Explore USAA mortgage loan options, including VA loans, conventional mortgages, and jumbo loans, with competitive rates and flexible terms for military members and veterans, offering home financing solutions and mortgage refinancing opportunities.

The United Services Automobile Association (USAA) is a well-established financial institution that offers a wide range of mortgage loan options to its members. USAA membership is exclusively available to active and former military personnel and their families. With a strong commitment to serving the military community, USAA provides competitive mortgage rates, flexible terms, and exceptional customer service. Whether you're a first-time homebuyer, a seasoned homeowner, or looking to refinance your existing mortgage, USAA has a mortgage loan option that can meet your unique needs and goals.

USAA's mortgage products are designed to cater to the diverse requirements of its members, including those with limited credit history, high debt-to-income ratios, or unique employment situations. The institution's mortgage experts work closely with borrowers to understand their financial circumstances and provide personalized guidance throughout the loan application process. By leveraging USAA's extensive knowledge and expertise, members can make informed decisions about their mortgage options and choose the best loan product for their situation. With USAA, members can enjoy a streamlined and hassle-free mortgage experience, from pre-approval to closing.

The USAA mortgage loan options are tailored to address the specific challenges faced by military personnel and their families, such as frequent relocations, variable income, and limited credit history. USAA's mortgage products are designed to be flexible, with features like lower interest rates, reduced fees, and more lenient credit score requirements. Additionally, USAA offers a range of mortgage loan options, including fixed-rate and adjustable-rate loans, jumbo loans, and VA loans, which are guaranteed by the Department of Veterans Affairs. By choosing USAA for their mortgage needs, members can benefit from the institution's deep understanding of the military lifestyle and its commitment to providing exceptional service and support.

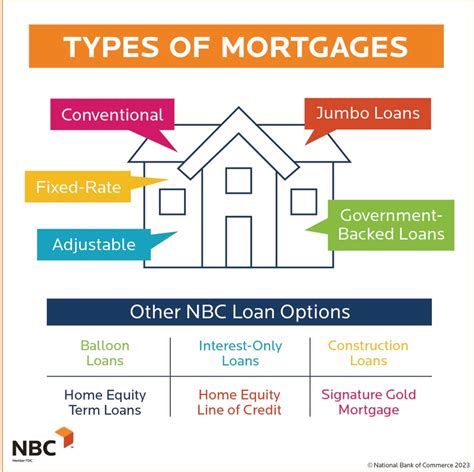

Types of USAA Mortgage Loans

USAA offers a variety of mortgage loan options to cater to the diverse needs of its members. These include:

- Fixed-rate mortgages: These loans feature a fixed interest rate for the entire term of the loan, providing predictable monthly payments and protection against rising interest rates.

- Adjustable-rate mortgages: These loans have an interest rate that can adjust periodically based on market conditions, potentially offering lower initial interest rates and monthly payments.

- Jumbo loans: These loans are designed for borrowers who need to finance high-value properties, with loan amounts exceeding conventional loan limits.

- VA loans: These loans are guaranteed by the Department of Veterans Affairs and offer favorable terms, including lower interest rates, lower fees, and more lenient credit score requirements, to eligible military personnel and veterans.

Benefits of USAA Mortgage Loans

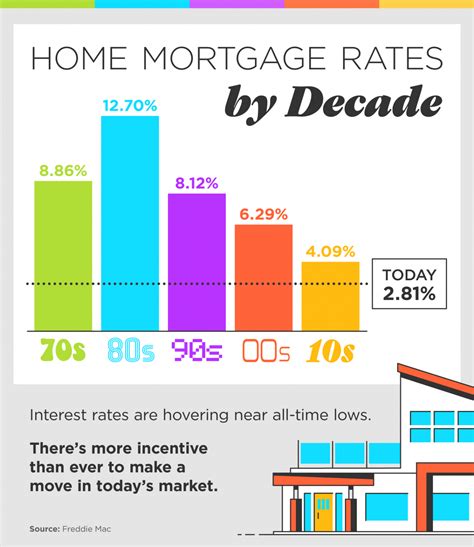

USAA mortgage loans offer several benefits to members, including:- Competitive interest rates: USAA offers competitive interest rates on its mortgage loans, helping members save money on their monthly payments and over the life of the loan.

- Flexible terms: USAA mortgage loans feature flexible terms, including a range of repayment options and loan terms, to accommodate the unique needs and goals of its members.

- Exceptional customer service: USAA is known for its exceptional customer service, with dedicated mortgage experts available to guide members through the loan application process and provide ongoing support.

- Reduced fees: USAA mortgage loans often feature reduced fees, including lower origination fees and closing costs, helping members save money on their loan.

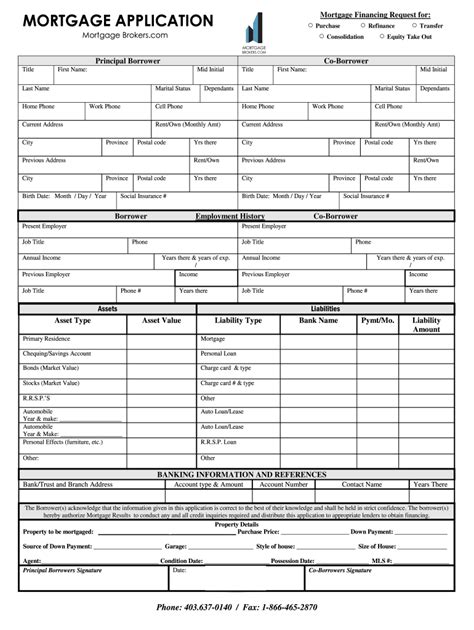

USAA Mortgage Loan Application Process

The USAA mortgage loan application process is designed to be straightforward and efficient, with several steps to help members navigate the process. These include:

- Pre-approval: Members can start by getting pre-approved for a mortgage loan, which provides an estimate of the loan amount they qualify for and helps them determine their budget.

- Loan application: Members can then submit a loan application, providing required documentation, such as income verification, credit reports, and identification.

- Loan processing: USAA's mortgage experts will review the loan application, verify the provided documentation, and order an appraisal of the property, if necessary.

- Loan approval: Once the loan application is approved, USAA will provide a loan commitment, outlining the terms of the loan, including the interest rate, loan amount, and repayment terms.

- Closing: The final step is closing, where the member signs the loan documents, transfers the ownership of the property, and receives the loan funds.

USAA Mortgage Loan Requirements

To qualify for a USAA mortgage loan, members must meet certain requirements, including:- Credit score: USAA typically requires a minimum credit score of 620, although some loan products may have more lenient credit score requirements.

- Income: Members must have a stable income and a debt-to-income ratio that does not exceed 36%.

- Employment: Members must be employed or have a stable source of income, such as retirement benefits or investments.

- Property type: USAA mortgage loans are available for a variety of property types, including single-family homes, townhouses, and condominiums.

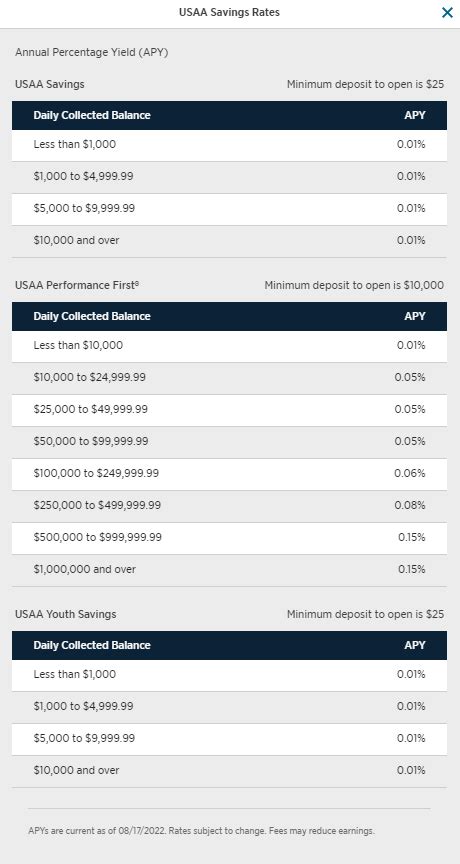

USAA Mortgage Loan Rates and Terms

USAA mortgage loan rates and terms are competitive and flexible, with options to suit a range of needs and goals. These include:

- Fixed-rate loans: USAA offers fixed-rate loans with terms ranging from 10 to 30 years, featuring predictable monthly payments and protection against rising interest rates.

- Adjustable-rate loans: USAA adjustable-rate loans feature initial interest rates that can adjust periodically based on market conditions, potentially offering lower initial interest rates and monthly payments.

- Jumbo loans: USAA jumbo loans are available for loan amounts exceeding conventional loan limits, with terms ranging from 10 to 30 years.

USAA Mortgage Loan Calculator

USAA provides a mortgage loan calculator to help members estimate their monthly payments and determine how much they can afford to borrow. The calculator takes into account factors such as the loan amount, interest rate, loan term, and property taxes, to provide an accurate estimate of the monthly payment.USAA Mortgage Loan Customer Service

USAA is known for its exceptional customer service, with dedicated mortgage experts available to guide members through the loan application process and provide ongoing support. Members can contact USAA's customer service team via phone, email, or online chat, to ask questions, request assistance, or provide feedback.

USAA Mortgage Loan Reviews

USAA mortgage loans have received positive reviews from members, who appreciate the institution's competitive interest rates, flexible terms, and exceptional customer service. Members have also praised USAA's streamlined loan application process, which makes it easy to apply for and manage their mortgage loan.USAA Mortgage Loan FAQs

Here are some frequently asked questions about USAA mortgage loans:

- What are the benefits of a USAA mortgage loan?

- How do I apply for a USAA mortgage loan?

- What are the requirements for a USAA mortgage loan?

- Can I refinance my existing mortgage with USAA?

- How do I contact USAA's customer service team?

USAA Mortgage Loan Image Gallery

In conclusion, USAA mortgage loan options are designed to meet the unique needs and goals of military personnel and their families. With competitive interest rates, flexible terms, and exceptional customer service, USAA provides a range of mortgage loan products that can help members achieve their dreams of homeownership. Whether you're a first-time homebuyer, a seasoned homeowner, or looking to refinance your existing mortgage, USAA has a mortgage loan option that can meet your needs. We invite you to explore USAA's mortgage loan options and discover how they can help you achieve your financial goals. Share your thoughts and experiences with USAA mortgage loans in the comments below, and don't forget to share this article with your friends and family who may be interested in learning more about USAA's mortgage loan options.