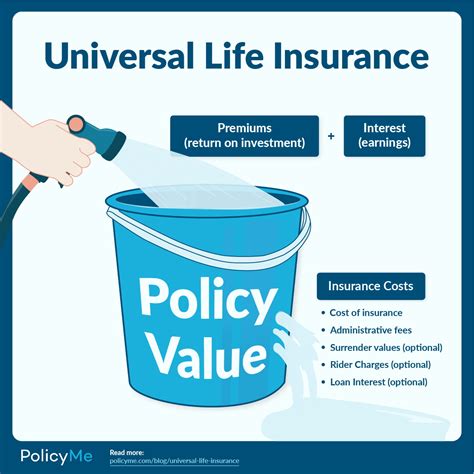

One way life insurance affects food stamps is through the policy's value. In some states, the cash value of a life insurance policy is considered when determining eligibility for food stamps. If the policy's value exceeds a certain threshold, it may be counted as an asset, potentially reducing or eliminating food stamp benefits. However, not all states consider life insurance policy value when determining eligibility, so it's essential to check your state's specific rules.

How to Calculate Life Insurance Policy Value

Calculating the value of a life insurance policy can be complex, but it's essential to understand how it's done. The policy's value is typically calculated by subtracting any outstanding loans or debts from the policy's cash value. For example, if you have a life insurance policy with a cash value of $10,000 and an outstanding loan of $2,000, the policy's value would be $8,000.

2. Life Insurance Benefits and Food Stamps Eligibility

Another way life insurance affects food stamps is through the benefits paid out after the policyholder's passing. In some cases, life insurance benefits may be considered income, potentially affecting food stamp eligibility. However, the rules surrounding life insurance benefits and food stamps vary by state, so it's essential to understand your state's specific regulations.

How Life Insurance Benefits are Taxed

Life insurance benefits are typically tax-free, but there are some exceptions. If the benefits are paid out in installments, rather than a lump sum, they may be subject to income tax. Additionally, if the policyholder's estate is subject to estate tax, the benefits may be reduced.

3. Life Insurance and the 50/20/30 Rule

The 50/20/30 rule is a guideline for allocating income towards necessities, savings, and discretionary spending. When it comes to life insurance and food stamps, the 50/20/30 rule can help you understand how your life insurance premiums may impact your eligibility for food stamps. If you're spending too much on life insurance premiums, it may affect your ability to pay for necessities, potentially impacting your food stamp eligibility.

How to Apply the 50/20/30 Rule

Applying the 50/20/30 rule is relatively simple. Allocate 50% of your income towards necessities like housing, utilities, and food. Use 20% for savings and debt repayment, and 30% for discretionary spending. By following this rule, you can ensure you're not overspending on life insurance premiums, potentially impacting your food stamp eligibility.

4. Life Insurance and the Five-Year Look-Back Period

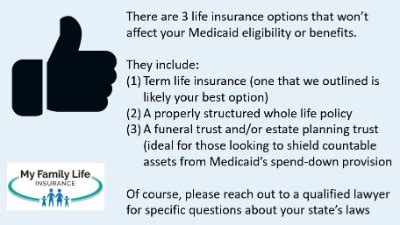

The five-year look-back period is a rule that applies to Medicaid and food stamp eligibility. If you've transferred assets, including life insurance policies, within the past five years, it may affect your eligibility for food stamps. This rule is designed to prevent individuals from hiding assets to qualify for government assistance programs.

How the Five-Year Look-Back Period Works

The five-year look-back period is relatively straightforward. If you've transferred assets, including life insurance policies, within the past five years, it may be considered when determining your eligibility for food stamps. This rule is designed to ensure individuals are not hiding assets to qualify for government assistance programs.

5. Life Insurance and Annuities

Finally, life insurance and annuities can impact food stamp eligibility. Annuities are a type of investment that provides a steady income stream, often used in retirement planning. However, if you're receiving food stamps, it's essential to understand how annuities may affect your eligibility.

How Annuities Work

Annuities are relatively simple to understand. You pay a lump sum or series of payments to an insurance company, and in return, you receive a steady income stream for a set period or lifetime. Annuities can be used to supplement retirement income or provide a guaranteed income stream.

Life Insurance and Food Stamps Gallery

In conclusion, life insurance can have a significant impact on food stamps, affecting eligibility and benefits in various ways. By understanding how life insurance policy value, benefits, and annuities can impact food stamps, you can make informed decisions about your financial planning and government assistance programs. Whether you're considering purchasing life insurance or already have a policy in place, it's essential to understand the complex rules surrounding food stamps and life insurance.

We hope this article has provided valuable insights into the world of life insurance and food stamps. If you have any questions or comments, please don't hesitate to reach out. Share this article with friends and family who may be affected by the complex rules surrounding life insurance and food stamps.