Intro

Discover how life insurance payouts impact food stamp benefits. Learn the 3 key ways a lump sum payment can affect SNAP eligibility, including resource limits, income calculations, and reporting requirements. Understand how to navigate these changes to maintain essential food assistance while utilizing life insurance proceeds wisely.

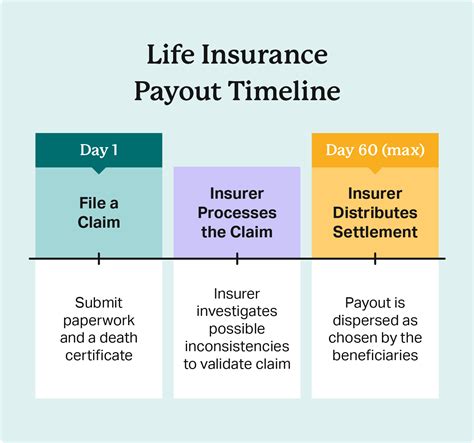

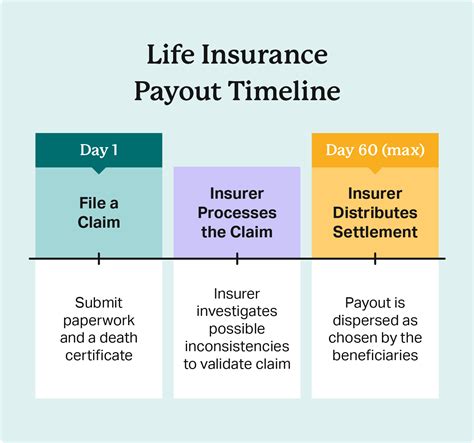

When a loved one passes away, the emotional toll can be overwhelming. In addition to dealing with grief, families may also face financial challenges. For those who rely on government assistance programs, such as food stamps, the loss of a family member can impact their eligibility and benefits. In this article, we will explore how life insurance payouts can affect food stamps.

Life insurance is an essential investment for individuals who want to protect their loved ones financially in the event of their passing. However, for those who rely on government assistance programs, the payout from a life insurance policy can have unintended consequences. The Supplemental Nutrition Assistance Program (SNAP), also known as food stamps, is a vital program that helps low-income individuals and families purchase food. However, the program has strict eligibility requirements, and receiving a life insurance payout can impact benefits.

Receiving a life insurance payout can increase an individual's income, which may affect their eligibility for food stamps. The SNAP program has strict income limits, and individuals who receive a large payout may exceed these limits, making them ineligible for benefits. This can be a significant challenge for individuals who rely on food stamps to feed themselves and their families.

Countable Resources and Food Stamps

When determining eligibility for food stamps, the SNAP program considers an individual's countable resources. Countable resources include cash, savings, and other assets that can be easily converted into cash. Life insurance payouts are considered countable resources, and receiving a payout can impact an individual's eligibility for food stamps.

For example, let's say John receives a life insurance payout of $10,000 after his father passes away. If John has no other income or resources, he may be eligible for food stamps. However, if he receives the life insurance payout, his countable resources will increase, and he may no longer be eligible for benefits.

How Life Insurance Payouts Affect Food Stamps

Receiving a life insurance payout can affect food stamps in several ways. Here are three ways in which a life insurance payout can impact benefits:

- Income Limits: Receiving a life insurance payout can increase an individual's income, which may affect their eligibility for food stamps. The SNAP program has strict income limits, and individuals who receive a large payout may exceed these limits, making them ineligible for benefits.

- Countable Resources: Life insurance payouts are considered countable resources, and receiving a payout can impact an individual's eligibility for food stamps. As mentioned earlier, countable resources include cash, savings, and other assets that can be easily converted into cash.

- Asset Limits: Some states have asset limits for food stamp recipients. Receiving a life insurance payout can increase an individual's assets, which may affect their eligibility for benefits.

Exempt Resources and Food Stamps

While life insurance payouts can impact food stamps, there are some exempt resources that do not affect eligibility. For example:

- Burial Expenses: Life insurance payouts used to pay for burial expenses are exempt from consideration as countable resources.

- Housing Expenses: Life insurance payouts used to pay for housing expenses, such as rent or mortgage payments, are also exempt from consideration as countable resources.

Strategies for Managing Life Insurance Payouts and Food Stamps

If you receive a life insurance payout and are concerned about how it may affect your food stamps, there are several strategies you can use to manage your benefits. Here are a few options:

- Spend the Payout: One option is to spend the life insurance payout on exempt resources, such as burial expenses or housing costs. This can help reduce your countable resources and maintain your eligibility for food stamps.

- Use the Payout for Education: Another option is to use the life insurance payout for education expenses, such as tuition or fees. This can help improve your financial situation and increase your earning potential.

- Consult with a Financial Advisor: Finally, it's a good idea to consult with a financial advisor to determine the best way to manage your life insurance payout and maintain your eligibility for food stamps.

Conclusion

Receiving a life insurance payout can have unintended consequences for individuals who rely on government assistance programs, such as food stamps. By understanding how life insurance payouts can affect food stamps, individuals can take steps to manage their benefits and maintain their eligibility. It's essential to consult with a financial advisor and explore strategies for managing life insurance payouts and food stamps.

Life Insurance and Food Stamps Image Gallery