Receiving assistance from the Supplemental Nutrition Assistance Program (SNAP), also known as food stamps, can be a vital lifeline for individuals and families struggling to make ends meet. However, the process of applying for and maintaining benefits can be complex and may involve various forms of verification, including tax returns. In this article, we will explore the relationship between the food stamp office and tax returns, including what information is shared, how it is used, and what applicants can expect.

Why Does the Food Stamp Office Need to Verify Tax Returns?

The primary purpose of verifying tax returns is to ensure that applicants are eligible for SNAP benefits and to determine the correct benefit amount. Tax returns provide valuable information about an individual's income, which is a critical factor in determining SNAP eligibility and benefit levels. By reviewing tax returns, the food stamp office can verify the accuracy of the information provided on the application and ensure that benefits are distributed fairly.

What Information is Shared Between the Food Stamp Office and the IRS?

The food stamp office may request information from the Internal Revenue Service (IRS) to verify an applicant's income. This information may include:

- Gross income

- Adjusted gross income

- Earned income tax credit (EITC)

- Other forms of income, such as Social Security benefits or retirement income

The IRS may provide this information to the food stamp office through a process called "third-party verification." This process allows authorized agencies, such as the food stamp office, to access tax return information for specific purposes, such as verifying income.

How Does the Food Stamp Office Use Tax Return Information?

The food stamp office uses tax return information to:

- Verify income reported on the SNAP application

- Determine SNAP eligibility and benefit levels

- Identify potential discrepancies or inconsistencies in the application

- Monitor and update benefit levels as necessary

What Happens if an Applicant's Tax Return is Selected for Review?

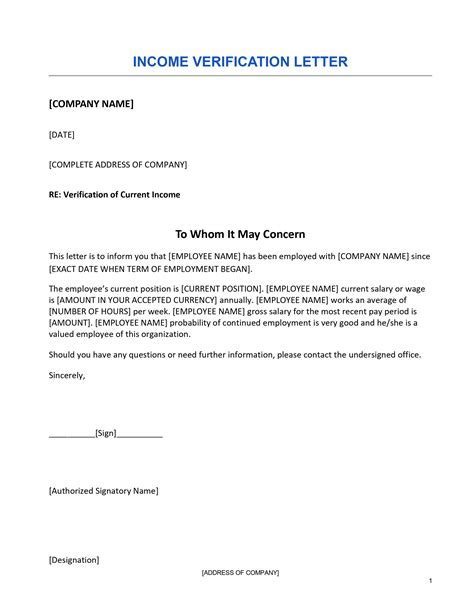

If an applicant's tax return is selected for review, the food stamp office may request additional documentation or information to verify the accuracy of the tax return. This may include:

- Copies of tax returns (Form 1040, etc.)

- W-2 forms

- 1099 forms

- Other documentation supporting income reported on the tax return

Applicants may be required to provide this documentation within a specified timeframe, usually 10-30 days. Failure to provide the requested documentation may result in delays or denial of benefits.

Can Applicants Refuse to Provide Tax Return Information?

Applicants have the right to refuse to provide tax return information. However, this may result in delays or denial of benefits. If an applicant refuses to provide tax return information, the food stamp office may:

- Deny the application due to lack of information

- Request additional documentation or information to verify income

- Place the application on hold until the required information is provided

How Often Does the Food Stamp Office Check Tax Returns?

The frequency of tax return checks varies depending on the state and local agency administering the SNAP program. Some agencies may conduct regular reviews, while others may only review tax returns in response to specific circumstances, such as:

- New applications

- Redetermination of benefits

- Reports of income changes

- Random sample reviews

What Can Applicants Do to Ensure Accurate Verification of Tax Returns?

To ensure accurate verification of tax returns, applicants can:

- Ensure accurate reporting of income on the SNAP application

- Provide complete and accurate tax return information

- Respond promptly to requests for additional documentation or information

- Keep records of tax returns and supporting documentation for future reference

Conclusion

The food stamp office may check tax returns as part of the application and verification process for SNAP benefits. Applicants should be prepared to provide accurate and complete tax return information to ensure timely and accurate determination of benefits. By understanding the role of tax returns in the SNAP application process, applicants can better navigate the system and ensure access to this vital form of assistance.

SNAP Benefits Image Gallery

Frequently Asked Questions

Q: Does the food stamp office always check tax returns? A: No, the food stamp office may only check tax returns in certain circumstances, such as new applications or redetermination of benefits.

Q: Can I refuse to provide tax return information? A: Yes, applicants have the right to refuse to provide tax return information. However, this may result in delays or denial of benefits.

Q: How often does the food stamp office review tax returns? A: The frequency of tax return reviews varies depending on the state and local agency administering the SNAP program.

Q: What happens if my tax return is selected for review? A: If an applicant's tax return is selected for review, the food stamp office may request additional documentation or information to verify the accuracy of the tax return.

Q: Can I appeal a decision related to tax return verification? A: Yes, applicants have the right to appeal decisions related to tax return verification.