Intro

Explore USAA HELOC options, including home equity lines, loan rates, and repayment terms, to leverage your homes value with flexible borrowing and repayment choices.

The United Services Automobile Association (USAA) is a well-established financial institution that provides a wide range of financial products and services to its members, including home equity lines of credit (HELOCs). For homeowners who are looking to tap into the equity they have built in their homes, a USAA HELOC can be a valuable option. In this article, we will delve into the details of USAA HELOC options, exploring the benefits, features, and requirements of these financial products.

USAA is known for its commitment to serving the financial needs of military personnel, veterans, and their families. As such, the institution offers a range of financial products and services that are tailored to meet the unique needs of this demographic. When it comes to HELOCs, USAA provides its members with flexible and affordable options that can be used to finance a variety of expenses, from home improvements and renovations to debt consolidation and major purchases. With a USAA HELOC, members can borrow against the equity in their homes, using the funds to achieve their financial goals.

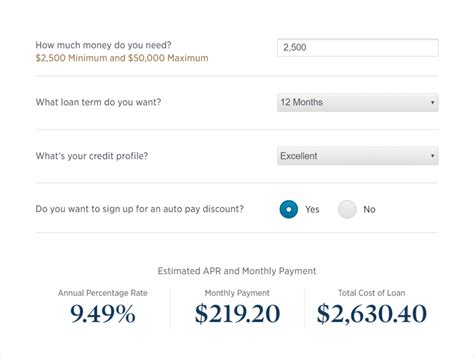

One of the key benefits of a USAA HELOC is its flexibility. These financial products allow members to borrow and repay funds as needed, making them an attractive option for those who need to manage ongoing expenses or unexpected costs. Additionally, USAA HELOCs often come with competitive interest rates and flexible repayment terms, making it easier for members to manage their debt and stay on top of their finances. Whether you're looking to finance a home renovation, consolidate debt, or cover unexpected expenses, a USAA HELOC can provide the financial flexibility you need to achieve your goals.

USAA HELOC Options Overview

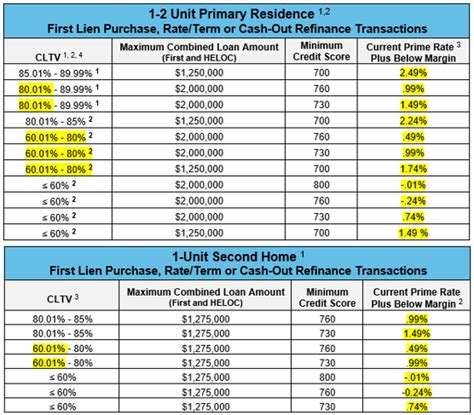

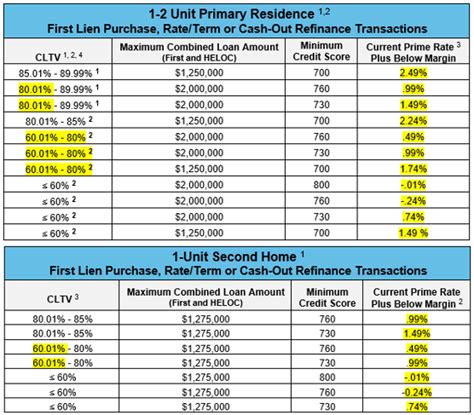

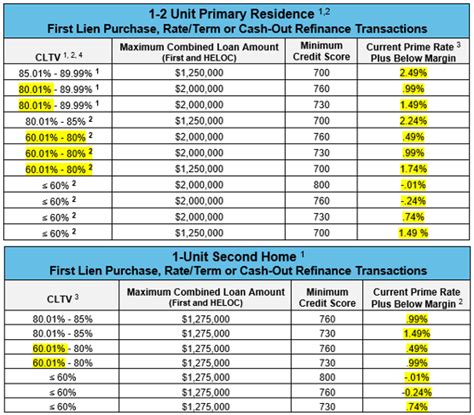

USAA offers its members a range of HELOC options, each with its own unique features and benefits. These options include variable-rate HELOCs, fixed-rate HELOCs, and interest-only HELOCs, among others. By understanding the different types of HELOCs available, members can make informed decisions about which product is right for their financial needs. In this section, we will explore the different USAA HELOC options in more detail, highlighting the benefits and features of each.

Variable-Rate HELOCs

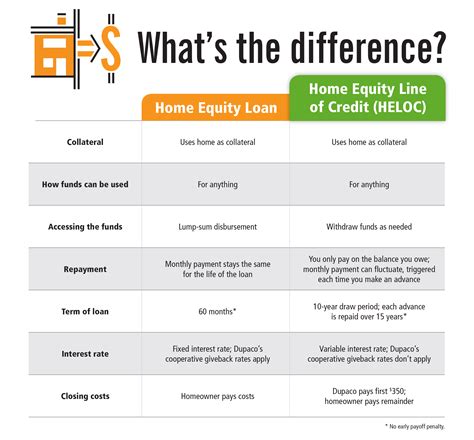

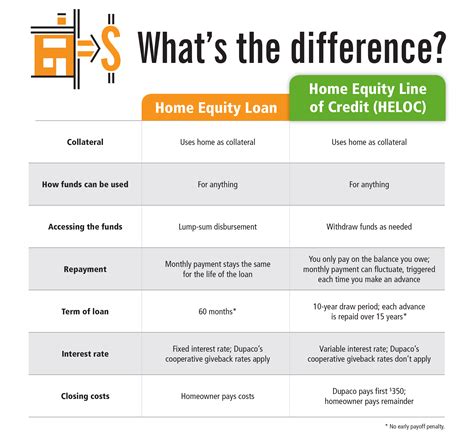

Variable-rate HELOCs are one of the most common types of HELOCs offered by USAA. These financial products come with interest rates that can fluctuate over time, based on market conditions and other factors. While variable-rate HELOCs may offer lower initial interest rates, they can also come with higher rates over time, which can increase the cost of borrowing. However, for members who plan to repay their HELOC quickly, a variable-rate option may be a good choice.Fixed-Rate HELOCs

Fixed-rate HELOCs, on the other hand, come with interest rates that remain the same over the life of the loan. These financial products can provide members with greater predictability and stability, as they know exactly how much they will owe each month. Fixed-rate HELOCs can be a good option for members who want to avoid the uncertainty of variable interest rates and who plan to keep their HELOC for an extended period.

Interest-Only HELOCs

Interest-only HELOCs are another type of financial product offered by USAA. These HELOCs allow members to make interest-only payments for a specified period, typically 5-10 years. During this time, the member is only required to pay the interest on the loan, rather than both interest and principal. While interest-only HELOCs can provide greater flexibility and lower monthly payments, they can also result in higher payments over the life of the loan.USAA HELOC Requirements

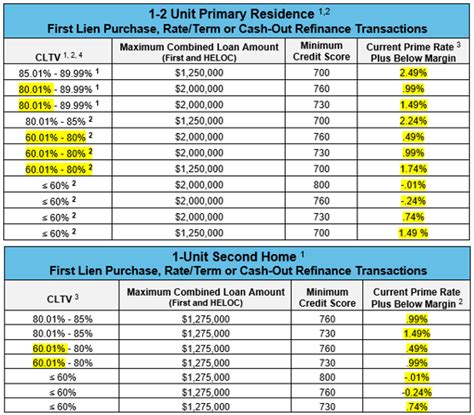

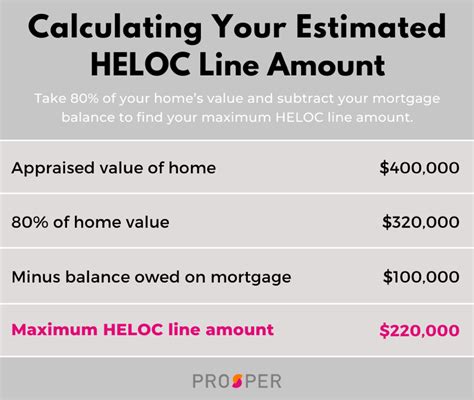

To qualify for a USAA HELOC, members must meet certain requirements. These requirements include a minimum credit score, a maximum debt-to-income ratio, and a minimum amount of equity in the home. Additionally, members must be USAA members, which requires a military affiliation or other eligibility criteria. By understanding the requirements for a USAA HELOC, members can determine whether they qualify for these financial products and can begin the application process.

USAA HELOC Benefits

The benefits of a USAA HELOC are numerous. These financial products can provide members with the funds they need to achieve their financial goals, whether that's financing a home renovation, consolidating debt, or covering unexpected expenses. Additionally, USAA HELOCs often come with competitive interest rates and flexible repayment terms, making it easier for members to manage their debt and stay on top of their finances.USAA HELOC Application Process

The application process for a USAA HELOC is relatively straightforward. Members can apply online, by phone, or in person at a USAA financial center. To apply, members will need to provide certain documentation, including income verification, credit reports, and appraisal information. Once the application is submitted, USAA will review the member's creditworthiness and determine whether they qualify for a HELOC.

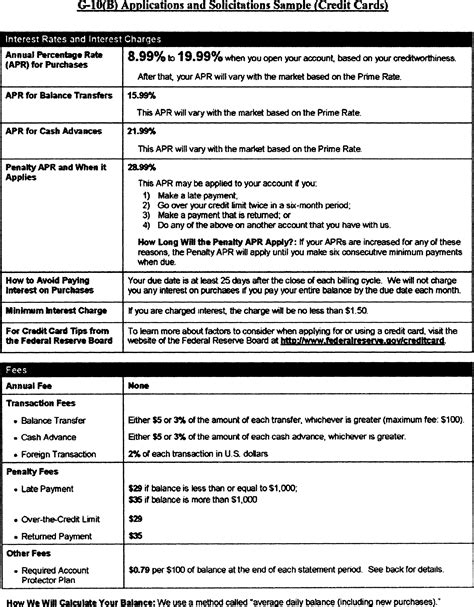

USAA HELOC Fees and Charges

Like all financial products, USAA HELOCs come with certain fees and charges. These fees can include origination fees, annual fees, and late payment fees, among others. By understanding the fees and charges associated with a USAA HELOC, members can make informed decisions about whether these financial products are right for their financial needs.USAA HELOC Alternatives

While USAA HELOCs can be a valuable financial tool, they may not be the right choice for every member. Fortunately, there are alternative financial products available, including home equity loans, personal loans, and credit cards. By understanding the different options available, members can make informed decisions about which financial product is right for their needs.

USAA HELOC FAQs

Here are some frequently asked questions about USAA HELOCs: * What is the minimum credit score required for a USAA HELOC? * How long does the application process take? * What are the fees and charges associated with a USAA HELOC? * Can I use a USAA HELOC to finance a home renovation? * How do I repay a USAA HELOC?Gallery of USAA HELOC Options

USAA HELOC Image Gallery

In conclusion, USAA HELOC options can provide members with the financial flexibility they need to achieve their goals. By understanding the different types of HELOCs available, the requirements for qualification, and the benefits and fees associated with these financial products, members can make informed decisions about whether a USAA HELOC is right for their financial needs. We invite you to share your thoughts and experiences with USAA HELOCs in the comments below. Have you used a USAA HELOC to finance a home renovation or consolidate debt? What were your experiences with the application process and repayment terms? Your insights can help others make informed decisions about their financial options. Additionally, if you found this article helpful, please share it with others who may be considering a USAA HELOC.