Intro

Discover how tax refunds impact food stamp eligibility. Learn if receiving a tax refund affects your Supplemental Nutrition Assistance Program (SNAP) benefits, and how its calculated. Get answers on whether tax refunds are considered income, and how to report them to maintain your food stamp benefits eligibility.

The prospect of receiving a tax refund can be a welcome relief for many individuals and families, especially those who are struggling to make ends meet. However, for those who rely on government assistance programs such as food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), the question remains: does a tax refund affect food stamp eligibility?

In this article, we will delve into the world of tax refunds and food stamp eligibility, exploring how these two seemingly unrelated concepts intersect. We will examine the rules and regulations surrounding SNAP benefits, and provide guidance on how to navigate the complexities of the system.

Understanding Food Stamp Eligibility

Before we dive into the specifics of tax refunds and food stamp eligibility, it's essential to understand the basics of SNAP benefits. Food stamps are a vital resource for many low-income households, providing assistance with purchasing groceries and other essential food items.

To be eligible for SNAP benefits, households must meet specific income and resource requirements. These requirements vary from state to state, but generally, households must have a gross income that is at or below 130% of the federal poverty level. Additionally, households must have limited resources, such as cash, savings, and other assets.

How Tax Refunds Impact Food Stamp Eligibility

So, how do tax refunds affect food stamp eligibility? The answer lies in the way that SNAP benefits are calculated. When a household applies for SNAP benefits, their eligibility is determined based on their gross income and resources.

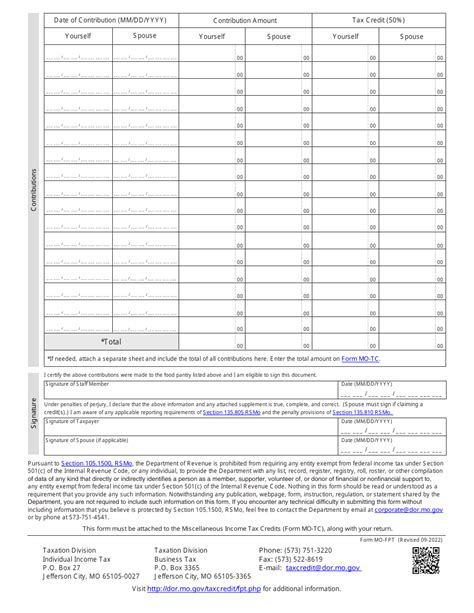

A tax refund is considered a lump-sum payment, which is not counted as income for SNAP purposes. However, the refund can impact a household's resource calculation. In most states, a tax refund is considered a resource, which can affect a household's eligibility for SNAP benefits.

Here's how it works:

- If a household receives a tax refund, it is counted as a resource for a limited time, usually six months.

- During this time, the household's resource calculation is adjusted to reflect the tax refund.

- If the household's resources, including the tax refund, exceed the state's resource limit, they may be ineligible for SNAP benefits.

Example: How a Tax Refund Affects Food Stamp Eligibility

Let's consider an example to illustrate how a tax refund can impact food stamp eligibility.

Meet Sarah, a single mother of two who receives SNAP benefits. Sarah's household income is $1,500 per month, which is at or below the federal poverty level. She has $500 in savings and $200 in cash.

Sarah receives a tax refund of $2,000, which she uses to pay off debt and cover some essential expenses. However, the tax refund is considered a resource for SNAP purposes.

As a result, Sarah's resource calculation is adjusted to reflect the tax refund. Her total resources now exceed the state's resource limit, making her ineligible for SNAP benefits for a period of six months.

Strategies for Managing Tax Refunds and Food Stamp Eligibility

While a tax refund can impact food stamp eligibility, there are strategies that households can use to manage their benefits and resources effectively. Here are a few tips:

- Use the tax refund wisely: Consider using the tax refund to pay off debt, cover essential expenses, or save for future expenses.

- Spread out the tax refund: Instead of receiving the tax refund as a lump sum, consider spreading it out over several months. This can help reduce the impact on SNAP benefits.

- Keep records: Keep accurate records of your income, expenses, and resources, including any tax refunds. This can help you navigate the SNAP application process and ensure that you receive the benefits you are eligible for.

Additional Resources

For households that are struggling to make ends meet, there are additional resources available to help with food and other essential expenses. Here are a few options:

- Food banks: Food banks provide food assistance to households in need. You can find your local food bank by visiting the Feeding America website.

- Soup kitchens: Soup kitchens provide meals to individuals and families in need. You can find your local soup kitchen by visiting the Soup Kitchen website.

- Government assistance programs: In addition to SNAP benefits, there are other government assistance programs available to help with food, housing, and other essential expenses. You can visit the Benefits.gov website to explore these options.

Conclusion

In conclusion, a tax refund can impact food stamp eligibility, but it's not a guarantee that benefits will be affected. By understanding the rules and regulations surrounding SNAP benefits and using strategies to manage tax refunds effectively, households can navigate the complexities of the system and ensure that they receive the benefits they need.

We hope this article has provided valuable insights into the world of tax refunds and food stamp eligibility. If you have any questions or concerns, please don't hesitate to reach out to your local SNAP office or a qualified benefits counselor.

Gallery of Tax Refund and Food Stamp Eligibility

Tax Refund and Food Stamp Eligibility Gallery

FAQs

Q: How does a tax refund affect food stamp eligibility? A: A tax refund can impact food stamp eligibility by affecting a household's resource calculation.

Q: How long is a tax refund considered a resource for SNAP purposes? A: A tax refund is considered a resource for six months.

Q: Can I use a tax refund to pay off debt and cover essential expenses? A: Yes, it's recommended to use a tax refund to pay off debt and cover essential expenses.

Q: Are there additional resources available to help with food and other essential expenses? A: Yes, there are additional resources available, including food banks, soup kitchens, and government assistance programs.

Q: How can I navigate the complexities of the SNAP system? A: You can navigate the complexities of the SNAP system by keeping accurate records, using strategies to manage tax refunds effectively, and seeking guidance from a qualified benefits counselor.